- Home

- Publications et statistiques

- Publications

- Bank stress-tests at the time of Covid-1...

Post n°196. Unlike the fictitious scenarios used in standard prudential stress test exercises (see post "Bank stress tests: tools for prudential analysis – Episode 1"), the Covid-19 crisis represents an unprecedented adverse scenario. This is an opportunity to draw the first lessons from it: (i) on the resilience of the banking system, as observed for the time being, and (ii) on the improvement of stress-test tools in the light of this experience.

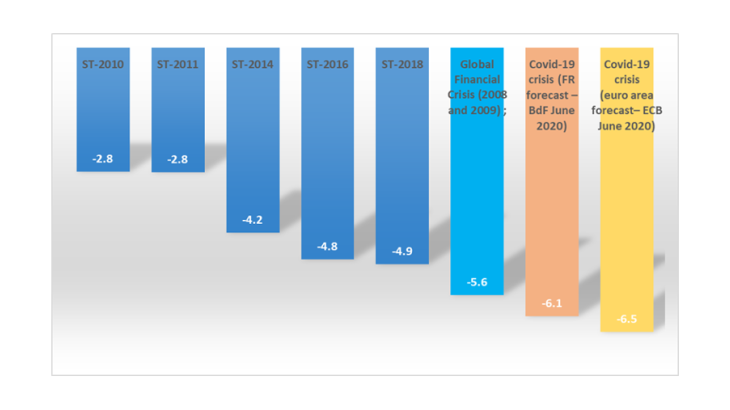

Note: 2-year cumulative difference between the adverse scenario and the baseline scenario of EBA stress tests. For the Covid-19 crisis, difference between the December 2019 and June 2020 Banque de France forecasts. For the Global Financial Crisis, difference between observed GDP and the European Commission's spring 2008 GDP forecasts.

The impact of the Covid-19 crisis: a more severe forecast than the scenarios tested since 2010

There remains considerable uncertainty surrounding the potential impact of the Covid-19 crisis on banks and the lessons learnt from the stress test exercises can be particularly useful in this context. In practice, since the stress tests started being implemented in 2009, the severity in terms of GDP shock of the scenarios used (in terms of deviation from the forecasts’ central scenario) by the European Banking Authority (EBA) has increased. Nevertheless, the severity of the scenarios used up until the 2018 exercise appears to be weaker than that of the current shock as estimated for France in the Banque de France forecasts dated June 2020 (in terms of deviation from the December 2019 forecasts - Chart 1). The European Central Bank (ECB) used this shock in terms of deviation from the forecasts (December 2019 vs. June 2020) to conduct a stress test known as "Vulnerability Analysis" in June 2020.

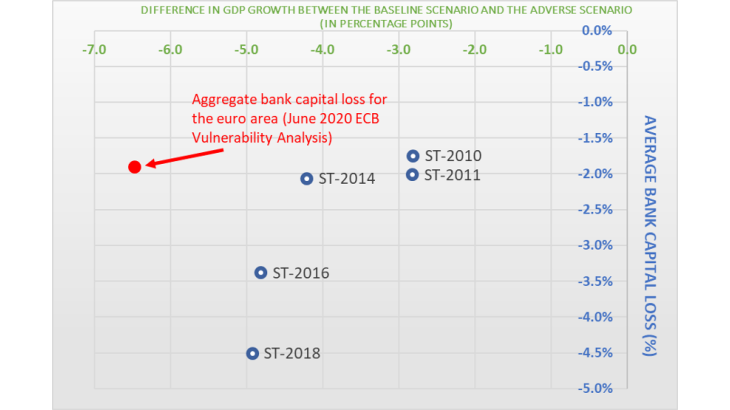

Chart 2 shows a close link between, on the one hand, the annual GDP shocks considered in the scenarios of previous EBA stress tests and, on the other, the estimated capital ratio losses for the French banking system. It should be noted that other assumptions, such as, for example, those concerning the evolution of interest rates and asset prices (shares and real estate), are also important in standard stress test exercises.

Note: the average bank capital loss of French banks and the average GDP loss (in blue: France, in red – EA) are assessed over a 2-year horizon.

Considering the increasingly severe GDP shocks, the stress tests conducted by the EBA since 2010 estimate ever-increasing capital losses for the French banking sector. However, it is important to relate these modelled capital losses to the initial situation of credit institutions' prudential ratios at the time of each exercise: banks are comparatively much better capitalised at the end of 2019 than in 2010 (on average around 5 percentage point solvency ratio). Thus, all other things being equal, they are better able to absorb macroeconomic shocks without jeopardising their ability to finance the real economy.

