- Home

- Governor's speeches

- From a Capital Markets Union to a genuin...

From a Capital Markets Union to a genuine Financing Union for Transition

François Villeroy de Galhau, Governor of the Banque de France

Published on 23rd of February 2024

Eurofi – Ghent, 23 February 2024

Speech by François Villeroy de Galhau, Governor of the Banque de France

Ladies and Gentlemen,

It is a great pleasure to be here today, and I extend my warmest thanks to David Wright, Didier Cahen and Eurofi’s team for organising this event in this architectural jewel of the city of Ghent. The focus of my speech today will be on the Capital Markets Union (CMU). Some may think that this theme it is a bit too familiar, with the same tired messages. But this time is different.

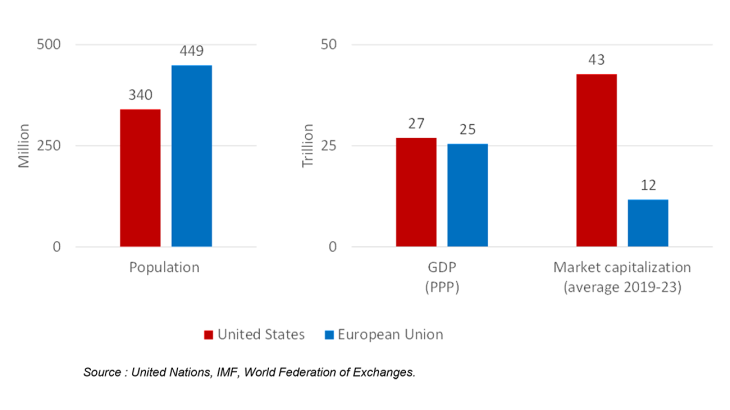

The Capital Markets Union has long been seen as the Ugly Duckling,i sparking little public interest, and lacking political ownership. The reasons for this are well known: the CMU involves a myriad of technical measures, relating to a wide number of sectors – the financial sphere, as well as corporate legislation and capital taxation. The Commission has nonetheless worked tirelessly on the 2015 and 2020 action plans and accomplished massive progress, albeit underestimated: no less than 33 out of 36 measures have been implemented or are underway. Nevertheless, Europe remains far below its potential in terms of financial power relative to its economic and demographic power (slide 2).

In line with this insufficient dynamism, the EU’s share in the global volume of financial transactions almost halved between 2006 and 2022.ii But a window of opportunity has recently opened with Christine Lagarde’s push for a “Kantian shift”.iii In France, the Minister for Economic Affairs Bruno Le Maire launched a taskforce led by my predecessor Christian Noyer,iv to make “tangible recommendations”. I don’t want to preclude their conclusions and the views I share this morning are mine. But I couldn’t agree more with one conviction: we should go beyond the “CMU fatigue” – which is real –, and scale up our “CMU ambition”. To change gear, I am calling today for a higher purpose (I) and for broader instruments (II).

I. Why: unite around a higher purpose

After the Great Financial Crisis, the CMU has been promoted mainly for its “stabilising” effect, which has proved insufficiently galvanising. The 2015 action plan was with the idea of shifting companies’ debt financing from banks to markets – a more “US-like” model –: this opposition was simply misleading, while we should pursue complementarity. The CMU was also intended to cushion asymmetric shocks in an Optimal Currency Area perspectivev – which remains valid, but not very appealing politically. As a result, we put too much emphasis on the “M” of the CMU, i.e. on the development of market financing, and too little on the “C”, i.e. on equity financing, as well as on the “U” for cross border flows.

