The modernization of judicial systems in European countries often involves merging courts. This was the case in Italy in 2013, France in 2009, and the Netherlands in 2008. Between 2010 and 2016, 10 European countries reduced the number of courts by 15% or more. Court mergers are intended to reduce costs, eliminate smaller and often less efficient entities, and break with inefficient local habits. However, they may also increase the distance to justice and risk overloading absorbing courts, at least in the short term.

What is the impact of court mergers on efficiency? This paper focuses on French bankruptcy courts and offers a novel approach to judicial efficiency—not measured by case speed, as often done, but by the quality of decisions. In bankruptcy proceedings, courts must decide whether a firm should be restructured or liquidated. They face two possible errors: restructuring a firm that cannot be saved (a “Type 1 error”) or liquidating one that could have recovered (a “Type 2 error”). We treat courts as decision-makers that “screen” insolvent firms and examine whether the 2009 reform improved this screening ability.

To measure efficiency, we apply a difference-in-differences strategy, comparing bankruptcy outcomes of firms affected by the reform with those that were not. The analysis relies on an (almost) exhaustive dataset of 600,000 bankruptcy cases in France between 2000 and 2019. We study outcomes such as the probability of receivership, restructuring, and firm survival.

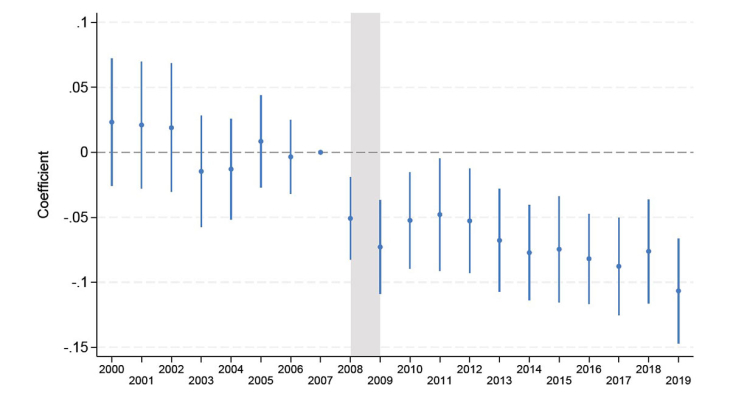

The results show that the reform reduced continuation bias (fewer Type 1 errors) in absorbed courts, while having no effect on the survival of viable firms (unchanged Type 2 errors). We show that at least part of the reduction in the continuation bias comes from a lower probability of putting non-viable firms to receivership. Figure below illustrates this result: the probability of receivership for firms from absorbed courts falls sharply after the reform.

We also find that the reform did not affect outcomes in absorbing courts, despite concerns at the time that these courts would struggle with heavier caseloads. In fact, the behavior of absorbing courts influenced the absorbed courts more than the reverse. Figure below further shows that the reform’s effect was immediate and lasting, reflecting a break with local habits. From a policy perspective, this suggests that the effectiveness of absorbing courts, rather than their size, is key to the success of such reforms.

To summarize, the reform reduced continuation bias by spreading the better practices of absorbing courts, without increasing liquidation bias. Concerns about reduced access to justice or congested courts were not borne out. Overall, the reform’s impact was positive.

Keywords: Corporate Bankruptcy, Commercial Courts.

Codes JEL : G33, K22