- Home

- Governor's speeches

- Financing the climate transition: buildi...

Financing the climate transition: building bridges between needs and resources

François Villeroy de Galhau, Governor of the Banque de France

Published on 22nd of April 2024

Les Rencontres de l’Institut de la Finance Durable – Paris, 22 April 2024

Speech by François Villeroy de Galhau, Governor of the Banque de France

Ladies and Gentlemen,

I am delighted to be here with you today, and I would like to thank Yves Perrier and Cécile Goubet for inviting me to make the closing speech at the Rencontres of the IFD on “time for action". Indeed, we have no choice but to take action: every day we are increasingly witnessing the adverse, albeit foreseen, effects of climate change. Let's not give in to resignation and inaction: the Paris Agreement remains a decisive achievement. To meet its objective, we in France and Europe have set ourselves ambitious targets for reducing net greenhouse gas emissions: -55% by 2030 compared with 1990 levels, and net zero by 2050. For the financial sector, the task is clear: it involves mobilising, with the support of the public authorities, the funding needed for the transition. The needs are considerable, but public resources are limited (I).1 However, private resources are truly significant: we must therefore build a more direct bridge between the two (II).

I. Considerable investment needs, but no magic public funds

a. The need for additional investment

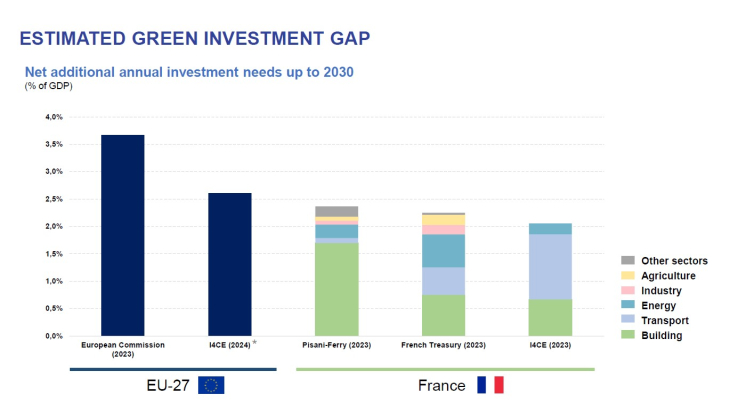

The first step is to quantify the investment needs required to achieve net zero: an increasing number of studies have been carried out on the subject, with a (relative) consensus on the overall amount needed by 2030, i.e. around 2.4% to more than 3% of GDP. In France, according to the Pisani-Ferry and Mahfouz report (2023),2 the additional annual net investment needs are estimated at EUR 66 billion by 2030, or around 2.4% of annual GDP - this "net" measure would require that current carbon investments be entirely reallocated. These figures are close to the estimates published at the end of 2023 by the French Treasury3 (EUR 63 billion/year by 2030), and consistent with the estimates of the Institute for Climate Economics (I4CE) of 2.1%,4 which focus on a slightly narrower scope (excluding agriculture and industry).

At the European level, needs appear to be greater: the European Commission recently raised its estimates of additional annual investment to EUR 620 billion by 2030, or 3.7% of the European Union's GDP5: this high estimate may be overstated. The Institute for Climate Economics estimates the EU-wide climate investment deficit at EUR 406 billion (2.6% of GDP).6 These aggregate figures encompass very different individual situations and energy mixes in different countries, which may explain the slightly higher estimate than in studies on France.

However, the estimates diverge more substantially with regard to their sectoral composition: in the Pisani report, construction accounts for the bulk of investment - but not of emission gains. The transport sector accounts for between 0.1% and 1.2% of French GDP, depending on the source. These differences stem partly from the uncertainty surrounding the final configuration of our transport system (use of rail, individual vehicles, etc.).

Finally, it should be noted that the amounts mentioned focus on the challenge of mitigating climate change; the needs associated with adaptation could prove to be even greater, but are more uncertain at this stage.7

