- Home

- Governor's speeches

- “Where there is danger, a rescuing eleme...

“Where there is danger, a rescuing element grows as well”

François Villeroy de Galhau, Governor of the Banque de France

Published on 10th of June 2025

Paris Finance Forum – 10 June 2025

Speech by François Villeroy de Galhau, Governor of the Banque de France

Ladies and Gentlemen,

I am delighted to participate in this latest edition of the Paris Finance Forum, and I would like to warmly thank Augustin de Romanet and Jean-Charles Simon for their invitation. This year, Paris has once again demonstrated its vibrancy by climbing to fourth place in the OFEXi ranking of global financial centres. The fact remains, however, that this has been an unprecedented year, both for the global economy and for finance. I propose taking solace in the words of the German poet Hölderlin: “where there is danger, a rescuing element grows as well”.ii I will outline three threats (1) before inviting us to take three winning gambles (2).

1) A pivotal year with a combination of three threats

1.1. (Geo)political unpredictability

The first threat is clearly (geo)political unpredictability, amplified this year by the shift in US policy.

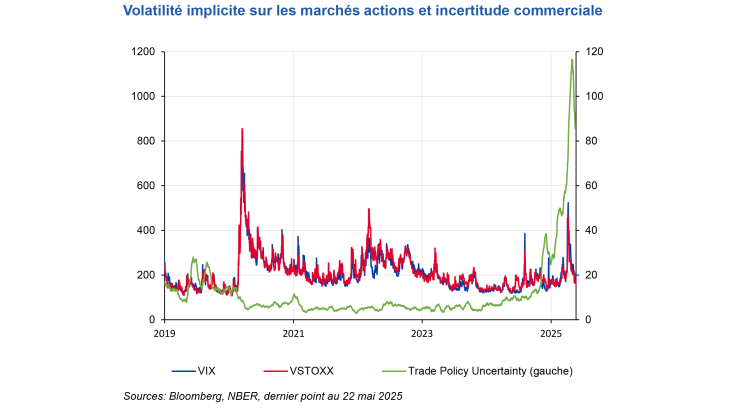

From an economic standpoint, the global outlook – primarily in the United States – has been significantly weakened by the new US administration’s shift towards protectionism and its persistent unpredictability. But it is also undermining financial stability, causing exceptionally high short-term volatility, particularly in US bond markets, which have failed to play their traditional safe-haven role. Confidence in the dollar as an international reserve currency could be eroded,iii while the international role of the euro could be fostered as clearly explained by Christine Lagarde in Berlin a fortnight ago.

In this volatile environment, the ECB is a pillar of stability, having successfully normalised its monetary policy over the past year with eight successive cuts to short-term rates. I expressed this wish back in January, when our rates were still at 3%, that we would return to 2% by the summer. Since last Thursday, we have been in the favourable “2 and 2” zone, with inflation forecast at 2% this year – which is our target – and our key rate at 2%, well below the US and UK levels of 4.25%. But in such an uncertain environment, this favourable zone does not mean a comfortable zone or a static zone: we will remain pragmatic and data-driven, and as agile as necessary.

1.2. Technological disruptions

The second threat comes from technological transformations in the financial sector. These developments create as many vulnerabilities as they do opportunities, particularly in two critical areas: crypto-assets and artificial intelligence (AI).

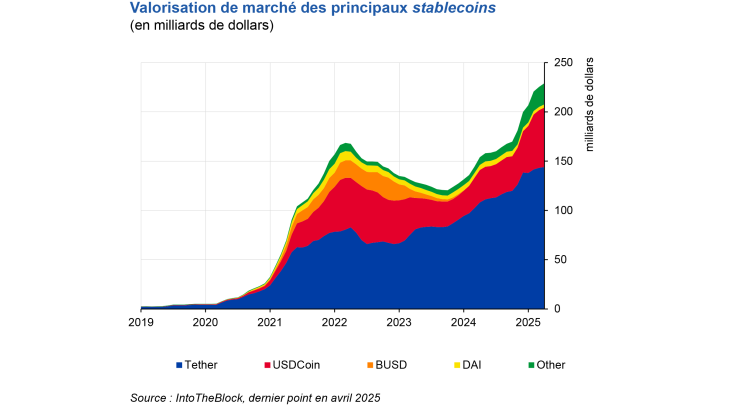

Crypto-assets are back in the spotlight, particularly stablecoins, which are mostly backed by the US dollariv and strongly promoted by the new US administration.

