We build a new two-country model of the euro area (EA-BDF), based on the large-scale FR-BDF model of France and a new medium-scale block of the rest of the euro area (STREAM). STREAM follows a similar approach to FR-BDF. It is also a semi-structural model inspired by the FRB/US approach: it uses the Polynominal Adjustment Costs (PAC) framework and includes explicit expectations that can be either VAR-based (VBE), model-consistent (MCE) or hybrid (HYB). We estimate this model equation-by-equation under VAR-based expectations, using the same structural VAR model (E-SAT) as in FR-BDF, but extended with REA variables.

We have made several simplifications in STREAM compared with FR-BDF. First, on the supply side, potential output is exogenous and a NK price Phillips curve based on the unemployment gap determines inflation (GDP price deflator). We do not explicitly model the labor market and the price-wage loop: an Okun’s law relates unemployment and output gaps. Second, on the demand side, we simply relate nominal income of households to nominal GDP with a reduced-form error-correction equation. Then, we relate household consumption to permanent income and to interest rate, with a role for current demand in the short run. Main drivers of total investment are demand and the expected real cost of capital, based on the sovereign long rate. As in FR-BDF, the government uses a fiscal rule on social transfers for stabilizing its budget balance-to-GDP ratio toward a level consistent with a target of the debt-to-GDP ratio.

In order to capture trade spillovers between France and REA, we make less simplification with respect to the trade block. We model both consolidated and internal REA exports and imports (volume and deflators). Consolidated exports and imports depend on foreign/internal demand and relative price, through error-correction models. We relate internal imports (volume and deflators) to REA demand and prices; we assume internal exports equal to internal imports. Finally, the euro effective exchange rate and euro/dollar exchange rate equations (real UIP conditions) are common to both models and the REA term-structure is similar to that of France, applied to a weighted average of the four biggest REA countries’ sovereign bond rates.

Given its two-region structure, the EA-BDF model allows studying various shocks, including asymmetric shocks at the EA level, under different types of expectations and endogenous monetary policy response. First, we are able to simulate EA-wide shocks with an endogenous reaction of monetary policy and its transmission to long-term interest rate and nominal effective exchange rate. As a result, we can consider different types of monetary policy rules (inflation, price-level or average-inflation targeting rules) and their respective stabilization properties in response to shocks. Second, the ability to switch from VAR-based to model-consistent or hybrid expectations is a strength of our model, in particular with respect to questions related to monetary-fiscal interactions and alternative monetary policy rules. Third, having a two-country model allows us to simulate both symmetric and asymmetric shocks and evaluate spillover effects from trade and monetary policy response.

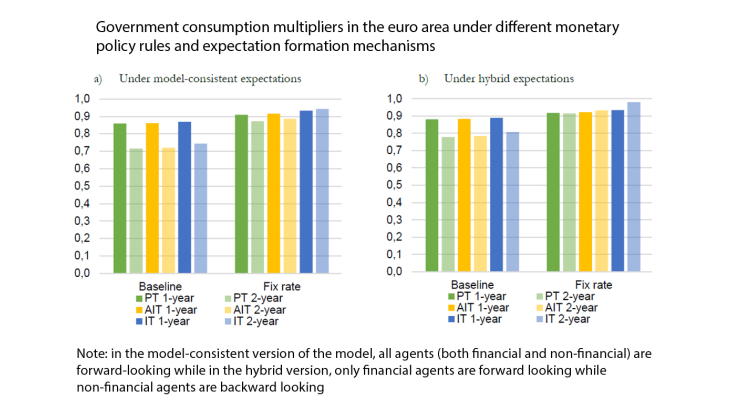

In this paper, we study the effects of a persistent government spending shocks in a monetary union and obtain two main results, which are robust whatever the type of expectations. First, by studying symmetric and asymmetric shocks for both regions, we find that positive trade spillovers would compensate negative monetary policy spillovers in France, at a 2-year horizon. Second, we study monetary-fiscal interactions under alternative monetary policy rules: inflation-targeting, price-level targeting and average-inflation targeting) and alternative expectations (model-consistent or hybrid). We find that fiscal multipliers are always higher when monetary policy is transitorily constrained (or accommodative) because of its effects on expected inflation, real cost of capital and the exchange rate. Finally, when monetary policy is transitorily constrained, fiscal multipliers are lower under the price-level targeting rule compared to the inflation-targeting rule, because of the future monetary policy tightening, which is required for the price-level reversal.