b. No magic public funds

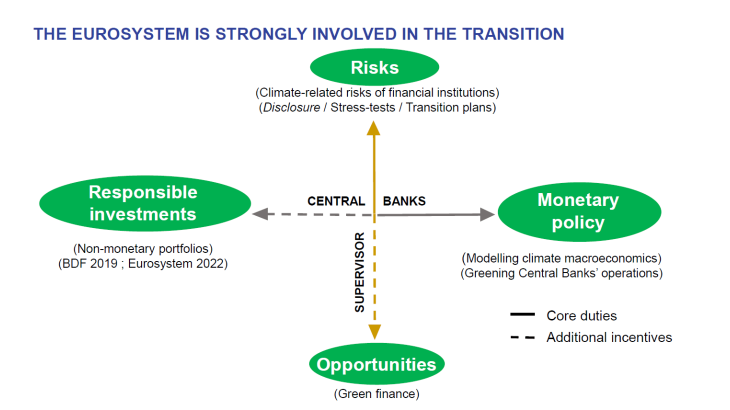

Faced with these clearer investment needs, the possibilities for public financing - both monetary and fiscal - are clearly limited. We need to resist the magic wand temptation. First, there is the monetary illusion by which central banks could bear the bulk of the effort.8 Let me stress that this is neither economically desirable nor legally possible: on the one hand, pure monetary financing could result in an inflationary surge that would harm our fellow citizens –we are fortunately emerging from an inflationary crisis whose economic, social and political costs we have widely witnessed -; on the other, it would contravene the European Treaties, which prohibit the monetary financing of deficits. While we refuse to be under any illusion, we show maximum commitment in the face of climate change. The Banque de France has been recognised as the greenest central bank in the G20. Along with the ECB, it is a pioneer both as a supervisor - climate risk monitoring and stress tests - and as a monetary authority – greening of monetary policy operations, climate macroeconomics. We set up the NGFS network (Network for Greening the Financial System) in Paris at the end of 2017; it now has more than 140 highly committed members, with the Banque de France acting as its global secretariat. We are playing our part, all our part, but central banks can replace neither business transition plans nor sound public policies.

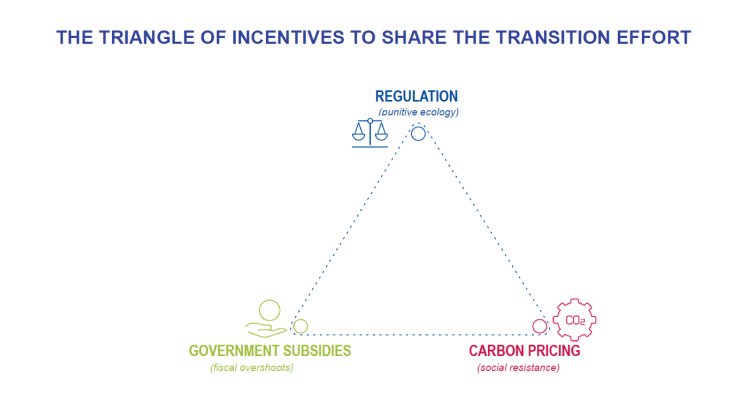

The other illusion would be that of massive budgetary financing - especially in France, where debt reached 111% of GDP in 2023, with one of the largest deficits in Europe. Of course, some public funding will be needed, but it cannot and must not account for the bulk of it. The successive industrial revolutions - and this is one of them - have been financed mainly by private initiatives, not by public funds. However, appropriate incentives are needed.9 The difference of approach between Europe and the United States is particularly evident when it comes to the form these incentives should take: regulation (as in the case of Europe’s highly ambitious “green package”), subsidies (as with the US Inflation Reduction Act), or carbon pricing? The three corners of this are not necessarily incompatible; each has its limits, taken in isolation: fear of “punitive ecology” in the case of regulation; fiscal overshoots and political risks for subsidies; and strong social resistance to carbon pricing. So we need a combination of these three solutions.

The fact remains that the price of carbon will have to rise: although politically unpopular, it remains an economic no-brainer. Whatever form it takes, carbon pricing will have to be global – not just national or European – and socially equitable. Europe – which is relatively ahead in this field – needs to press relentlessly for this international “new frontier”.10 Only a price signal will succeed in aligning the behaviour of firms, consumers and private finance, by making returns on green investments attractive.

II. Mobilising our significant private resources: the Savings and Investments Union to support the transition

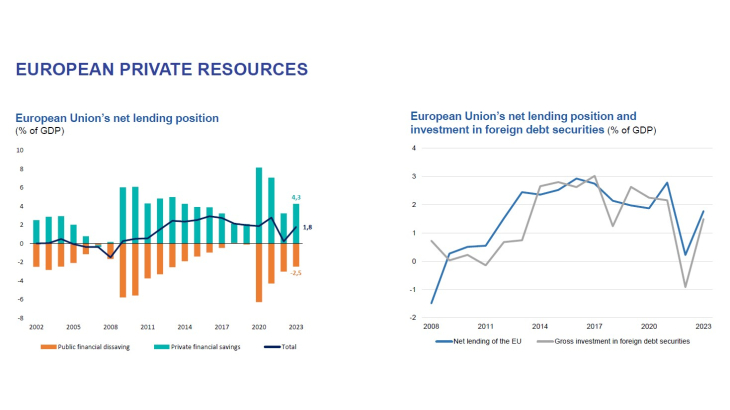

Faced with these substantial needs, Europe nevertheless possesses an "unknown resource". Europe's private savings surplus11 (businesses and households combined) represented over 4% of European Union GDP in 2023. All in all, after deducting public deficits, the EU's net lending position amounts to 1.8% of GDP, and more than EUR 300 billion. It is therefore crucial to mobilise these resources, which are currently invested in particular in the United States and emerging countries, mainly in the form of debt securities (on average EUR 260 billion per year since 2015). To put it another way, we are financing non-European debt instead of supporting the development of our businesses and the transition.

