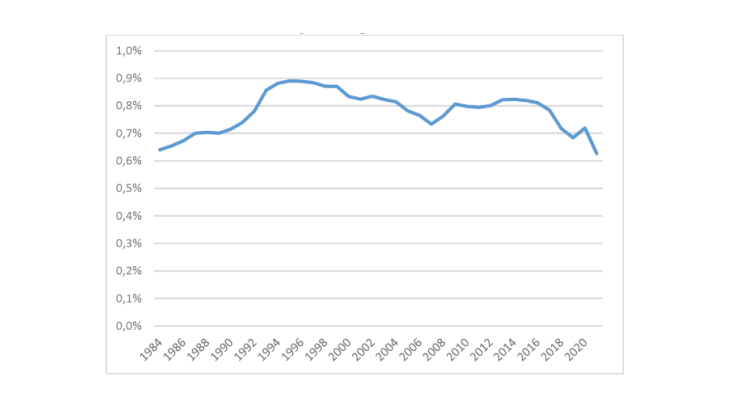

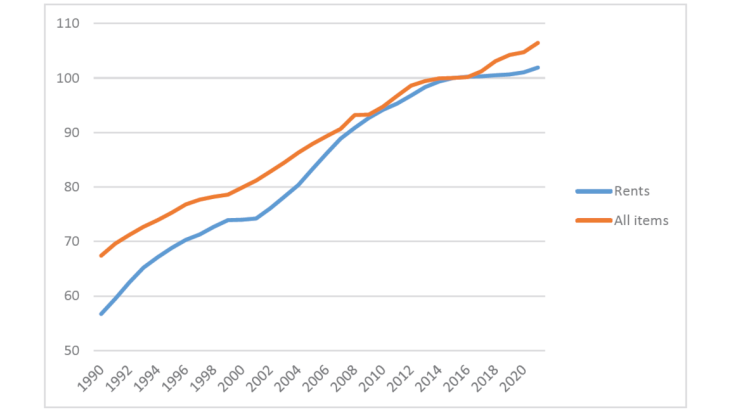

Source: Annual consumer price index - Base 2015, for actual rents and all items, all French households, INSEE.

In theory, housing subsidies can lead to a rise in overall demand for housing and therefore in rents, at least in the short term, when supply elasticity is considered to be low. Under these conditions, the housing benefit will be partly captured by landlords. In the long term, rents, and more generally the equilibrium, depend on the elasticity of supply. The supply can increase extensively via a rise in the number of dwellings, or intensively via an increase in their quality. In practice, however, rental housing supply can remain partly inelastic.

A short-term upward effect on rents has been found in numerous countries

Several concordant empirical studies conducted in different countries have already highlighted and measured the short-term inflationary impact on rents of housing subsidies targeting tenants, as for example Eriksen and Ross (2015) or Collinson and Ganong (2018) in the United States.

In France, where rents have risen faster than the consumer price index (Chart 2), Laferrère and Le Blanc (2004) and Fack (2006) find a positive effect of housing subsidies on rents in the 1990s. These two studies use the natural experiment provided by the reform of housing subsidies at the start of the 1990s. Laferrère and Le Blanc (2004) show that the significant impact of housing subsidies on rents is only slightly explained by an increase in dwelling quality. Fack (2006) shows that the reform led to a rise in rents that represented 78% of the amount of the subsidies, with no observed improvement in quality.

A new method for measuring the long-term impact

Our recent study measures the long-term impact of housing subsidies on rents, and on the quantity and quality of private rental dwellings in France. It thus provides an insight into the elasticity of the supply of rental housing.

To measure the long-term impact of housing benefit, we compare similar urban agglomerations receiving higher or lower subsidies since the reform of housing subsidies in the 1990s.

An overall upward long-term effect on rents

We find no significant impact of housing subsidies on rents in the 1980s, when the expenditure on housing benefit was lower. In contrast, we show that they led to a rise in rents in the two decades following the reform (from 1995 to 2016), with a stronger impact in the short run (in the 1995 to 1999 period).

Between 2000 and 2016, housing subsidies had an overall positive impact on rents, even for tenants that were not subsidised. The impact for non-claimants is large, as in the United States (Susin, 2002). In France, given that 40% of tenants in the private sector are subsidised, a landlord can take housing subsidies into account when setting the rent, before knowing whether or not the tenant is subsidised.

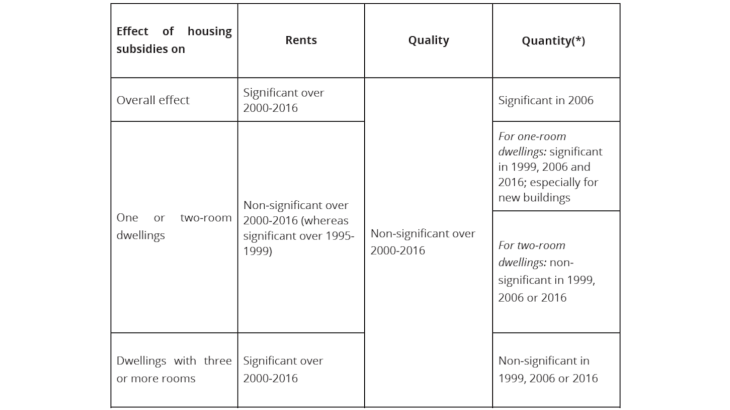

The positive impact on rents holds with a constant magnitude when we divide the study period (2000-2016) into two sub-periods (2000-2008 and 2009-2016). This inflationary impact is accompanied by an increase in the quantity of private rental housing; no effect on quality is detected (Table 1).