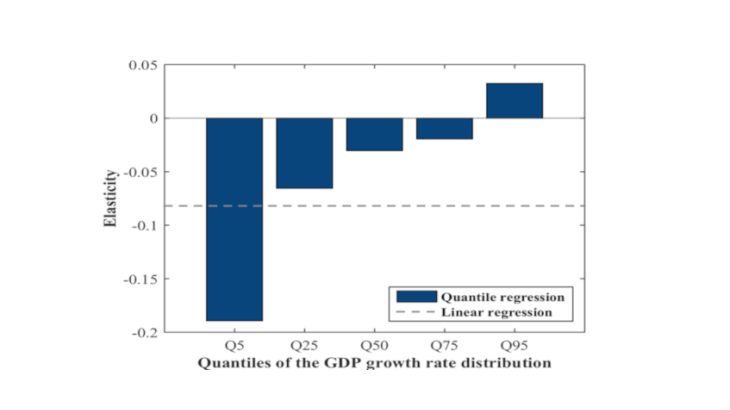

Note: This chart shows the results of the regression of the GDP growth rate on financial conditions for each quantile of the distribution of GDP variations. The slope of the regression is 0.04 for the 95% quantile and -0.2 for the 5% quantile.

Link between financial conditions and euro area growth

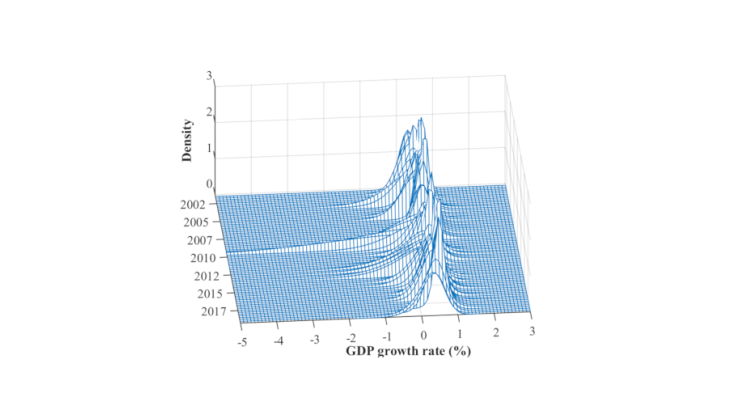

The theoretical and empirical literature has shown that financial markets play a key role in the transmission and propagation of shocks, but that the relationship between financial market developments and economic growth is complex and non-linear. In particular, Bernanke and Gertler (1989) formalised the amplification mechanism of financial shocks to the real economy. In this context, we use the quantile regression method over the period 2001-2018 to assess the sensitivity of future euro area GDP growth to our financial conditions index. This regression is useful because it delivers an estimate of the elasticity of the GDP growth rate to financial conditions for any range of values (referred to as quantiles) of the economic growth rate, and thus captures the non-linear nature of this relationship. Chart 2 shows the values of these elasticities for various quantiles, when macroeconomic conditions in the previous quarter are controlled for, and the elasticity (quantile independent) estimated by standard linear regression. The latter is negative, which indicates that a tightening of financial conditions tends on average to slow economic activity. However, the quantile regression indicates that the relationship is the strongest (around -0.20) for changes in GDP located at the bottom of the distribution (which are most often negative), thus highlighting a significant non-linear effect. A tightening of financial conditions tends to amplify the effects of negative shocks to the real economy, while an easing of these conditions has a more limited impact on economic activity.

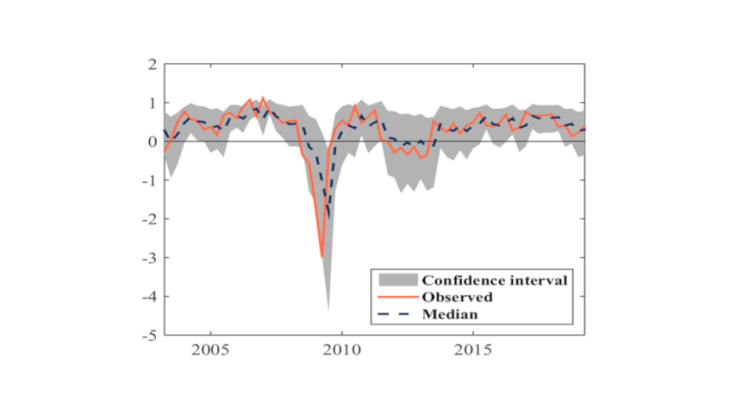

The forecasts obtained from the model are close to the GDP growth rates observed in the euro area (see Chart 3). The confidence interval, measured as the difference between the highest and lowest of the conditional quantiles, is asymmetric, especially during periods of recession. During these episodes, we observe that the distance between the 5% quantile and the median is greater than that between the 95% quantile and the median. This shows that the model is able to correctly take into account financial risks. While the upside risks are relatively stable over time, the downside risks vary greatly depending on the financial conditions of the euro area.