- Home

- Publications and statistics

- Publications

- System-wide stress tests: a deep dive in...

Post n°249. The growth of non-bank financial intermediation calls for a more holistic risk assessment encompassing the entire financial system and the interactions between financial intermediaries. The incorporation of investment funds into a stress test for banks further increases the impact of a shock in terms of depletion of bank capital by 1%.

Developments in non-bank intermediation call for system-wide stress tests

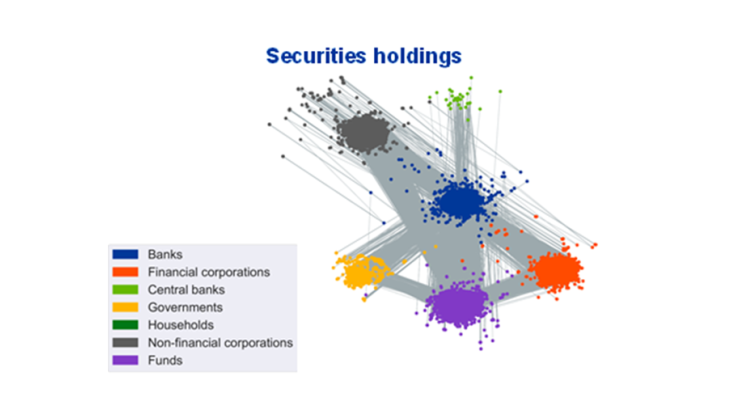

The financial system in the euro area (EA) has significantly changed since the 2008 financial crisis. Banks’ dominant position in financial markets waned in favour of non-bank financial intermediaries such as investment funds, pension funds and insurers. Funds’ assets under management more than doubled from 2008 to 2019, reaching EUR 14 trillion. This compares to total assets of around EUR 31 trillion held by euro area credit institutions, which have remained broadly stable since 2008. These developments raise new questions but also new challenges for the analysis of financial stability, calling for a more holistic risk assessment encompassing the entire financial system and for a better understanding of the complex interactions between different financial intermediaries, including not only banks but also non-bank financial institutions (see Chart 1 for a representation).

In order to measure the risk bearing capacity of the financial system, stress-testing exercises have become an essential tool - see former Banque de France blog posts number 195 and 196 on bank stress testing. Regulators use them extensively to assess the strength of various financial entities such as banks, investment funds, insurance companies, central counterparties (CCP), occupational pension funds, etc. Nevertheless, those stress tests at the institution-level have shortcomings. By analysing an institution in isolation, supervisors miss the amplification channels that result from interconnections between institutions. Therefore, sectoral stress tests have been developed to better take into account within-sector interconnectedness. Sectoral stress test may include second-round effects that fuel changes in bank balance sheets, e.g. Budnik et al. (2020), or contagion due to interbank holdings of debt, e.g. Covi et al. (2019). While these various methods can also be linked together, there has been no integrated framework linking the different financial sectors.

Initial studies on system-wide stress testing model the relations between sectors, e.g. Aikman et al. (2019) consider each sector to be a representative agent. These models shed some light on the transmission channels. However, they do not offer insights into intra-sector heterogeneity. Under the Eurosystem Financial Stability Committee mandate, we develop a system-wide framework that explicitly models heterogeneous behaviours at the sectoral level and constraints (e.g. regulatory), making use of granular data on exposures both within and between sectors.

System-wide stress testing builds upon comprehensive data to model interactions

Modelling the financial system as a whole, at a granular level, is challenging. Therefore, we proceed gradually. In Sydow et al. (2021), we build a two-sector framework, with the possibility of adding more sectors in the future. The current framework includes euro area banks and open-ended investment funds, accounting for total assets of EUR 45 trillion. Granular data encompasses banks’ and funds’ securities holdings, and banks’ loans.

