Housing subsidies are one of the main tools for housing policy in many developed countries. These subsidies aim to limit the budget share of housing for tenants and to improve their housing conditions for a given budget share. In theory, their introduction may result in an increasing aggregate demand for housing, and therefore rents, at least in the short term, when housing supply is considered as weakly elastic. Under these conditions, housing allowance would be partly captured by landlords. In the long run, rents and more generally the equilibrium depend on the elasticity of supply. The supply can increase in an extensive way by a growing number of dwellings or in an intensive way by their increased quality. Rental housing supply can, however, remain partly inelastic, for example if local authorities implement restrictive land use policies.

In many countries, several concordant empirical studies have already highlighted and measured the short-term inflationary impact of housing subsidies targeting tenants. The aim of this paper is to test the assumption of the inelasticity of rental housing supply by measuring the long-term impact of housing subsidies on rents, quantity, and quality of private rental dwellings by taking the French example.

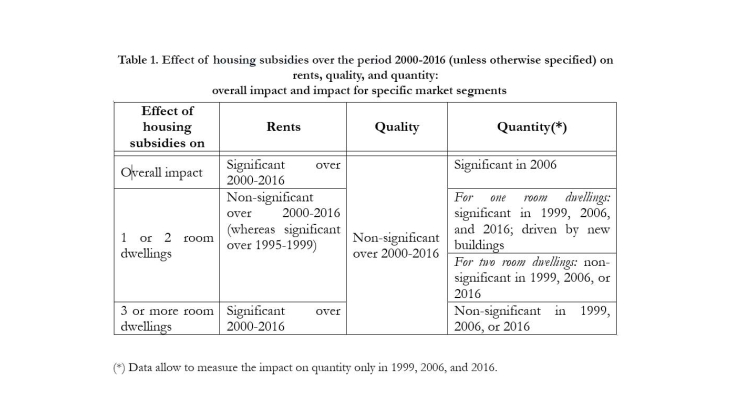

To measure the long-term impact of housing subsidies, we compare similar agglomerations receiving higher or lower subsidies since the reform of housing subsidies in the 1990s, which strongly increased the number of beneficiaries. We find no significant impact of housing subsidies on rents in the 1980s, when the expenditure for housing benefit were lower, while we highlight that housing subsidies caused an increase in the rents in the two decades following the reform (from 1995 to 2016), with a stronger impact in the short run (in the 1995-1999 period). Between 2000 and 2016, we show that housing subsidies have an overall positive impact on rents, even for tenants who do not benefit from subsidies. This positive impact on rents holds with a constant magnitude when subdividing the 2000-2016 study period in two sub-periods (2000-2008 and 2009-2016). This inflationary impact is accompanied by an increase in the quantity of private rentals; no impact on quality is detected (see Table 1 for a summary of results).

We show that this long-term inflationary impact is heterogeneous and accompanied by different reactions on the housing market, depending on market segments. For dwellings with three or more rooms, the rental housing supply remained inelastic in quality and in quantity and higher housing subsidies led to a lasting increase of rents between 2000 and 2016. For one or two room dwellings on the contrary, rents stopped increasing significantly between 2000 and 2016 (after their rise between 1995 and 1999) and the quantity of private one-room rentals increased in 1999, 2006, and 2016, driven by new buildings. Our finding could be due to the entry of a greater number of students in housing markets where subsidies are higher. For small dwellings, the housing market responded to this increase of demand by an increase of supply in quantity. The supply of one-room rentals is probably the most elastic one, as landlords who opt for rental investment are more easily solvent to buy a small dwelling or prefer diversify their risks by buying several small dwellings if they are wealthy enough to do so.