1 In 2019, French citizens still preferred to use cash for everyday purchases, despite a growing preference for card payments

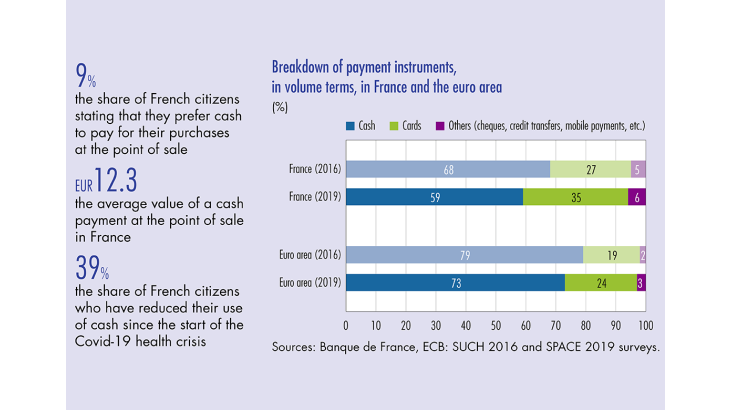

According to the SPACE (study on the payment attitudes of consumers in the euro area) survey, in 2019 cash remained the most widely used means of payment in France (and in the Eurosystem) both at the point of sale and from person to person: its share stood at 59% in France (73% in the euro area), while card payments accounted for only 35% of transactions (24% in the euro area).

Like in the previous survey conducted in 2016 (SUCH survey), cash remained the most popular means of payment (see Chart 1a). However, it fell sharply (by nine percentage points in three years in France) in favour of card payments, whose share increased (up eight percentage points over the same period), driven by contactless payments, which now account for 38% of card transactions in France.

In value terms, 25% of the total amount of French point of sale and person to person transactions are settled in cash (48% in the euro area), down three percentage points since 2016 (down six percentage points for the euro area).

Overall, as in 2016, France is one of the euro area countries that uses the least amount of cash, in value terms, along with the Netherlands, Luxembourg, Belgium, Finland and Estonia.

The decline in cash use can also be seen across the euro area as a whole, where on average it has fallen below the symbolic threshold of 50% of payments in value terms.

The French citizens surveyed were characterised – as in 2016 – by an increasingly strong preference for cashless means of payment (see Chart 3). In this respect, 69% say they prefer to use a card to pay for everyday purchases (against 49% on average in the euro area). And they are the least inclined in the euro area to use cash: only 9% prefer to pay in cash (27% on average in the euro area), down eight percentage points from the 2016 survey.

Cash payments have traditionally been used for small day to day purchases (see Chart 4): 92% of payments under EUR 5 are settled in cash in the euro area. The fact that the average amount of cash payments in France has almost doubled in three years (from EUR 7.5 in 2016 to EUR 12.3 in 2019) shows that competition from contactless payments in this segment of very (…)

[to read more, please download the article]