Since the 2008 Global Financial Crisis, firms’ funding patterns have changed. Notably, there has been a significant shift toward more market-based finance with active issuances of debt securities by non-financial corporations (NFC) (Darmouni and Papoutsi, 2022). In the euro area, the share of bond financing rose from 9% in 2007 to 17% in 2021, while in France it increased from 19% to 29% over the same period. In a recent study (Alder et al. 2023), we use firm-level data to investigate the quantitative implications of firms’ debt structure on the transmission of monetary policy to investment.

ECB interest rate policy and bond liquidity shocks

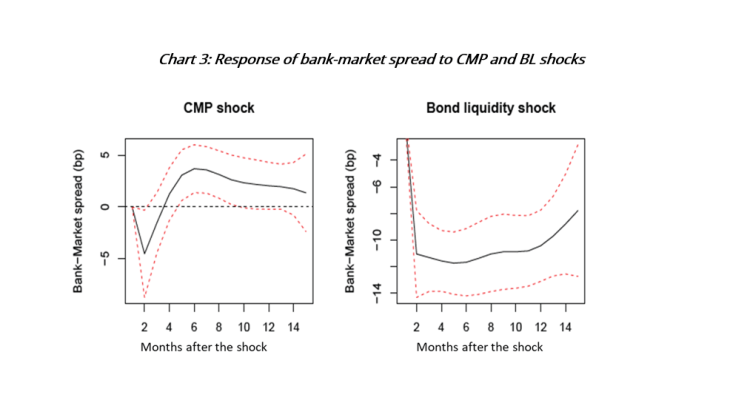

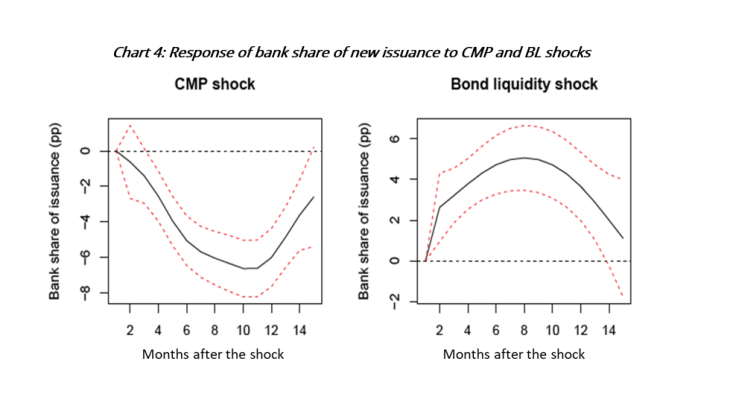

According to the bank lending channel, policy rate increases lead to more restrictive bank credit. In these circumstances, bond markets can provide an alternative to bank financing (Kashyap et al., 1993). If monetary tightening decreases the creation of bank loans, but stimulates corporate bond issuance, then the effectiveness of monetary policy could be hampered.

The central bank can affect investment not only through interest rate policy, but also through liquidity conditions, as these can influence lending and borrowing decisions. We capture the liquidity effects of monetary policy shocks using movements in the French-German 10-year sovereign rate spread around ECB announcements, affected particularly by unconventional monetary policies. We show that this shock is significantly correlated with liquidity in bond markets, and label it Bond Liquidity (BL) shock.

Unconventional policy easing, such as asset purchases, can reduce risk premia on debt securities and stimulate corporate bond issuance more than bank lending. Thereby, interest rate policy and bond liquidity shocks can have different effects on NFC investment depending on firms’ debt structure.

In what follows, we show the average effect of interest rate policy and BL shocks on French firms’ investment, and the role of the corporate debt structure in monetary policy transmission.

ECB monetary policy impacts French firms’ investment

We examine the effect of monetary policy shocks using yearly, firm-level data on French companies from FIBEN, the Banque de France credit register. We use high frequency surprises around ECB announcements to identify monetary policy shocks. These surprises are based on changes in the risk-free yield for maturities of up to one year (CMP shock) and changes in the 10-year sovereign spread between French and German bonds (BL shock). To capture the time profile of the investment response, we use panel local projections (Jordà, 2005).

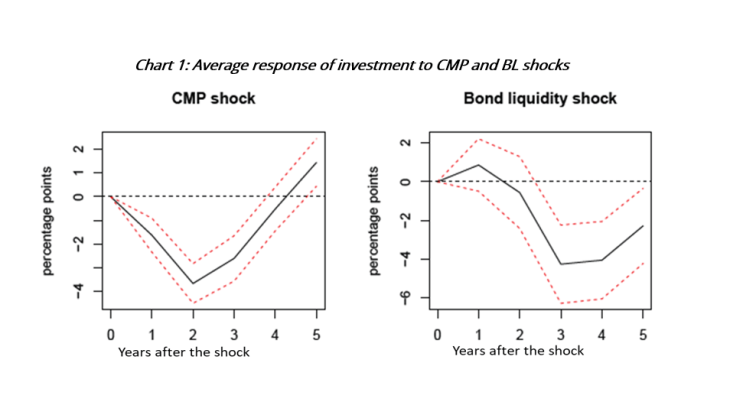

Chart 1 shows the impulse response function, i.e. at each horizon (from 1 to 5 years) of the estimated average firm-level effect in percentage points of a 100 basis point upward surprise for each shock on firm net investment rates. The CMP shock (left panel) has an economically and statistically significant negative effect in the first three years after the shock. The BL shock (right panel) is insignificant in the first two years but decreases French firms’ investment starting from the third year after the shock.

Corporate debt structure and monetary policy transmission

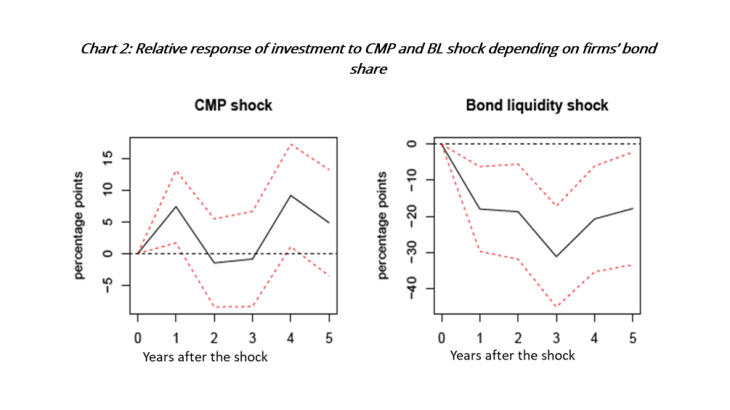

To evaluate the role of the corporate debt structure, we interact monetary policy shocks with the firm’s individual lagged share of bond debt, allowing the responses of firm investment to vary depending on their debt structure. Chart 2 shows the response for these interaction variables, where the point estimates can be interpreted as the difference in reaction of investment ratios between a firm that borrows using only corporate bonds and a firm that borrows only via bank loans. As the left-hand graph indicates, after a contractionary CMP shock, the higher the share of market debt of a firm, the less its investment falls. On the other hand, after a contractionary BL shock, the higher the market debt share of a firm, the more its investment falls.

Thus, monetary policy transmission to firm investment is a function of each firm’s share of bond debt and the specific type of monetary policy implemented. Interest rate policy has a stronger impact on firm investment when the firm is more reliant on bank loans, while monetary policies that increase liquidity in bond markets (such as quantitative easing) have a stronger effect when firm financing is more market-based.