- Home

- Publications et statistiques

- Publications

- The collapse of French exports in the Co...

The collapse of French exports in the Covid crisis: mainly those of large business units

Post n°238. The Covid-19 crisis led to a collapse of French exports in April and May 2020. Using customs data, we investigate the role of the performance of individual exporters. Although the number of exporters contracted by roughly a quarter, excluding aeronautics, it was the reduction in exports of the hundred or so largest exporters (representing 36% of French exports before Covid) that accounted for approximately half of the decline observed at the aggregate level.

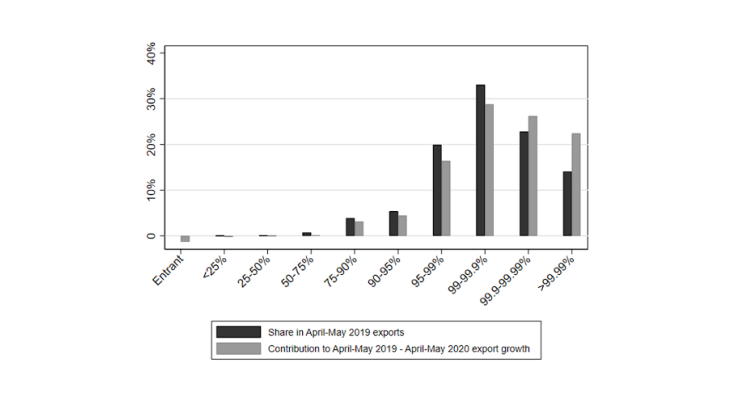

Note: the black bars show the share of each size class in total exports in April-May 2019, while the grey bars show the contribution of each size class to the slump in in exports. Thus, the reduction in exports by companies in the group of the largest 0.01% of exporters accounts for 22% of the total collapse, whereas they accounted for 13% of exports in April-May 2019. The calculation includes entrants and exiters in 2020.

What factors explain the sudden and unprecedented collapse of French exports in April 2020 compared to April 2019? Identifying the sources of this slump helps to better understand the channels of adjustment of foreign trade when faced with large shocks. Here, we adopt an approach that focuses on the individual performance of companies. Indeed, research in international trade over the past two decades has shown that exporter heterogeneity is a fundamental factor in understanding aggregate export trends.

We analyse the impact of this heterogeneity excluding the aeronautics sector, which followed a specific trend during the crisis (see Berthou and Gaulier 2021), and show that it is the reduction in exports by the hundred or so largest exporters that accounts for about half of the fall observed at the aggregate level (Chart 1).

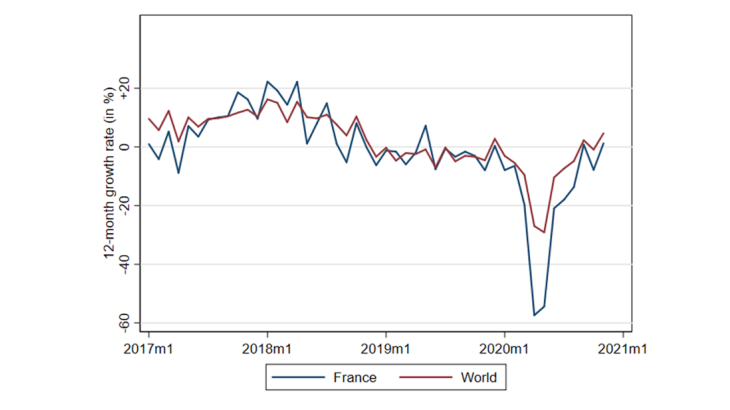

We use monthly customs data at the granular level of the legal unit, product and destination to map this 40% collapse in French exports in April 2020 compared to April 2019, which is even greater than the decline recorded during the Great Financial Crisis of 2008/2009 (Chart 2).

Note: Global exports calculated as the sum of exports from 97 countries accounting for 90% of world trade in 2018.

Massive exit of small exporters

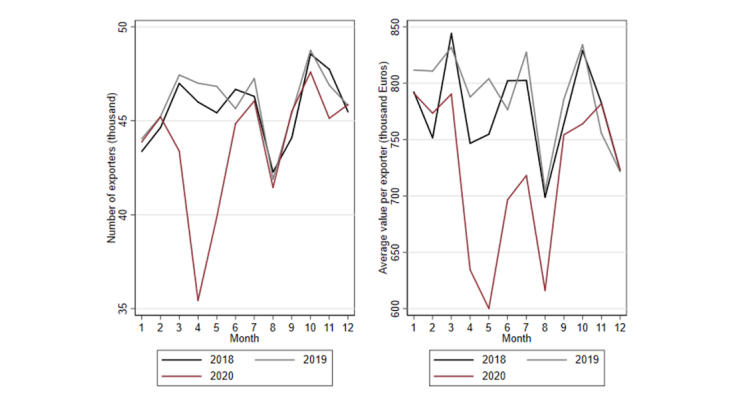

We begin by illustrating, in the left-hand panel of Chart 3, the unprecedented fall in the number of French exporters: in April 2020, there was a loss of around 11,000 exporters compared with April 2019, a reduction of 23% (the analysis excludes very small exporters). The chart includes the pre-crisis years 2018 and 2019 for a better assessment of the exceptional nature of the 2020 developments (the drop in August/September is linked to seasonality, and is also observed in 2018 and 2019). The number of exporters returns to pre-crisis levels towards the end of the year. The right-hand panel of Chart 3 shows changes in the average value of exports per exporter, which also falls sharply in April/May, but returns more slowly to normal and remains at the end of the year at a lower level than in previous years.