On the one hand, we have investment needs and, on the other, the resources to finance a large part of them. We therefore urgently need to build effective bridges between the two, by reallocating European capital flows. And to do this, we must renew the European project, seen as somewhat old-fashioned and overly technical: the Capital Markets Union. Its current title does not state its aim: that is why I am advocating the creation of a genuine Savings and Investments Union, whose main objective would be to allocate European savings to the ecological transition. The Letta report on the future of the single market published last Wednesday — and no doubt the Noyer report for France on Thursday — are a step in this direction. To achieve this greater goal, we also need fewer but more ambitious instruments.

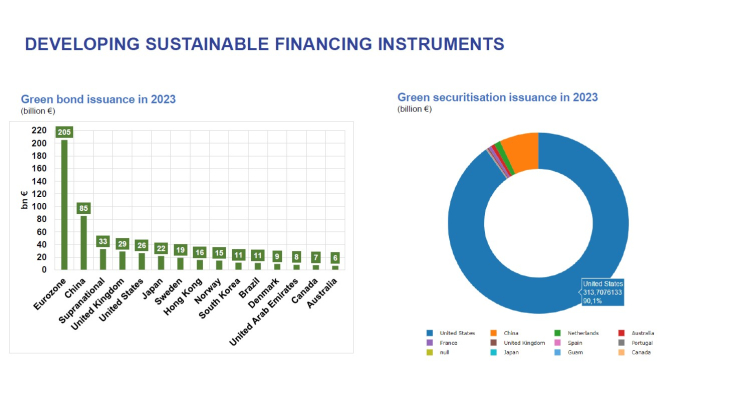

Sustainable finance is, by definition, a valuable tool in this area. Europe has been a pioneer in this field: it has established a single body of regulations (Taxonomy, SFDR, CSRD, ESG Rating)12 to provide a framework for the disclosure of non-financial information and thus steer European financing. It is also a leading issuer of green bonds, accounting for 40% of the global market in 2023.

In order to support the development of "sustainable" financial instruments and prevent the risks of greenwashing, it is strongly recommended to continue to promote ESMA certification, as was done for the EU Green Bonds (EuGB) label. Furthermore, the opportunities offered by tokenisation in terms of transparency and programmability are particularly promising in the field of green finance, making it possible, for example, to integrate and monitor compliance with ESG criteria in smart contracts.

But beyond that, green securitisation represents a major lever for financing the transition. Europe is surprisingly lagging behind in this area, with 90% of issuance currently in the United States. European regulations paved the way at the end of 2023 for using the European Green Bond label (EuGB) for green securitisations, provided that the funds unlocked from bank balance sheets – for example by securitising housing loans – are allocated to European Taxonomy-aligned sustainable activities. Banks' capacity to finance green projects could be increased by several hundred billion euro a year. The Banque de France therefore strongly advocates the development of this market segment, in line with the common position adopted by the Governing Council on 7 March13 and with the Letta report. These arrangements could be rounded out by the creation of a common European issuance platform, or even by public incentives such as a European guarantee.

When it comes to the question of financing the transition, we must fight against two symmetrical temptations: discouragement, and magic public funding. To avoid both of these, I firmly believe, in conclusion, that these transformations are not only desirable, but can also be financed. We can achieve this, on two conditions (i) that private savings are mobilised and that (ii) this is done in a coalition that reunites Europe and its public and private players. This is, in sum, the whole purpose of the IFD, and I thank you for your attention.

1 To paraphrase Daniel Cohen, "Le monde est clos et le désir infini" (2015).

2 France Stratégie, Jean Pisani-Ferry and Selma Mahfouz, The Economic Implications of Climate Action, May 2023

3 Directorate General of the Treasury, The economic challenges of the net zero transition (interim report), December 2023.

4 Institute for Climate Economics (I4CE), Landscape of Climate Finance (?), December 2023.

5 European Commission, 2023 Strategic Foresight Report – Sustainability and people’s wellbeing at the heart of Europe’s Open Strategic Autonomy, July 2023.

6 I4CE, European Climate Investment Deficit report an investment pathway for Europe's future, 21 February 2024.

7 I4CE, Anticiper les effets d’un réchauffement de +4°C : quels coûts de l’adaptation ?, April 2024.

8 Jézabel Couppey-Soubeyran, Pierre Delandre, Augustin Sersiron, Le pouvoir de la monnaie, 2024.

9 France and Europe: from crisis management to a longer-term ambition, Letter to the President of the Republic, 22 April 2024.

10 See in particular the working paper by V. Gaspar (IMF) and R. de Mooij (IMF), "How does decarbonization change the fiscal equation?" Peterson Institute, November 2023.

11 Financial savings based on national accounts: savings after investment and capital transfers.

12 Sustainable Finance Disclosure Regulation (SFDR) and Corporate Sustainability Reporting Directive (CSRD).

13 Statement by the ECB Governing Council on advancing the Capital Markets Union, 7 March 2024.

Updated on the 22nd of April 2024