In 2023, inflation remains the main economic challenge for the Eurosystem, which, since 2022, has been pursuing an active monetary policy to lower inflation to 2% by increasing interest rates.

Academic research has established that monetary policy is more effective when economic agents’ inflation expectations are stable and close to the inflation target. One of the conditions for medium term price stability is that households and firms should not expect high inflation in the future. If they did, this would affect their consumption or price setting decisions and risk sustaining inflation. Consequently, for the central bank, maintaining price stability consists in enabling economic actors to coordinate their decisions around a shared and credible

inflation target.

The effectiveness of monetary policy is thus contingent on its ability to influence the expectations of economic agents, especially households (Lagarde, 2023). However, perceptions and expectations of inflation vary widely from one individual

to another and depend not just on sociodemographic factors such as age or gender, but also on individuals’ experience of purchasing specific goods, especially those they buy frequently (Bignon and Gautier, 2022). In view of this, how can central banks influence households’ inflation expectations? One crucial factor is the level of trust in the central bank’s ability to keep inflation low and stable. Accessible, transparent and convincing communication (Hermel and Proissl, 2023) can positively affect trust, and is even more effective when households and business leaders are attentive to and understand the central bank’s actions (Assenmacher et al., 2022).

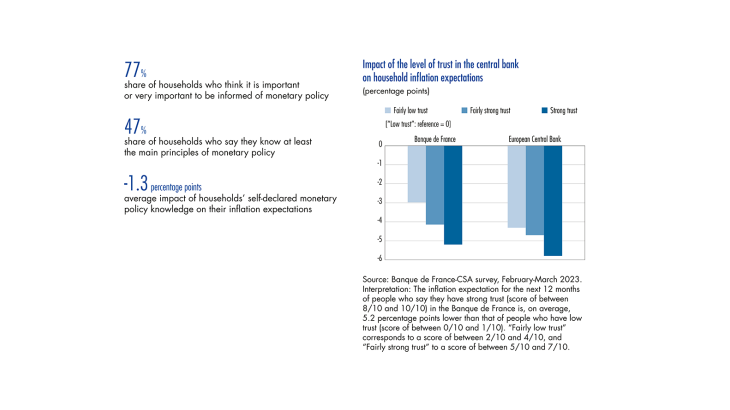

To measure households’ monetary policy knowledge, their trust in the central bank and the impact on their inflation expectations of the attention they pay to central bank action, the Banque de France has conducted an annual survey since 2021, in collaboration with the polling institute CSA. The 2023 survey was carried out between 28 February and 28 March and covered 5,028 French residents aged 18 and over who were representative of the French population.

The survey found that French people think it is important to be informed of monetary policy and that trust in the Banque de France and the European Central Bank (ECB) is relatively high. The more individuals know about and understand monetary policy, the greater the impact of their trust on their inflation expectations. Higher trust combined with greater knowledge of and attention to monetary policy challenges helps to anchor household expectations at the 2% inflation target, reinforcing the effectiveness of monetary policy transmission to the economy.

[To read more, please download the article]