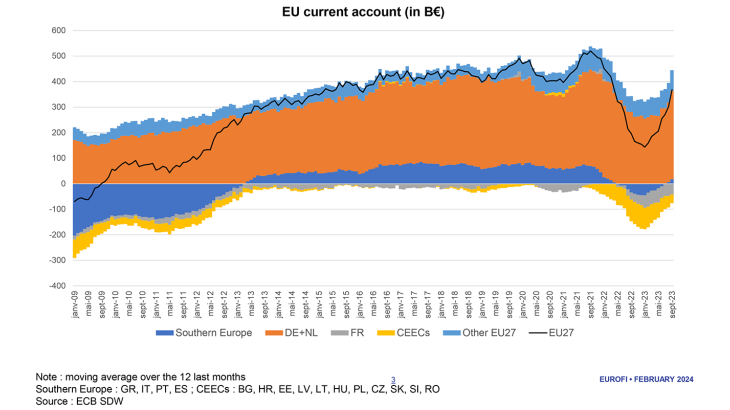

The priority is now to shift to a higher and more unifying purpose. Here, the precedent of the single market can provide valuable insights: Jacques Delors’s genius was to bring a collection of 300 technical texts under the banner of the four freedoms of movement. I think that the CMU’s banner is quite clear today: we need to unlock financing for the twin European transformations, ecological and digital. They will require, respectively, up to EUR 620 billion and EUR 125 billion of additional investment per year in the EU up to 2030.vi In more economic terms, we must shift from a mere stabilising purpose to an allocation purpose, and thus “rebrand” the CMU. I hereby call loudly and clearly for a “Financing Union for Transition”. And we should therefore mobilise the European excess of savings over domestic investment,vii which should amount to around EUR 370 billion in 2023 (slide 3).

Let me be more specific about what this Financing Union for Transition encompasses. The current – and very welcome – momentum on the CMU must not leave two other fundamental projects behind, – or worse, serve as an excuse for scrapping them. First, the Banking Union is a natural complement to the CMU. Together, Pan-European capital markets and banks would be a powerful vector, enabling funds to flow freely across Europe. We have built a successful “Supervision Union” – for 10 years now –, but not yet a Banking Union. On the one hand, we could renounce a fully-fledged European Deposits Insurance Scheme and opt for an alternative set-up, such as liquidity support between national Deposit Guarantee Schemes. On the other hand, we must overcome long-standing deadlock on home/host issues with pragmatism. We should foster the development of genuine pan-European banks – we have almost none – by facilitating cross-border waivers on capital and liquidity, and “branchification”.

Second, a Financing Union is inherently linked to the single market. Often seen as a grand legacy from the past, the potential of the single market is far from having been fully tapped, especially in the area of services. The IMF’s recent call to deepen the single marketviii and the upcoming report on the future of the single market lead by Enrico Lettaix should be politically aligned with the momentum on the CMU: less national state aids, which distort the optimal allocation of capital; and more European integration in at least three sectors that were left aside in 1993 and require major investment, namely, energy, telecoms and technology, and defence.

II. How: broaden our scope around four more ambitious instruments

Of course, a great deal of work which has already been done on a number of technical issues needs to be continued, such as the harmonisation of insolvency law.x As the first goal of our Financing Union for Transition should be to finance innovation and greening, let me focus accordingly this morning on four more ambitious instruments.

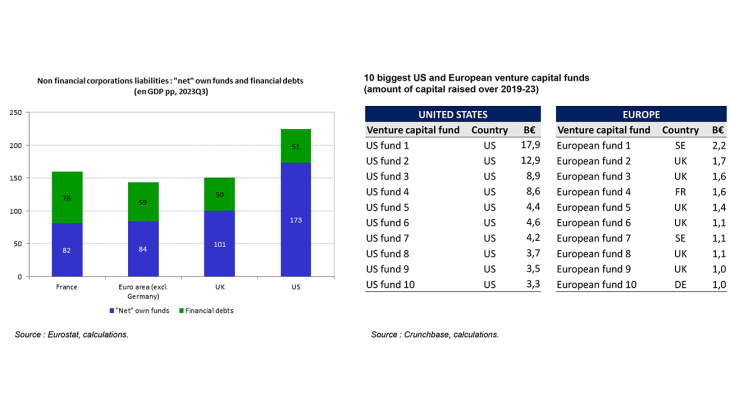

1. Equity financing is the most appropriate tool for innovative projects, given their higher level of risk and the need to finance them over a long-term horizon. There is undeniably a growing momentum here: private equity fundraising has grown by 246% since 2015,xi and more than 40 funds have been registered each year since 2014 under the EuVECA dedicated label (European venture capital Funds). But we are still lagging dramatically behind the United States: in the third quarter of 2023, equity financing only represented 84% of euro area GDP versus 173% in the United States (slide 4). And the biggest European venture capital fund is still smaller than the 10th US venture capital fund, in terms of the amount raised over 2019-23.

