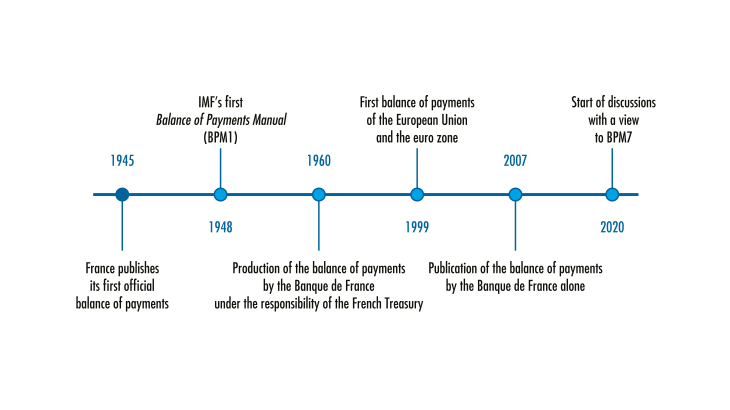

1 1945 67: the balance of payments, a new tool for controlling foreign exchange

State takeover of the compilation on balance of payments statistics in the framework of the International Monetary Fund

In the inter-war period, the production of balance of payments statistics differed from country to country. While public authorities in the United States and the United Kingdom had a long practice as from the beginning of the 20th century, in most other countries (including France) balance of payments statistics were only compiled occasionally by private economists. A first attempt by the League of Nations to harmonise compilation at international level was interrupted by the war.

After the war, the International Monetary Fund (IMF) resumed the work already started, in particular to obtain more reliable statistics in the context of fixed exchange rates. In 1948, in concert with its member states, it published the first Balance of Payments Manual (BPM1) to provide common definitions. Communicating the balance of payment data to the IMF became mandatory for all the member states, with the aim in particular of preventing foreign exchange crises.

In 1944, the Bretton Woods agreements effectively sealed a new international monetary order under the aegis of the IMF, based on fixed exchange rates to avoid any return of the monetary turbulence of the interwar period. In this context, monetary authorities, i.e. governments and central banks, put in place foreign exchange restrictions to control outflows and inflows of foreign currencies.

Balance of payments statistics were a central tool in this system. Indeed, while foreign exchange controls were aimed at limiting outflows of currencies on an ex-ante basis, particularly by granting import licences, the balance of payments provided an ex-post summary of currency movements corresponding to trade movements. In the context of fixed exchange rates with limited possibilities of devaluation, a current payments deficit had to be financed in foreign currencies, either by drawing on gold or foreign currencies held by the central bank or by recourse to international lenders, foreign governments or financial institutions. After a series of deficits and a fall in reserve assets, the 1957 “balance of payments crisis” therefore led France to seek aid the following year from the IMF (Feiertag, 1995) and to renegotiate the repayment of the loans extended by the United States and by American banks.

[to read more, please download the article]