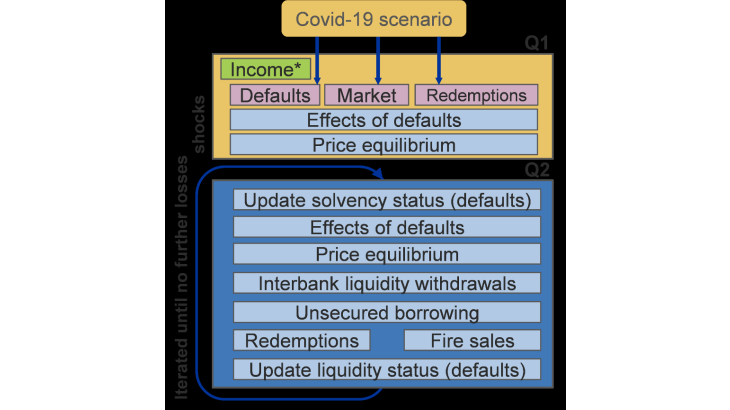

For our first simulation results, we applied the shock scenario of the 2020 ECB vulnerability analysis exercise conducted for banks under the single supervisory mechanism’s supervision: satellite models are used to translate the adverse scenario into non-financial corporate (NFC) defaults, drops in market prices and fund redemptions.

Those initial defaults and redemption flows trigger the contagion dynamics (Chart 2). Initial NFC defaults and fund redemption flows lead to additional defaults or liquidity shortfalls of banks and funds. These lead to fire sales, which affect equilibrium prices of common asset holdings and dry up the interbank market. These mechanisms generate new redemptions by investment fund investors and might drive additional bank capital or liquidity shortfalls. The liquidity and solvency status of each institution is calibrated based on actual regulatory requirements.

This contagion loop is, therefore, an iterative process. We track (i) how an initial shock is transmitted and amplified within our simplified financial system of euro area banks and investment funds and (ii) how regulatory and internal constraints may force financial entities to react. Our model does not aim to capture all firm-level specificities but rather focuses on the main channels of transmission. System-wide stress tests are, thus, often cruder in terms of detailed risk-specific modelling of an entity’s behaviour compared to sectoral stress tests but provide important additional insights regarding amplification effects due to the interconnectedness of different financial agents.

Accounting for system-wide interactions increases losses for the financial system

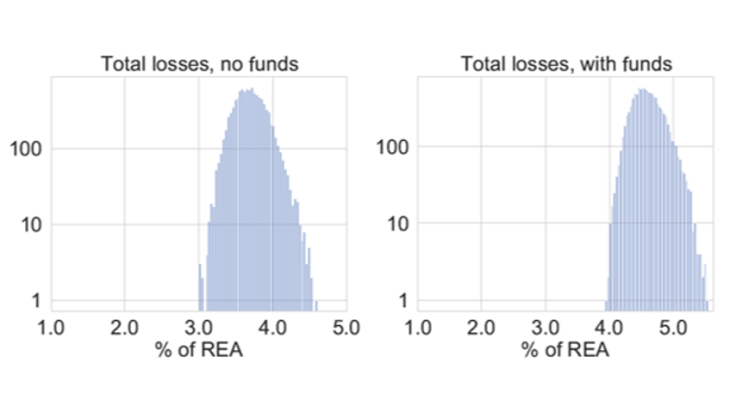

One of the model’s main results highlights the relevance of interconnections between banks and investment funds for measuring the impact of a shock. We run 10,000 simulations of the model from the initial stochastic defaults of large corporations. Chart 3 presents the distribution of bank losses as a percentage of the risk exposure amount and compares results with and without investment funds interactions being taken into account.

The chart reveals that the incorporation of investment funds into a stress test for banks further increases the impact of a shock in terms of depletion of bank capital. More specifically, the distribution of losses moves from 3-4% of REA (Risk Exposure Amount) to 4-5% of REA when investment funds are considered to be an additional sector in our stress testing framework. This chart illustrates the importance of having a system-wide approach for stress testing in order to take into account the fact that the interaction with investment funds potentially amplifies banking system losses.

These results encourage us to further study the contagion channels between different financial institutions and to go ‘system-wide’ by integrating additional relevant sectors for financial stability analysis such as insurance companies, hedge funds, money market funds, or central counterparties. Our journey towards the system-wide stress testing of the financial system has just started and future work will focus on policy applications of our framework.

Updated on the 25th of July 2024