They pose a serious risk of a “de-Europeanisation” and privatisation of the currency,v they currently have no robust federal framework in the United States and expose their users and the financial system to numerous financial risks. The development of AI is a decisive boost for productivity – whose gains can be estimated at between 0.3 and 1% per year –; but it may also contribute to the amplification of financial vulnerabilities. For example, AI market concentration could increase the risk of dependence on third party players. The use of the same types of tools could also amplify herd behaviour, resulting in greater volatility and procyclicality.

1.3. Disintermediation of the financial system

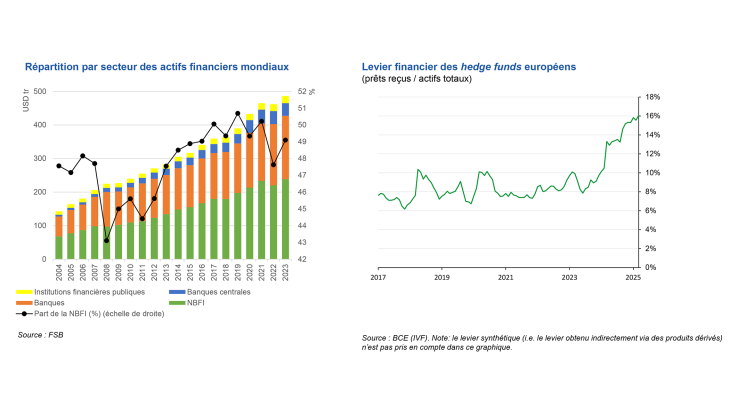

The third threat stems from developments in the financial system itself. Two-thirds of financial sector growth since 2008 has come from non-bank financial intermediation (NBFI),vi which now accounts for nearly 50% of global financial assets .

This development could help diversify the sources of financing for the European economy. However, in recent years, several episodes have highlighted the vulnerabilities associated with NBFI: too opaque, highly interlinked, sometimes too leveraged. First, hedge funds, whose use of leverage is rising in Europe and the United States currently account for more than 50% of transactions in the secondary European government debt market. While they can contribute to boosting market liquidity, they can potentially also amplify volatility in the event of tensions. Another area of vigilance is growth in private credit: in 2024, total assets under management in Europe reached EUR 430 billion, compared with EUR 150 billion in 2014.viii Banks’ exposure to these private funds remains difficult to accurately assess for supervisors, and sometimes even the banks themselves, due to the opacity of the market and the multiple layers of leverage in the ecosystem.

2) Three winning gambles?

I want to turn now to three paradoxical gambles. Gambles because we haven’t won yet and our game is not yet up to scratch. And paradoxical because they require shaking off our form of collective stupefaction, in order to transform these emerging threats into opportunities.

2.1. Regulation can help innovation to go hand in hand with stability

The first gamble is that well-tailored regulation can help to innovation go hand in hand with stability. This is only an oxymoron in appearance: without trust, innovation can only be temporary; without innovation, financial stability is just stasis. Crypto-assets are a good illustration of this. France and Europe were pioneers in the field, with the creation of the DASP status in 2019, followed by the adoption of a harmonised European framework based around the MiCA Regulation.x MiCA is a decisive step forward: it supports the secure and lasting development of tokenised finance while also helping to regulate dollar-backed stablecoins. Their rapid growth, which is set to accelerate further, must not come at the expense of European monetary sovereignty.

Our first response to the rapid development of dollar-backed stablecoins is the wholesale central bank digital currency (CDBC) and the digital euro, which will make it possible to maintain central bank money’s key role in the digital world.

