Published on 7th of May 2018

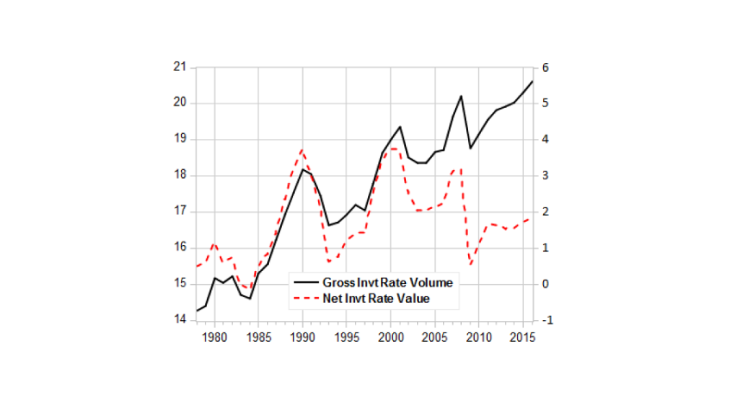

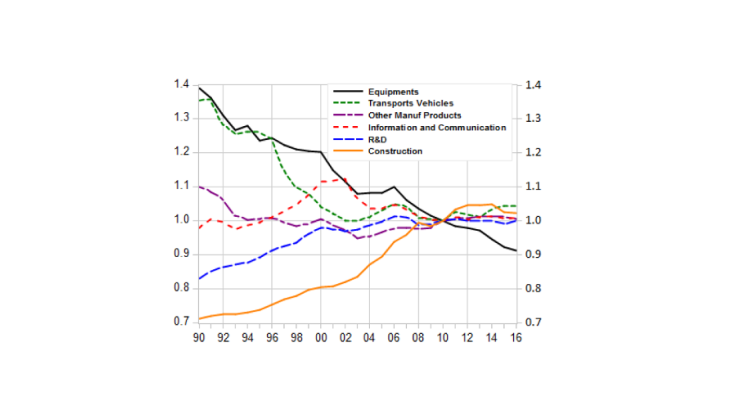

Post n°64. In France, the gross investment rate of non-financial corporations is trending upwards, and was half a percentage point higher in 2016 than its previous peak of 2007-2008. However, after deducting capital depreciation, the net investment rate, which corresponds to the increase in productive capital, was one percentage point lower than its 2008 peak and equivalent to its mid-2000s level. The acceleration in depreciation stems from the increase in both capital per unit produced and in the average depreciation rate, which is itself linked to the greater share of intangible assets in investment.