1. The challenge of harmonizing insolvency regimes

Developing an insolvency law that is in line with the best international standards has become a major issue for economic attractiveness. In particular, the aim is to prevent resources from being tied up in low productivity activities, when they could be used more efficiently by innovative or better managed companies (OECD, 2019). This can be achieved by shortening timeframes, minimising costs and maximising the value of companies in difficulty (from a turnaround perspective). The creation of common standards is also essential to lower the barriers to cross border investment and thus contribute to a better allocation of capital. This has always been a major concern in the European Union (EU), given member countries’ integration into a common internal market. The desire to harmonise European insolvency law is a long standing one in the EU: for a long time, this idea seemed so far fetched that it might have aroused scepticism.

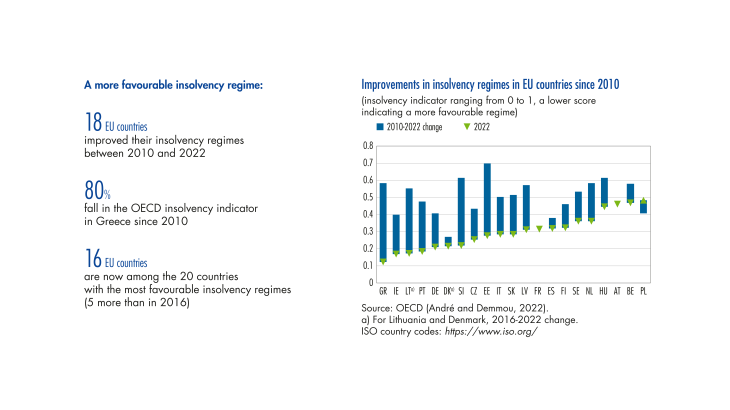

However, the convergence of national laws, which began with the signing of the Brussels Convention of 23 November 1995, is well underway and has even gained momentum in recent years, in the context of the Capital Markets Union and the Banking Union. This is reflected in the adoption in 2019 of the Restructuring and Insolvency Directive, which was supplemented, on 7 December 2022, by the publication of a new proposal for a directive aimed at harmonising and improving certain aspects of insolvency law (timeframes, amounts recovered, fairness and predictability of procedures).

Initially dictated solely by concerns about aligning national civil laws – which were seen as the fundamental corollary to the establishment of a single market based on the free movement of goods, people, capital and services – the convergence process now also aims at achieving the common good of macroeconomic and financial stability.

2. Harmonisation fostered by the gradual removal of traditional conceptual barriers

For a long time, harmonisation was considered impossible to achieve in the EU because of the major differences between national legislations. The obstacle was of a conceptual nature, due to the coexistence in Europe of two law systems, which, historically, have assigned divergent purposes to collective proceedings. On the one hand, continental law, which is relatively fragmented, has historically focused more on punishing debtors (criminal sanctions, prohibition from practising following bankruptcy, etc.) and clearing liabilities, through a procedure that is highly judicialised.

[To read more, please download the article]