- Home

- Publications et statistiques

- Publications

- Are markets signalling that the risk of ...

Post n°24. Financial markets confirm that, since autumn 2016, deflationary risks in the euro area have dissipated. Market indicators – which are admittedly susceptible to a number of biases – nevertheless continue to reflect medium-term inflation expectations which are below the Eurosystem’s target (inflation rates of below, but close to, 2% over the medium run).

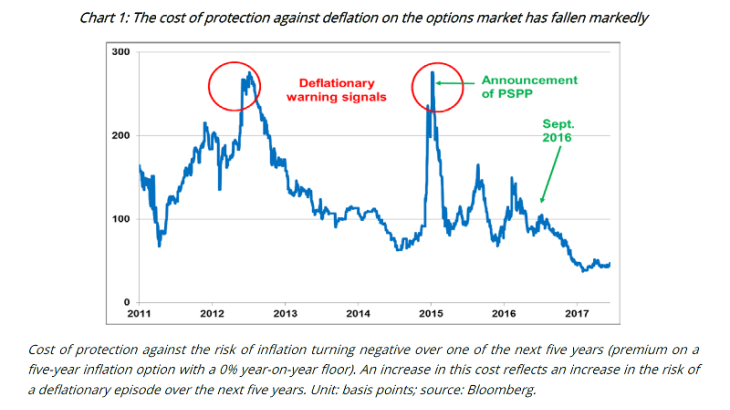

According to market-based indicators, the period from 2011 to 2016 was marked by several “deflationary warnings” in the euro area, in the middle of 2012 and at the beginning of 2015 in particular. Since September 2016, these indicators have been sending a clear message: the risk of deflation – that is, the risk of a general and self-sustained reduction of the level of prices – has virtually disappeared. The cost of protection against the risk of negative inflation was reduced sixfold between January 2015 and May 2017 (see Chart 1). It has now reached its lowest level since the European sovereign crisis, namely, approximately 45 basis points over a five-year horizon.

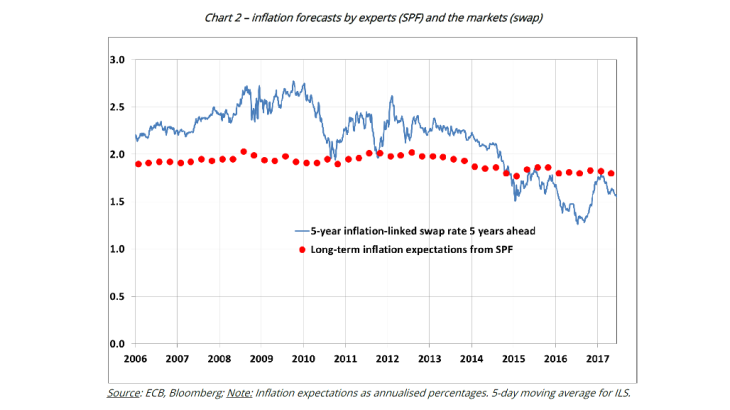

Moreover, swap market-based inflation expectations have moved closer to the expectations derived from surveys such as the ECB’s Survey of Professional Forecasters (hereafter “SPF”) (see Chart 2). The former had, by contrast, been systematically lower than the latter since mid-2014. The decline and subsequent disappearance of the perceived risk of deflation and the convergence of market-based expectations towards surveybased expectations followed the ECB’s implementation of its asset purchase programmes (for more on these programmes, see Banque de France (2016)). The uptick observed over recent quarters does not signal a warning of inflation either; rather, it indicates a scenario in which inflation is positive but persistently below monetary policy targets (“lowflation”).

Financial markets provide inflation expectations “in real time”

Measurements of inflation expectations based on the valuation of financial instruments, which reflect the market consensus on future inflation, have been developed since the beginning of the 2000s.