In the interbank arena, the Eurosystem is advocating a tokenised settlement offering in central bank money and is working to provide an initial solution to banks and financial markets by the start of 2026, to be followed by further stages. These “tokenised bank reserves” will constitute a secure and liquid settlement asset for financial players, in a highly dynamic payment universe and a financial sector undergoing tokenisation. In the retail arena, the Eurosystem is preparing to issue a digital euro. This “digital banknote +” will also reduce our dependence on international networks, which account for 66% of card payments in the euro area. Its distribution will rely on a “public-private partnership” with commercial banks, based on a balanced economic model.

At the same time, the emergence of euro-backed alternatives – euro stablecoins, tokenised deposits, tokenised money-market funds – deserves, in collaboration with market participants, increased attention, including with regard to their cross-border use. The European authorities must also closely monitor the implementation of MiCA and start considering a possible “MiCA 2” regulation that takes better account of these sovereignty issues.

Lastly, it is vital that we equip ourselves with adequate monitoring tools and a regulatory framework adapted to non-bank finance. In order to better account for the risks posed by interlinkages with the financial sector, the ACPR and the Banque de France, together with the AMF, are preparing a pilot systemic stress test this year involving banks, insurers and investment funds. This exercise has no regulatory implications, but will allow us to better understand the nature of the risks and their transmission channels. It is a first in Europe, where no such exercise is being considered in the near term.

2.2. Europe can benefit from America’s policy shift

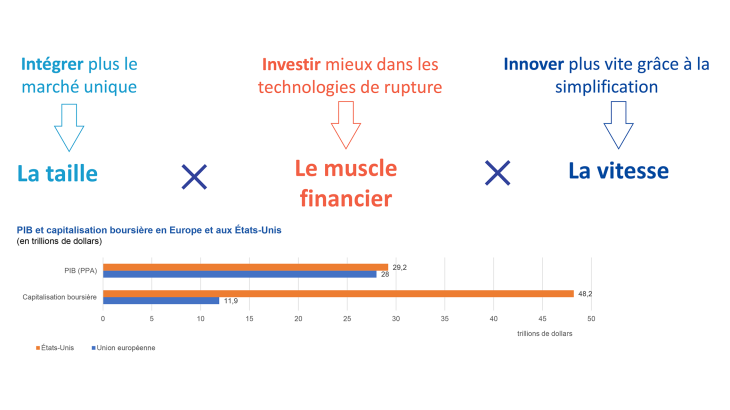

The second paradoxical gamble consists in seizing “Europe’s moment” in response to America’s radical policy shift. We have the ability to make this leap, provided we have the firm and lasting will to do so. Let’s be frank: we are currently falling short of the mark. We’ve got the right diagnosis, with the Draghi and Letta reports in 2024, then the strategy laid out by European Commissioner Albuquerque in March 2025. But what we need now to act is a general mobilisation, based around 3 imperatives – “3 i’s”,xi or, if you prefer, size multiplied by muscle multiplied by speed.

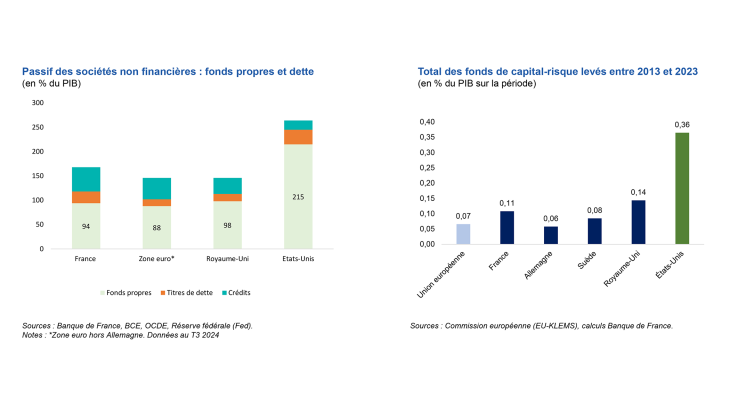

First, we need to better integrate the single market. This means capitalising on our size – which is equivalent to that of the United States – by removing internal barriers. Second, we need to invest better, giving greater priority to the most promising disruptive innovations and avoiding falling into the “middle technology trap” highlighted by Jean Tirole.xii To do this, we need to develop Europe’s financial muscle through a genuine SIU. Europe lacks neither savings nor loans: it does lack secure and liquid assets to attract international investors, and lacks capital to finance innovation. Our main priority should therefore be to increase equity financing, which amounts to 215% of GDP in the United States for non-financial corporations, compared with 88% in the euro area.

