This paper documents a novel pattern of monetary policy by exploring whether central bank asset purchases can produce differentiated effects on the economy. Two of the asset purchase programs of the European Central Bank (ECB) provide a unique setting to explore this question. During the pandemic, the ECB increased the monthly pace of its asset purchases within the Public Securities Purchase Programme (PSPP) initiated in 2015. It also launched another asset purchase program called the Pandemic Emergency Purchase Programme (PEPP). Both programs purchase essentially identical assets (euro area sovereign bonds). However, they have been motivated by different rationales or intermediate objectives. In January 2015, the ECB worried about deflation risks as both inflation and inflation expectations were falling, with the ECB President Mario Draghi putting inflation swaps in the spotlight. On 18 March 2020, the PEPP was announced in response to the pandemic-driven financial and economic crisis as the Eurozone was facing a sharp increase in financial stress on sovereign debt markets.

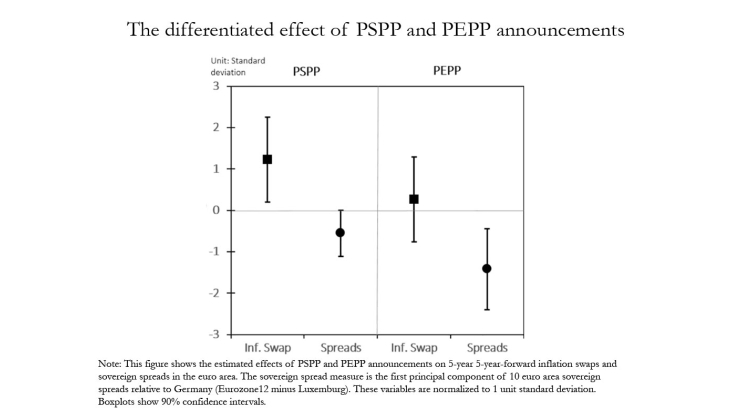

This paper explores why the ECB considered having two separate programs by comparing their respective financial market effects. Using an event-study methodology, we assess the effects of the two asset purchase programs on the two asset prices that capture the respective intermediate objective of the programs: 5-year in 5-year-forward inflation swaps and euro area sovereign spreads. The main result of this paper is that the PSPP and PEPP are not substitutes. We find that ECB announcements of purchases of the same assets do not produce the same effects according to whether they relate to the PSPP or PEPP. PSPP announcements have a positive impact on inflation swaps and only a slight negative impact on euro area sovereign spreads. At the opposite, PEPP announcements have no impact on inflation swaps, but a strong negative effect on sovereign spreads. This effect of PEPP announcements is more than twice larger than the one of PSPP announcements.

We explore the potential sources of these differentiated effects. Although the same assets are purchased, the characteristics of the programs differ. We investigate seven alternative hypotheses. The first hypothesis is that our estimates would reflect differences in operational characteristics like the size, length and purchase pace. A second hypothesis is that the PEPP announcement was not as clear as the PSPP announcement (specifically linked to inflation). A third hypothesis relates to the fact that the PSPP announcement was largely anticipated by ECB watchers compared to the PEPP. A fourth hypothesis is that our estimates reflect that different variables were under stress when the programs were implemented. A fifth hypothesis is that the financial and economic context evolved. A sixth hypothesis relates to PEPP capital key deviations while the PSPP has to comply with ECB capital key shares. We find that these factors do not explain the differentiated effects. Finally, a seventh hypothesis is that communicating different intermediate objectives for each program suggests that the PSPP and PEPP policies follow different reaction functions and triggers different asset price reactions. The empirical and narrative evidence presented in this paper is consistent with the hypothesis that the rationale for both policies were interpreted as different.

A key policy implication of our main result relates to the potential benefit of central bank asset purchases as a monetary policy instrument. Two asset purchase programs can be implemented in parallel with different effects and help reach distinct intermediate objectives. Our results suggest that central banks could make use of this additional flexibility to achieve their objectives. More generally, what central banks choose to communicate (the stated purpose or structure of a given policy) can affect how financial market participants react.