This article analyses the economic and financial situation of French companies in 2020 using the set of corporate financial statements in FIBEN, a database maintained by the Banque de France. The scope of the study encompasses companies based in France that are liable for company income tax, that generate turnover of more than EUR 750,000 and that do not belong to the financial sector. The study considers the annual accounts of more than 330,000 legal units, which are grouped into 220,800 companies based on the definitions provided by France’s Economic Modernisation Act, i.e. small and medium-sized enterprises (SMEs), intermediate-sized enterprises (ISEs) and large enterprises (LEs).

The analysis presented here supplements a study of large French groups, published in the Bulletin de la Banque de France. This second study, which focuses on large private non-financial groups, is based on the set of consolidated financial statements in the FIBEN database and thus covers the entire scope of consolidation for these firms, i.e. including the activities of international units, unlike this paper, which is concentrated on units based in France.

1 The health crisis unleashed a major activity shock in 2020

Turnover shrank across all company size categories and in most industries

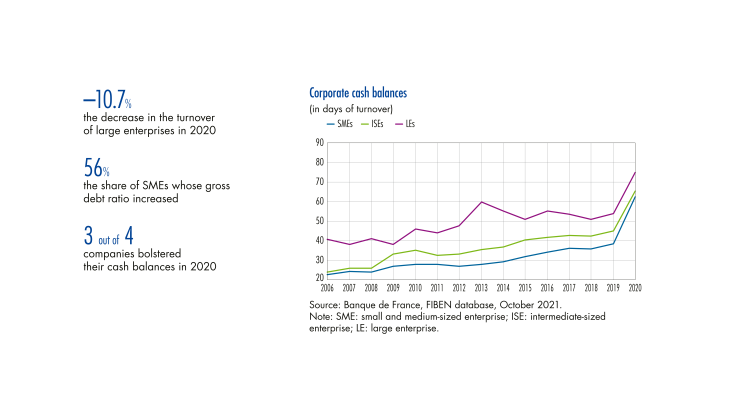

At the end of 2020, following the emergence of the Covid 19 crisis, the roll-out of support measures and behavioural adjustments by companies in response to these developments, corporate turnover fell by 7.8% relative to 2019 (see Table 1). This was the first such fall since 2009, when turnover tumbled by 8.3%. Although all sizes of companies were affected, Les experienced the biggest shock (–10.7), while ISEs (–6.8%) and SMEs (–4.0%) were relatively less affected. Contributing factors to these differences are discussed in the box below.

Turnover also fell in most industries, although there were significant cross-sector differences, with extremely pronounced declines in accommodation-food services (–31%) and transportation (–12%). Both of these sectors were particularly exposed to health-related restrictions during the first lockdown and, to a lesser extent, the second.

Conversely, real estate (–3.4%), information and communication (–2.7%), agriculture (–0.1%), and education-health-social work (+3.9%) held up better.

However, these statistics, which cover entire company size categories and industries, conceal widely varying individual situations. For one thing, only 59% of legal units that closed their financial statements at end-December 2020 recorded a turnover decrease compared with 2019. (…)

[to read more, please download the article]