The Matrix, Terminator, Robopocalypse, or Robot series... The invasion of robots destroying humanity is a recurrent topic in science fiction, from cinema to literature.

There is no reason for concern; such an invasion is not for today! Nevertheless, robotics, automation and artificial intelligence are playing an increasingly important role not only in our lives, but also in our factories. Indeed, robotic technologies have been growing considerably since the early 1990s, with a sevenfold rise in robot density (defined as the number of robots per million hours worked) in the euro area: from 0.25 in 1990 to more than 1.75 in 2019 according to Cette, Devillard and Spiezia (2021).

Does this phenomenon have implications for monetary policy?

Robot density as a factor for explaining the heterogeneous effects of monetary policy across sectors

Like Peersman and Smets (2005), the economic literature has established that monetary policy is transmitted differently across economic sectors and, in particular, that the durability of a good can be a differentiating factor. The demand for durable goods, such as capital goods, is indeed more sensitive to a change in interest rates through the cost of capital channel than the demand for non-durable goods.

Another potentially differentiating factor has never been studied in the literature so far: robot density (or degree of robotisation). Intuitively, in a heavily robotised industry, where capital significantly replaces labor, monetary policies that stimulate demand could have a lower effect on employment as they would fail to replace jobs that technology has made obsolete. This post examines this intuition.

According to the definition of the International Federation of Robotics (IFR), a robot is an "automatically controlled, reprogrammable multipurpose [manipulator]". A robot is therefore a machine that acts fully autonomously, without the need for a human operator, and can be programmed to perform multiple tasks. Although their growth is strong in the industrial sector, the adoption of robots varies widely across industries according to the IFR. The automotive industry alone accounts for 39% of industrial robots, followed by the electronics industry (19%) and chemicals and plastics (9%). By contrast, the low-robotisation industries (around 1%) are paper and printing, wood and furniture, and textiles.

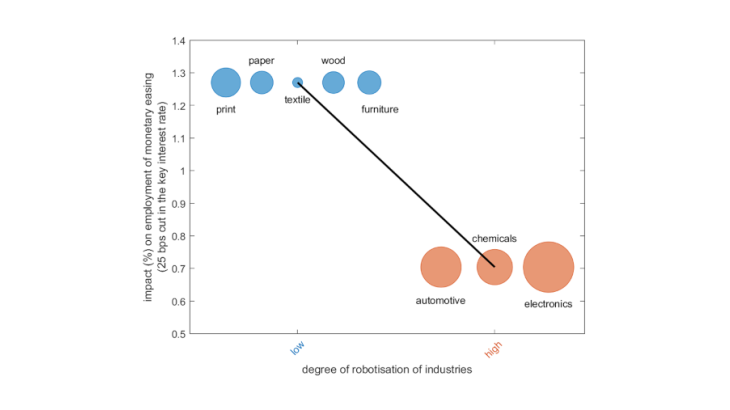

The objective of this post is to compare, using US data, the effects of monetary policy on employment in high and low-robotisation industries using a vector autoregression (VAR) framework and a panel data set on the different industries. The industries are broken down into two groups according to the level of robotisation: the first group includes high-robotisation industries (automotive, electronics, chemicals), while the second group includes low-robotisation industries (printing, paper, textiles, wood, furniture). The monetary shock is identified using an external instrument constructed from high-frequency financial data: a monetary surprise corresponds to a change in futures contracts on the federal funds rate that occurs during the monetary policy announcements of the Fed’s Federal Open Market Committee (FOMC) (based on a 30-minute window).

Of course, the method used is not above criticism. First, the analysis focuses on a typology of sectors and not on a "degree of robotisation" variable, and therefore does not perfectly neutralise the other characteristics of these sectors (for example, the degree of openness is relatively high in heavily robotised industries). This criticism can be tempered by the fact that, according to the economic literature, only the durability of goods is a differentiating factor and that the level of durability between the two groups studied is the same. Second, the period under review only covers the so-called standard monetary policy conducted from 1990 to 2007 and therefore does not allow for any conclusions to be drawn for the current period.

Chart 1 shows the employment response for each industry following an accommodative monetary policy decision to lower the Federal Reserve's federal funds rate by 25 basis points. The estimate shows that in response to the monetary stimulus, employment rises (at its maximum) by 0.7% in high-robotisation industries and by 1.3% in low-robotisation industries.

Monetary policy can influence firms' technological decisions

It thus appears that robotics helps to explain the heterogeneous effects of monetary policy across industries. This analysis can be largely supported and informed by the recent theoretical study by Fornaro and Wolf (2021) which suggests that monetary policy affects firms' technological decisions, and more specifically the allocation of production tasks between capital and labour. In their model, capital and labour are highly substitutable in performing some production activities. Thus, a decline in the cost of capital relative to wages results in substituting capital for labour in production tasks, which increases the use of robotic technologies and thus the automation of tasks.

In this context, in heavily robotised industries (where labour and capital are substitutable), a monetary stimulus by means of a lowering of interest rates reduces firms’ relative cost of capital and encourages a reallocation of production tasks towards capital, thus boosting labour productivity more than employment. By contrast, in low-robotisation industries, the reallocation of production tasks is less important and, consequently, the demand for labour accelerates more.