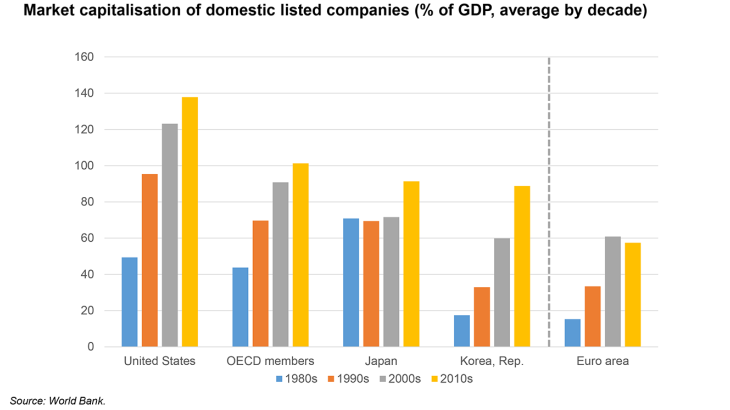

If I had one wish for the European financial sector, it would be to double the size of the EU’s market capitalisation to reach 100% of GDP over the next decade in order to boost innovation,xii as was the case in the United States in the 1990sxiii (slide 5).

We still need to identify and remove legal and fiscal obstacles to “European-scaled” and therefore genuinely cross-border funds, both in terms of investors and investments. But we should complement this with much stronger public-private partnerships, with European public capital supplementing pari-passu cross-border private funds. In this respect, the pan-European Scale-Up Initiative and the launch of the European Champion Tech Initiative supported by the EIB Group have an initial funding of EUR 3,75 billion; we should quickly at least double its size. More broadly, the European Investment Fund notably plans to leverage EUR 11 billion through guarantee and equity instruments;xiv Delivery will be key. In complement, we should develop European saving products, going beyond the redesigned regulatory framework for ELTIF.

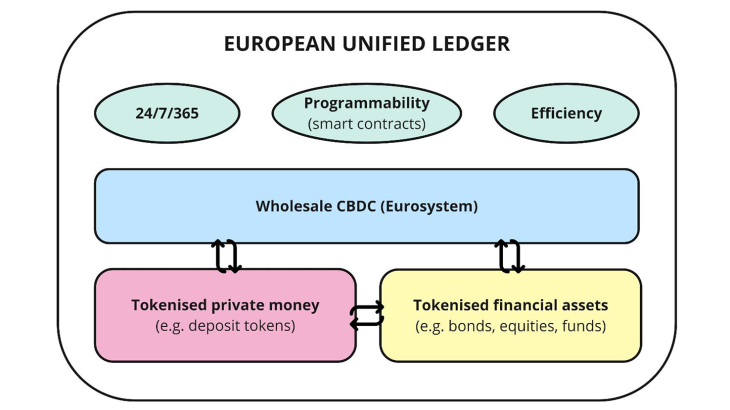

2. Looking forward, technological innovation is not only a purpose, but also a “design changer” of the CMU itself. Let me explain: technology - blockchain, tokenisation, smart contracts, etc. - is set to revolutionise, not only the payments sphere, but the whole market infrastructure domain. We are set to "tokenise" financial assets and the central bank money used to settle them - in the form of a digital wholesale euro –, as well as bank deposits. On the one hand, in Europe we have too many post-trade internal borders which slow down flows and limit our scope. On the other hand, the BIS is calling for a "unified ledger",xv which is a “creative frontier” on a global scale. Between these two considerations, the path to action seems clear to me. The CMU should now include the building of a European “unified ledger”: it could include all kinds of tokenised assets under a unified European governance supported by the Eurosystem. The two-tier monetary system would be maintained thanks to the anchoring role of a wholesale central bank digital currency (slide 6). Such infrastructure could reduce costs, counterparty risks and operational risks. It would facilitate the provision of various connected services 24/7 all around Europe, ensuring rapid and secure transactions, and thus having a catalysing effect on the CMU.

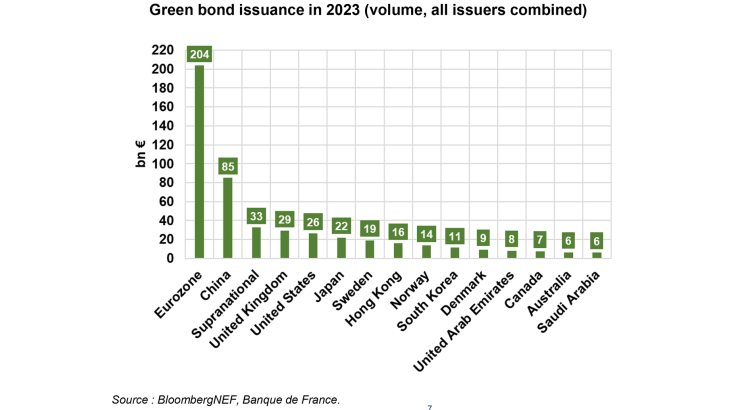

3. Green finance is clearly a highway for the Financing Union for Transition. Europe is a pioneer on this front with the adoption of a single rule book (Taxonomy, SFDR, CSRD)xvi on green finance, and is a key issuer of green bonds, accounting for 40% of the global market in 2023 (slide 7).

