- Home

- Publications et statistiques

- Publications

- Green securitisation: a lever for financ...

Post No. 399. In recent months, several proposals have been put forward for fostering a Savings and Investments Union. In this context, the Banque de France has identified “green” securitisation as a means of unlocking significant funding for the ecological transition. The creation of a European securitisation platform could help towards this goal.

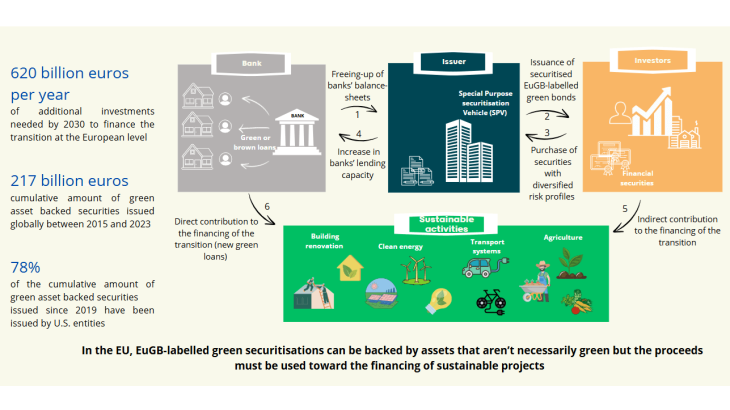

Chart 1: Green securitisation – European regulatory framework and main issues at stake

Securitisation could be used to meet the objectives of the Savings and Investments Union

The Savings and Investments Union (SIU) is a response to the Capital Markets Union’s (CMU) lack of progress towards financial integration, and to numerous calls to shift the CMU to a more unifying purpose: financing the ecological and digital transitions (F. Villeroy de Galhau, 2024). Europe has a savings surplus that can be used to this end, provided it has tools to channel the funds towards its substantial additional investment needs (see Chart 1) – estimated by the European Commission at EUR 620 billion per year for the sustainable transition (F. Villeroy de Galhau, 2024).

These additional investment needs can only be met by mobilising further resources, on top of those currently available. Public debate has identified two complementary channels for achieving this goal: increasing equity financing, especially for innovation, and giving banks the means to raise their lending capacity. In the case of the latter, policymakers have singled out the relaunch of the securitisation market as a key priority (notably Noyer, 2024). This ambition is nothing new (CMU action plan, 2015), and can build on the sound functioning of the European securitisation market during the Great Financial Crisis (2007-08) and the strengthening and harmonisation of the European securitisation framework since 2019.

However, it will be difficult to increase securitisation issuance without adapting the current prudential framework or the disclosure requirements applicable to securitisation (Banque de France/ACPR, 2025). Another key question, which is the focus of this blog post, is how to ensure the funds freed up from bank balance sheets are indeed allocated to the SIU’s new goals. Unlike conventional sustainable financing instruments (green bonds, sustainability-linked bonds), securitisation was not created for this specific purpose. Therefore, green securitisation seems a particularly useful adaptation, as it not only frees up banks’ balance sheets but also includes a mechanism to redirect the proceeds towards the ecological transition.

Green securitisation now benefits from a harmonised European framework

There is no harmonised definition of green securitisation, since it was initially developed outside the scope of existing regulatory frameworks. Its sustainable nature can refer to the greenness of the underlying assets (e.g. building renovation loans), or to the allocation of funds raised by selling these underlying assets (not necessarily green) towards green loans. The European legislator has clarified the definition by adopting the latter meaning. Hence, under the European green bond standard (or EuGB), which came into force in December 2024, securitisation qualifies as “green” and can be assigned the “EuGB” label, even when backed by non-sustainable claims (with the exception of loans financing fossil energies), provided the originating bank uses at least 85% of the proceeds to finance activities compliant with the European Taxonomy, This is known as the “use-of-proceeds” principle. Measures are also in place to guarantee this principle is met, notably disclosure requirements and checks by an external reviewer registered and supervised by the European Securities and Markets Authority, to ensure funds are effectively allocated to the sustainable transition.