In June 2020, the ECB/SSM (European Central Bank/ Single Supervisory Mechanism) conducted the stress test exercise known as "Vulnerability Analysis" for all EU banks considered as systemically important in the context of the Covid-19 crisis, without disclosing the results by country. A particularity to be noted for this exercise: it partly takes into account the measures adopted by the different governmental and supervisory authorities and central banks that act as shock absorbers in the simulation. This element is not usually taken into account in stress test exercises. On the other hand, as in standard EBA stress test exercises, they do not take into account banks' managerial responses to the crisis (this is known as the "static balance sheet" approach, see the post “Bank stress tests: tools for prudential analysis – Episode 1”).

A key communication tool, especially in the context of the Covid-19 crisis

Communication around these exercises is essential. It provides investors, but also bank clients, with information on banks' ability to withstand a major crisis. However, this communication is tricky:

- For banks that pass the test, i.e. those that remain above the regulatory capital ratio required by the competent supervisor, the stress test exercise gives all stakeholders (supervisors, bank managers, investors, customers) an idea of their resilience.

- For banks that fail the test, the stress test exercise is a way of signalling that the supervisor is taking measures to strengthen the institutions concerned, in particular by planning their recapitalisation (raising capital, withholding dividends, etc.), while avoiding a sudden balance sheet adjustment that would be detrimental to the financing of economic activity.

In all cases, communication must be sufficiently transparent to enable everyone to assess the resilience of the banking system to stress, while limiting the risk of self-fulfilling prophecies.

In the context of the Covid-19 crisis, the ECB/SSM, the bank of England, the Bank of Canada and the US Federal Reserve have each communicated on their stress test exercises. The results should be interpreted in the light of the perception of the Covid-19 crisis and the still highly uncertain environment at the time of their publication. In particular, they were conducted before the second wave of lockdowns carried out in many countries in autumn 2020. Unlike the standard exercises involving banks (the so-called "bottom-up" approach), these were entirely conducted by supervisors (a "top-down" exercise). Moreover, they do not simulate a fictitious scenario but aim to predict the impact of the Covid-19 crisis on bank health. They are thus more akin to forecasting exercises (i) with a highly uncertain economic recovery scenario and (ii) a methodology that is entirely based on the supervisory authorities’ models and does therefore not involve banks. In these "top-down" exercises, banks’ individual characteristics are less well integrated and further work is needed to possibly calibrate individual requirements in terms of capital strengthening. Only the aggregated results have therefore been published.

At the end of July, the ECB/SSM published the aggregated results for the 86 banks that it supervises and which are based on the analysis of three scenarios: (i) the pre-Covid-19 macroeconomic forecasts made at end-2019; (ii) the central forecasts published by the ECB in June 2020 (which corresponds to the Vulnerability Analysis point in Chart 2) and finally (iii) a more adverse scenario involving a deep and lasting recession. Thus, according to the SSM, the EU banking system is expected to experience an aggregate capital ratio loss of 1.9 percentage points in the central scenario (as forecasted) and a more significant impact (of around 5.7 percentage points) in the case of a more severe scenario than the forecasts for 2020.

Useful but perfectible tools

The 10-year experience of conducting bank stress tests and the recent episode of Covid-19 provides us with several lessons for the future of stress-test exercises.

- Lesson 1: Thanks to the definition of capital requirements in the regulatory framework, but also resulting from stress tests at the European Union level, the banking system has become better capitalised and therefore better prepared to face a shock such as the current crisis. Maintaining sufficiently severe scenarios is therefore essential; it is also a guarantee of credibility.

- Lesson 2: Stress tests are also risk monitoring tools that need to be implemented easily and rapidly; this flexibility is guaranteed by the existence of analytical simulation tools at the disposal of supervisors. They also used to assess the impact of support measures on banks, which is an innovative use of these tools.

- Lesson 3: The use of stress-testing tools must go hand in hand with a close dialogue with banks, in particular in order to be able to complete the results by integrating the potential portfolio readjustments (loans granted, financial instruments held, debt taken on, capital issued) that banks make in response to the shocks they are faced with.

- Lesson 4: Results often depend too strongly on a single scenario, which sometimes weakens the lessons to be learnt in terms of bank capital. Taking into account a number of scenarios and interpreting the stress-test results as impact intervals would be an objective way of addressing this issue.

- Lesson 5: Adopting a complementary approach where one would identify the scenarios for which a bank (or a banking system) is failing. This is referred to as "reverse stress testing". This would make it possible to identify, by business model, the "most adverse" scenarios and to monitor their plausibility and impact.

To sum up, while the importance of bank stress tests has once again been highlighted by the Covid-19 crisis, these exercises are not uncritical and many avenues for improvement outlined above could be explored. They nevertheless prove to be useful and complementary tools for individual bank supervision. It also seems necessary to examine these questions at the international level.

Updated on the 25th of July 2024