I would suggest forging a link here with another lever that is often mentioned but has made little progress - namely securitisation. We have a massive need for investment in mobility and energy infrastructure, and we have the basis for a common label thanks to EuGBs. Combining these two factors in green securitisation, around a common European securitisation platform, is probably the best solution in the face of political reticence and fears over financial stability. To accompany the development of green finance, in the long run the use of labels could be made mandatory for all instruments deemed sustainable, and controlled by external entities supervised by the ESMA to avoid greenwashing. Moreover, the specific characteristics of tokenisation such as transparency and programmability could prove particularly promising in the field of green finance thanks to the automated integration and verification of ESG criteria in smart contracts.

4. Turning to governance, as the old proverb says “too many cooks spoil the broth”. In the same vein, Europe’s capital market integration is hindered by the fragmented application of EU rules, implemented by several national regulators. Hence Christine Lagarde’s call for a “European SEC”, xvii with which I fully concur. We should seriously consider granting more supervisory power to the ESMA, at least over systemic cross-border entities. As a first step, we could offer an opt-in mechanism to such entities, which would greatly benefit from a single supervisory regime. It also means implementing a single rulebook on capital markets and associated areas. Moreover, Europe should take the lead in emerging areas, as has been the case for MiCA or for ESG rating agencies, to ensure a unified legal framework from the outset.

This Financing Union for Transition is certainly a decisive economic and financial project, but it carries higher political significance. Ultimately, a strong and deep Financing Union will be key to ensuring Europe’s strategic autonomy, unlocking and channelling its key domestic resource – private savings – to our priorities in a troubled and fragmented world, to which the upcoming elections add another layer of uncertainty. Let us not miss our chance and move forward as soon as possible, in the next European legislative term. Rest assured that we, central banks, will do everything in our power to make this Financing Union a reality. Thank you for your attention.

iHans Christian Andersen, The Ugly Duckling, 1843.

iiNew Financial, EU Capital Markets : a new call to action, September 2023.

iiiChristine Lagarde, A Kantian shift for the capital markets union, speech at the European Banking Congress, 17 November 2023.

ivLaunch of a French task force on the reboot of the Capital Markets Union, press release, 8 January 2024.

vRobert Mundell (1973). Uncommon arguments for common currencies. The economics of common currencies, 114-132 ; Pierfederico Asdrubali, Bent E. Sørensen, Oved Yosha (1996), Channels of Interstate Risk Sharing: United States 1963–1990, The Quarterly Journal of Economics, Volume 111, Issue 4, November 1996, Pages 1081–1110.

viEuropean Commission, 2023 Strategic Foresight Report – Sustainability and people’s wellbeing at the heart of Europe’s Strategic Autonomy, July 2023.

viiCurrent account balance.

viiiGopinath, G., Europe in a fragmented world, speech, 30 November 2023.

ixEnrico Letta on the Future of the Single Market, 15 September 2023.

xJean-Baptiste Gossé, Vincent Jamet, Elsa Lamy, Aubert Massengo, Speeding up the process of harmonising European insolvency law to strengthen financial integration, Bulletin Banque de France, 23 January 2024.

xiNew Financial, ibid.

xiiHsu et al. (2014) show that the innovation level is disproportionally higher in countries with better developed equity markets, especially for industries that are more high-tech intensive. Hsu, Po-Hsuan, Xuan Tian, and Yan Xu. 2014. "Financial Development and Innovation: Cross-Country Evidence." Journal of Financial Economics 112 (1): 116−35.

xiiiBrown, James R., Steven M. Fazzari, and Bruce C. Petersen. 2009. "Financing Innovation and Growth: Cash Flow, External Equity, and the 1990s R&D Boom." The Journal of Finance 64 (1): 151−85

xivEuropean Investment Fund, Annual Report 2022, April 2023.

xvBIS Annual Economic Report, Chapter III. Blueprint for the future monetary system: improving the old, enabling the new, 25 June 2023.

xviSustainable Finance Disclosure Regulation (SFDR) et Corporate Sustainability Reporting Directive (CSRD).

xviiChristine Lagarde, ibid.

Updated on the 25th of July 2024