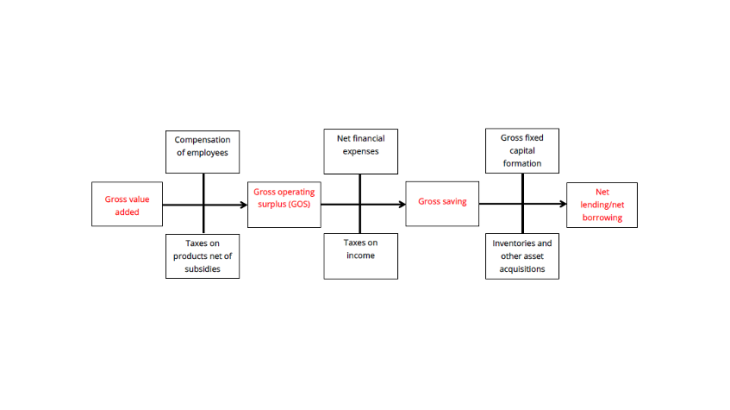

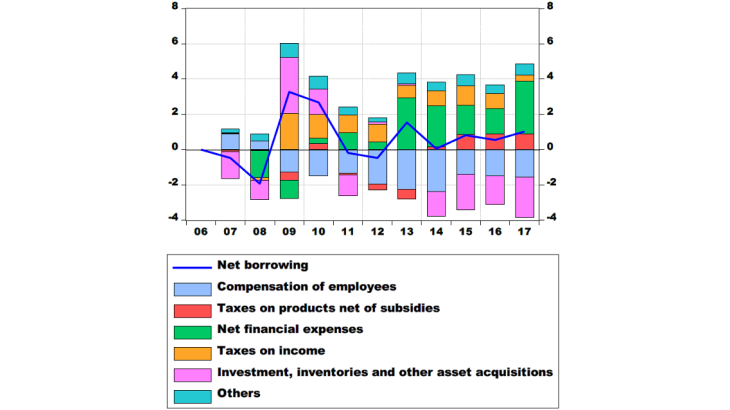

Taxes on income played their normal buffer role, with a share in value added that declined considerably from 2009 but in 2017 returned to a level close to that seen in 2006.

The first factor in the deterioration of the net borrowing of NFCs is the increase in the share of compensation of employees in value added since 2006, with an increase seen mainly in 2009 (see Cette and Ouvrard, 2018). This has been partially moderated by the CICE tax credit, visible since 2015 in the reduction in the share of taxes on products net of subsidies.

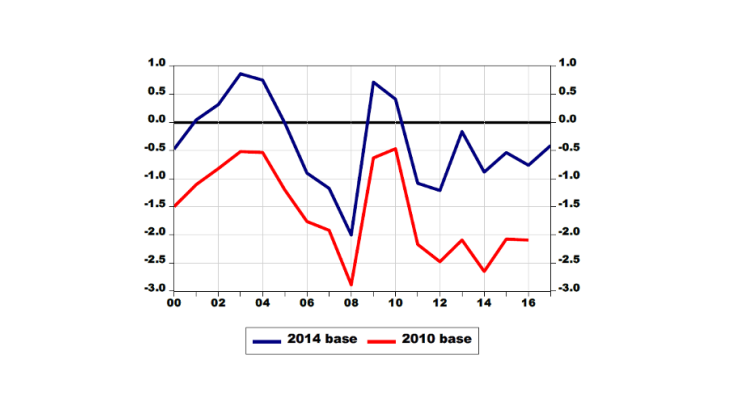

The second factor weighing on their net borrowing between 2006 and 2017 is capital formation (gross investment and inventories), whose share in value added first dropped sharply in 2009-10 before increasing to a level far in excess of that of 2006 and even that of the previous peak seen in 2007. The national accounts with a 2014 base also confirm (using data only currently available up to 2014) that the increase in the share of gross investment in value added (both gross and net) results from the greater share of fixed capital consumption, while the share of net investment declined (see Sicsic, 2018).

Conversely, the sharp reduction in net financial expenses made a positive contribution to the changes in the net borrowing of NFCs and more than offset the negative impact of the increase in the share of compensation of employees and investment.

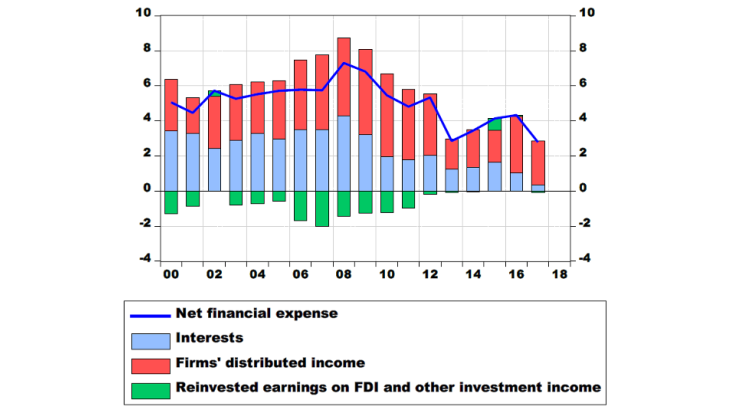

A significant drop in the share of net interest and dividends since 2006

Flows related to financial charges have a substantial impact on the NFCs' account with EUR 257 billion in expenses (22% of value added) and EUR 224 billion in receipts (19% of value added) in 2017. However, given the accounting difficulties encountered in terms of consolidation at the NFC level in particular, examining the aggregate flows, i.e. receipts net of expenses, is recommended (see Cnis' cost of capital report, 2015).

Thus, Chart 3 presents (in percent of value added) the net financial expense of NFCs and their main components: net interest and net distributed income (dividends), for which NFCs are net payers; and reinvested earnings on foreign direct investment (FDI), for which they are net creditors.