1 Exceeding the legal limit for payment delays: one in three suppliers is affected

Trade credit: from financing to the risk of contagion

Trade credit, which is credit granted through payment delays negotiated between customers and suppliers, is an important source of financing for businesses. According to the Observatoire des délais de paiement, in 2017, trade payables amounted to EUR 607 billion, i.e. 7.5% of French companies’ total liabilities.

The intensity of trade relations implies that the trade credit chain is a potential vector for spreading business difficulties, as late payments and payment defaults by customers can cause difficulties for suppliers themselves. This contagion mechanism can contribute to propagating macroeconomic and liquidity shocks along the trade credit chain and aggravate a recession.

However, while longer payment delays are a very common indicator of customer difficulties, it remains to be demonstrated that late payments by customers lead to supplier difficulties and trigger a contagion mechanism. This article sets out to accurately measure the impact of the length of customer payment delays on suppliers’ financial situation by using a bankruptcy prediction model (see Box 1) to estimate the increase in the probability of default associated with late payments.

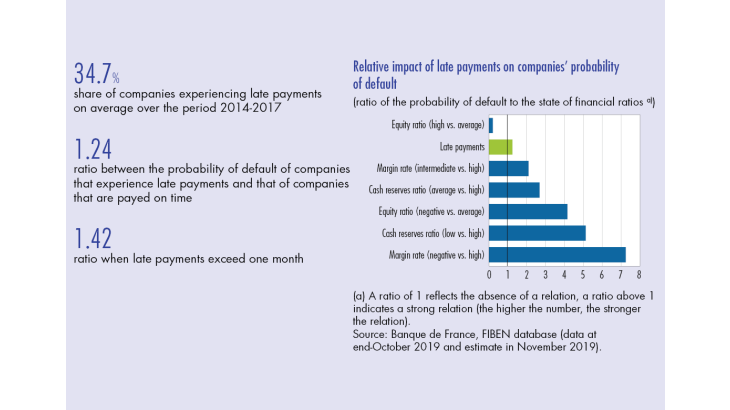

Importance of late payments

Over one-third of companies record payment delays on receivable accounts over 60 days, a legal ceiling introduced by the Loi de modernisation de l’économie (Economic Modernisation Act - LME). On average, in the 2010s, one in five suppliers was less than 30 days late and one in six was more than 30 days late (see Table 1). The number of suppliers with days sales

outstanding (DSO) above the legal ceiling of 60 days is therefore still high, even though their share has dropped significantly since 2009, the date at which the Act came into force.

However, the business failure rate increases with the length of days sales outstanding. This rate is almost twice as high when days sales outstanding exceed 90 days, compared to the level reached when customers meet the legal limit of 60 days. This finding points to the existence of a relation between business failure and late payments that should be investigated.

[to read more, please download the article]