Green securitisation is a nascent market segment

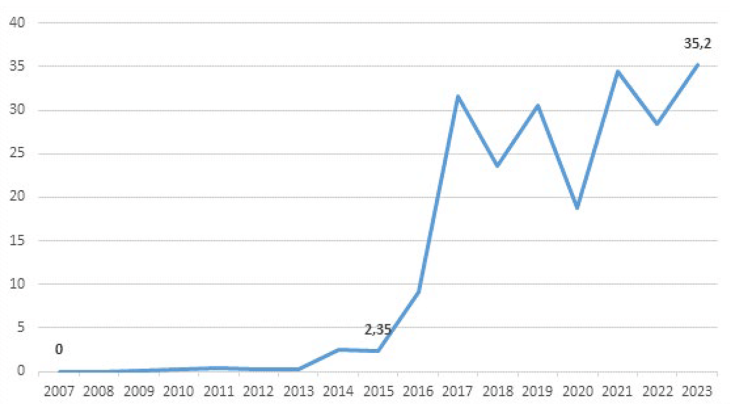

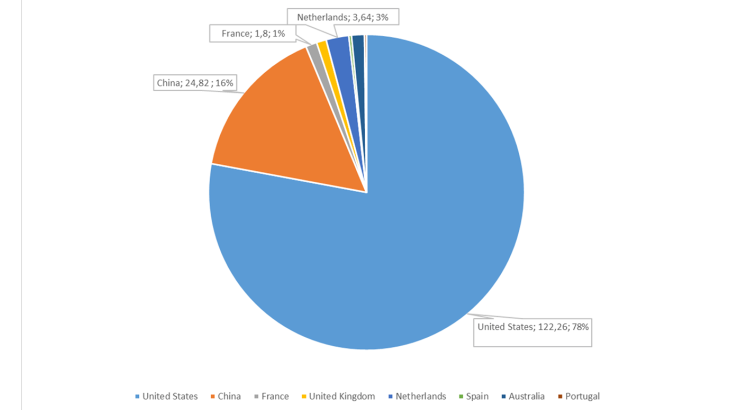

The EuGB regulatory framework aims to foster growth in the European green securitisation market, which is currently lagging behind other jurisdictions. Although the lack of a standard definition makes international comparison difficult, it is still possible through issuers’ declarations stating that their issues meet the use-of-proceeds component of the ICMA standard (Total amount of issuance reported by the issuer as meeting at least the use-of-proceeds criterion, according to Bloomberg). On this basis, between 2015 and 2023, a cumulative total of USD 217 billion of green asset-backed securities were issued worldwide, up from USD 6 billion between 2007 and 2015, indicating a recent surge in the market (see Chart 2). This expansion has largely been driven by US issuers, who account for 78% of green asset-backed securities issuance since 2019, compared with 16% for China (see Chart 3).

Chart 2: Annual global issuance of green asset-backed securities (use-of-proceeds principle) between 2007 and 2023 (EUR billions)

Chart 3: Green asset-backed securities by main country of issuance since 2019 (cumulative issuance based on the “use of proceeds” definition, in EUR billions)

Towards a European platform for green securitisation issuance?

At this stage, the EuGB label is the only shared and rapidly deployable tool that can ensure that funds freed up by securitisation are used to finance the ecological transition. It could also provide a first level of standardisation for European securitisation transactions. Its impact would be amplified if it were also coupled with the creation of a shared European platform for green securitisation. This is the position advocated by the ECB in its response to the public consultation claunched by the European Commission, stating that the creation of such a platform, focused on green securitisation, would be the most significant measure. In the United States, for example, a single platform, Fannie Mae (a shareholder-owned government-sponsored enterprise), has issued more than half of all US green securitisations since 2019. In Europe, an issuance platform would generate economies of scale and extend the investor and issuer base to less liquid financial centres. Such a platform would necessitate the definition of standardised rules as regards the eligibility of underlying claims and the subordination of tranches. The main source of underlying assets could be residential loans, as this would provide a large pool of relatively homogeneous and low-risk assets (The strong diversification of securitised residential loans would lower exposure to physical risks. Moreover, the indicator on physical risks developed by the ECB shows that risks are limited in the real estate sector). The European Investment Bank could be a key player, given its existing role in the securitisation market (ENSI). Nevertheless, the creation of a common issuance platform remains a medium-term objective due to the existence of structural obstacles, most notably the fragmentation of European loan terms and insolvency rules (Gosse, Jamet, Lamy, Massengo, 2023).

Download the full publication

Updated on the 25th of March 2025