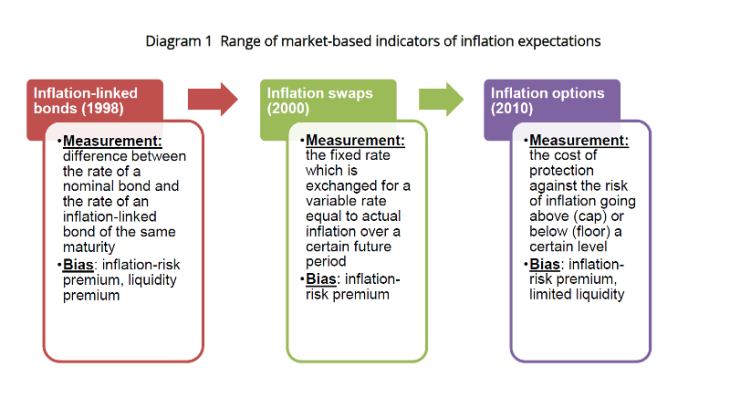

Initially limited to inflation-linked bonds, the range of financial products linked to inflation was extended to include swaps, and later options (see Diagram 1). As market participants’ use of these instruments to meet their hedging and position-taking needs has become more dynamic, the measurement of inflation expectations they provide has increased in relevance. The five-year, five-year forward inflation expectation rate derived from the swap market, that is, the expected average inflation rate over the five-year period that begins five years from today, is therefore a market indicator that is often monitored by central bankers.

These market price-derived indicators have two advantages over other survey-based measurements such as the SPF. Firstly, as they are derived from instruments quoted on the markets on a daily basis, they provide frequent and responsive measurements of inflation expectations. In particular, they allow the impact of an event or a shock on inflation expectations to be measured without the need to wait for the forecasts to be updated. Secondly, they are based on real-life transactions where investors bear a financial risk which is linked to the accuracy of their expectations. They are thus not subject to the risk of reporting bias or a limited incentive to respond with precision, as is the case with surveys.

However, the various measurements derived from the prices of market instruments are susceptible to a range of biases: they incorporate, in addition to the inflation expectation, a (variable) risk premium which compensates the purchasers of those instruments for their exposure to the risk of higher-than-expected inflation. The limited liquidity of some of these products is another source of bias.

Deflation, deanchoring: increased risks in 2012 and 2014

Inflation expectations play an important role in assessing the effectiveness of monetary policy. The Eurosystem’s objective is to ensure price stability, which is defined as inflation below, but close to, 2% over the medium term. Where medium-term expectations persistently deviate from that target, whether upwards or downwards, this could signal a loss of confidence in the effectiveness of the central bank or a lowercredibility of its commitment to meet its objective.

Such a risk arose in the euro area in 2014 against a background of fragile economic recovery in the wake of the sovereign crisis and the subsequent fall in oil prices. The inflation rate edged down gradually to close to zero at the beginning of 2015. At the same time, falling indicators of long-term inflation expectations suggested a risk of deanchoring of expectations and the possibility of very low inflation, or even deflation. The cost of deflation protection on the options market reached a record of 276 basis points at the beginning of January 2015, before the announcement of the public sector purchase programme (PSPP). The previous peak, of 270 basis points in June 2012, reflected the European sovereign crisis. The five-year inflation-linked swap rate five years ahead signalled a risk of deanchoring, reaching a low point of 1.3% in July 2016 (see Chart 2). In addition, the tendency of financial markets to be more pessimistic about inflation prospects than professional forecasters, which arose in 2015, persisted for nearly two years.

The recovery of expectations since 2016: key factors

Three factors can explain why inflation expectations stopped falling and why they have recently risen:

1) Non-standard monetary policy measures, in particular the introduction of the PSPP. These measures reduced the cost of credit and revived growth and inflation in the short term (Banque de France (2016)). Although it is unlikely to have an effect on inflation and growth at a five-year horizon, the PSPP nevertheless succeeded in anchoring expectations by demonstrating the commitment of the Eurosystem to meet its inflation target. Several “event studies” quantifying the impact of monetary policy announcements on market-based expectations confirm this (see Andrade et al. 2017, and Altavilla et al., 2015).

2) The sensitivity of inflation expectations to current oil prices. Although often mentioned by market participants, this correlation remains empirically fragile.

3) International spillovers. After the American elections, long-term inflation expectations in the euro area recovered under the apparent influence of those observed in the United States. However, the direction of those spillovers (studied by Ciccarelli et Garcia (2016) for example) does not seem to be stable over the long term.

In sum, while it is difficult to ascertain the exact part played by those factors in the recent recovery of market expectations, it appears safe to conclude that the battle against deflation has been won in the euro area. This being said, the level of medium-term inflation expectations derived from inflation-linked swaps is still lower than the 2% target. The various indicators available point to a slow and uncertain convergence towards the target level of inflation, in other words, a risk of prolonged lowflation. This risk is one of the main reasons for maintaining an accommodative monetary policy stance in the euro area.

Updated on the 25th of July 2024