Note: the left-hand panel shows changes in the number of exporters, the right-hand panel shows changes in the average value exported per legal unit. Authors' calculations based on Customs data.

The slump is explained by the decline in the values exported by each exporter, not by the sharp drop in their numbers

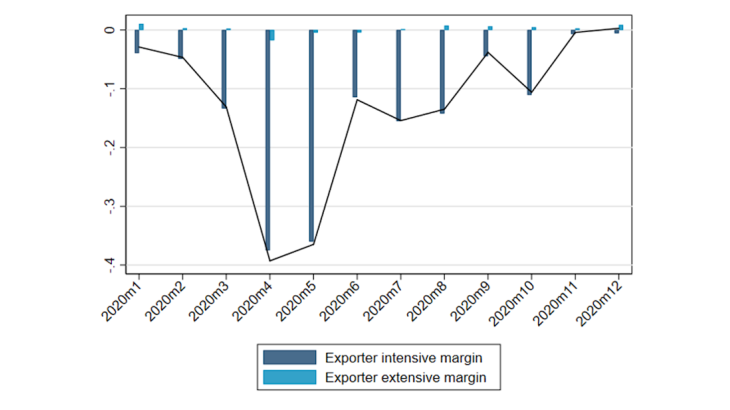

Chart 4 provides a breakdown of the change in exports for each month, compared to the same month in the previous year, by two components: 1) the entry-exit of exporters (the "extensive" margin) represented by the light blue bars and 2) the change in the average value of exports per legal unit (the "intensive" margin) represented by the dark blue bars. The contribution of the light blue bars to the fall in exports by value is negligible. The contribution of the extensive margin is close to zero and even positive towards the end of the year, due to the return of small exporters. The exporters that temporarily ceased their export activity were therefore the smallest, and their temporary exit from the statistics explains only a negligible share of the change in aggregate exports. The implication is clear: the fall in exports at the aggregate level is entirely explained by the reduction in the values exported by those legal units that continued to operate in foreign markets.

Note: the light blue bars show the contribution of the entry-exit of exporters ("extensive margin") and the dark blue bars show the contribution of the reduction in the change in the average value of exports of the remaining legal units in the sample ("intensive" margin). The black curve shows the interannual variation for each month in the value of aggregate exports. For example: the value of exports in April 2020 was 40% lower than in April 2019.

These results call for further analysis of the changes in the intensive margin. French exports, like those of other countries, show a high degree of concentration: in 2019, 0.1% of exporters - i.e. a hundred or so legal units - accounted for 36% of the value exported (41% if the aeronautics sector is included). And among these units, the group comprising the 0.01% largest exporters (about ten legal units) alone accounted for 14% of total exports (19% if the aeronautics sector is included). This concentration implies that the performance of these "export champions" is a determining factor in explaining the changes in aggregate exports.

"Export champions" are responsible for half of the slump

We now return to Chart 1 that shows the impact of exporter concentration on the response of aggregate exports to the Covid shock. The black bars represent the pre-crisis situation: the contribution to the total according to the position in the total distribution, whose values were explained in the previous paragraph. The grey bars show the contribution of each group to the total change in exports between April-May 2020 and the same period in 2019.

If, for a given export size class, the grey bar is higher than the black bar, this means that the group in question has contributed more than its pre-crisis share. This is true for the two groups of legal units with the largest exporters: the Covid shock was greater for these very large exporters than for the others. Overall, the decline in the sales of the hundred or so largest exporters in 2019 (i.e. the sum of the last two grey bars in Chart 1) accounts for almost half of the fall in French exports (excluding aeronautics). Within this group, the ten largest exporters alone account for a 22% decline in aggregate exports. It is important to note that these results persist when comparing performance by export size class within sectors using econometric methods. In other words, these results are not the consequence of the sectoral composition of French exports, and this remains true if we reintroduce the aeronautics sector.

These results are an illustration of the "granular" view of the economy (Gabaix, 2011): the performance of individual firms has a significant impact on macroeconomic developments when there is a high degree of concentration. While, in normal times, a handful of "export champions" contribute largely to France's aggregate performance on foreign markets, their poor performance also appears to be a determining factor in understanding the impact of Covid and the collapse of aggregate exports when the health crisis broke out.

*Access to the data used in this study was authorised by the Conseil national de l'information statistique (CNIS – National Statistical Information Board) and made available by the Centre d'accès sécurisé aux données (CASD - Secure Data Hub).

Updated on the 23rd of December 2024