In this paper, we analyse the transmission of monetary policy to French firm's investment and credit.

As compared to conventional monetary policy (CMP) shocks, we highlight a novel monetary policy shock that consists of movements in the French-German sovereign spreads around ECB announcements. We then show that this shock to bond spreads (BSP) is correlated with liquidity and credit risk in bond markets, and also impacts firms’ investment (Figure 1) and credit.

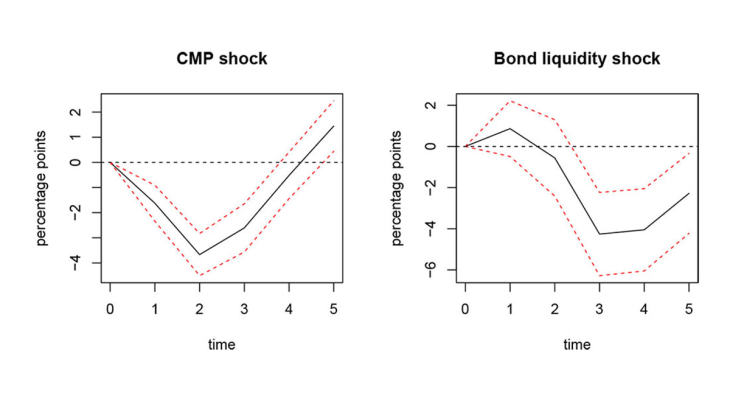

Using a large panel of French firms, we then show both types of policy diminish French firms' investment and credit after contractionary shocks. However, the strength of the impact depends on each firm's debt structure (Figure 2).

Firms that are more reliant on bank credit as a source of funding are relatively more impacted by conventional monetary policy shocks. On the other hand, firms that are more reliant on bond debt tend to be more sensitive to shocks that affect bond liquidity.

We also show that on aggregate there is important, but imperfect, substitution between the two types of funding sources. After a conventional shock, there is a rise in bond debt issuance that partially offsets the fall in new bank loans. On the other hand, after a shock to bond liquidity, there is a rise in bank loans that partially offsets the fall in corporate bond debt issuance.

Consistent with the interpretation that conventional monetary policy impacts the bank lending channel more directly than shocks that affect bond liquidity (and vice-versa), we also find that bank rates rise more than bond yields after a conventional monetary policy shock, while the opposite occurs after a bond spread shock.

Keywords: Monetary policy transmission, Corporate debt structure, Investment

Codes JEL : E22, E43, E44, E52