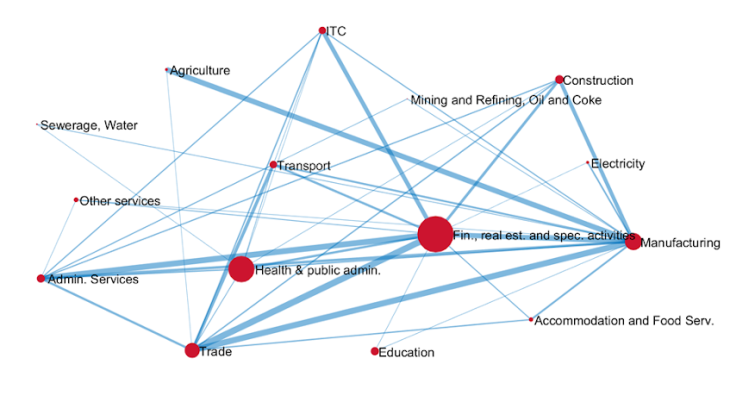

Note: The size of the red dots reflects the weight of each sector in value added, and the width of the blue lines reflects the amount of the main bilateral exchanges. Flows with foreign countries are not shown in the diagram to make it easier to read, but they are included in the model. ICT: information and communication technology

The impact of the tax is highly dependent on the sectoral structure of production

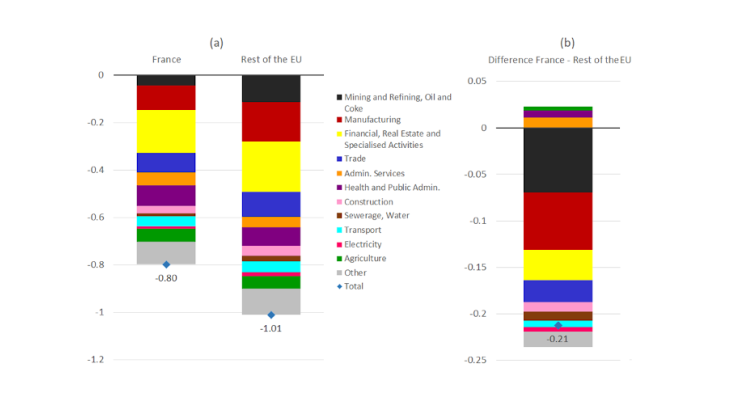

By construction, in our simulation, the tax rates applied to each sector depend on their respective GHG emissions. Thus, a sector that uses less carbon-intensive technologies will be less affected by the tax. For example, thanks to nuclear technology, the tax rate applied to France’s electricity production sector is half that applied to the same sector in the rest of the EU. As a result, its value added only declines by 0.6%, compared with a fall of 0.8% in the rest of the EU. However, its contribution to the aggregate impact is small, as shown in Chart 1a which provides a sectoral breakdown of the impacts in France and the rest of the EU.

By contrast, due to composition effects, sectors that are low-polluting but which account for a high share of aggregate value added are among the biggest contributors in both regions: financial, legal and real estate services, trade, health care and public administration account for 40% of the decline in value added, both in France and the rest of the EU. Unsurprisingly, the manufacturing industry, which generates more pollution and has a higher economic weight, especially in the rest of the EU, is the second biggest contributor to the fall in value added.

As well as being shaped by carbon intensity or by the economic weight of individual sectors, the impact of the tax is determined in a complex manner by the way in which it is propagated across national and international production networks (see Chart 2 for a simplified view of this for France): on the one hand it leads to a price rise which is then propagated downstream in value chains; on the other hand it triggers a fall in demand for intermediate inputs which is then propagated upstream. The extent of the propagation therefore depends on the size of the individual sectors, their relative positions in the production network, and the volume of bilateral inter-sectoral exchanges. Those sectors highest up in the network will be particularly affected, due to negative spillover effects that impact demand for their output. Mining and quarrying, as well as refined petroleum products – which is also affected directly by the tax on fossil fuel purchases – are among the worst-affected sectors.

A smaller impact in France than in the rest of the European Union

The rise in the carbon price in our scenario would reduce real value added in France by 0.8% compared with a decline of 1.0% in the rest of the EU – in other words, the aggregated impact in France would be 20% smaller.

Despite the differences between the two regions in terms of carbon intensity (higher for French households but lower on average for French firms than in the rest of the EU), this divergence mainly reflects differences in sectoral structure: even if the same tax rates were applied in both country blocks, there would still be a difference of 0.2 percentage point between the aggregate impact in France and that in the rest of the EU.

Due to composition effects, the sectors “oil, coke, mining and quarrying” and “manufacturing” account for more than half of the difference in impact between the two regions (see Chart 1b). They are among the sectors most affected by the tax, and have a higher economic weight in the rest of the EU than in France. Conversely, some sectors make a bigger contribution to the fall in value added in France than in the rest of the EU by virtue of their size: agriculture, public administration and defence, and administrative service activities. Aside from agriculture, however, these sectors are the least affected by the tax.

Conclusion

The analysis presented in this blog post illustrates the advantage of using a sectoral model to study the effects of a carbon price hike. It shows that, due to the structure of its economy, France is slightly better positioned than the rest of the EU to begin its climate transition using this tool. However, this study does not address the issue of how the impacts of a carbon tax may vary across households, or the need for a mechanism to redistribute tax proceeds in a gradual manner.