In terms of venture capital, five times less funds were raised in the EU than the United States between 2013 and 2023. Institutional investors could be brought on board for this, taking inspiration from the French TIBI or German WIN initiatives,xiii but scaled up to a European level. Pan-European funds could also be developed, with a new version of the European Tech Champions Initiative (ETCI) of the EIB open to private investors. Finally, we need to innovate faster with less bureaucracy. For the financial sector, this means adopting a European approach to simplification,xiv consisting in making regulations less complex but without eschewing our financial stability objective or the international Basel standards: fewer standards but better implementation to make them more effective. I welcome the creation of two high-level task forces at the ECB and EBA on this issue,xv which are expected to submit concrete proposals later this year.

But to turn these good intentions into action, we need to set a mobilising deadline,xvi as Jacques Delors did in the past with 1 January 1993 for the single market, and 1 January 1999 for the single currency. It is up to the Commission to propose this deadline, but why not 1 January 2028? Whatever the case, we need to step things up a gear if we want to emerge from the Trump years on a stronger footing and with greater sovereignty.

2.3. France and Paris are in a stronger position within Europe

Finally, within Europe, we can take a gamble on France and the Paris financial centre. Although our country faces serious economic and fiscal challenges, it still has many strengths. Our businesses, from the largest – international leaders that rival Germany in number – to the youngest (some 400,000 firms were set up in 2024, 30% more than ten years ago). The gross financial savings of French citizens, which amount to EUR 64 trillion, placing France’s financial institutions among the leading players in Europe. Lastly, the Paris financial centre that you represent – for the sixth year in a row France has been ranked the most attractive European country for foreign investors, and Paris is now the top tech ecosystem in Europe, according to the Global Tech Ecosystem Index 2025,xix ahead of London, Stockholm and Munich. The Holroyd “Attractiveness” lawxx of June 2024 has also strengthened our post-Brexit competitiveness by facilitating new stock market listings and supporting the financing of global trade.

I began with Hölderlin, and I shall conclude with Paul Valéry: “The future is not what is going to happen, but what we are going to do”.xxi Over the past ten years, we have succeeded in learning the lessons from the crises and preserving financial stability. But today, history is accelerating, and Europe and France must for their part also move forward with regulation that combines innovation with stability, and with a general mobilisation that constructs the economic and financial sovereignty of our continent. France has the advantage of having Europe's leading financial sector. Our country combines both the strength and the ambition to seize this moment of acceleration. Thank you

i Institut Louis Bachelier, Center for Financial Studies (2025), OFEX ranking, January

iiHölderlin (F.) (1808), “Patmos”.

iii Villeroy de Galhau (F.) (2025), Letter to the President of the Republic: From stupefaction, to general mobilisation, how to respond to America's policy shift, 9 April. i

vSablecoins backed by the US dollar account for 99% of market capitalisation. Source: Banque de France (2025), Financial Stability Report, to be published in June.

v Villeroy de Galhau (F.) (2025), Letter to the President of the Republic: From stupefaction, to general moblisation. How to respond to America's policy shift, 9 April. Villeroy de Galhau (F.) (2025), “A mobilising deadline for seizing ‘Europe’s moment’” Hearing before the National Assembly Foreign Affairs Committee, 14 May.

vi “NBFI refers to a system for raising funds and providing funding that involves players outside the traditional banking system” Source: Saillard (M.), Schwenninger (A.) and Watel (A.) (2023), “Non-bank financial intermediation:vulnerabilities and challenges”, Eco Notepad, Banque de France, September.

viiFSB (2024), Global Monitoring Report on Non-Bank Financial Intermediation, December.

viii Buch (C.) (2025), “Hidden leverage and blind spots : addressing banks’ exposures to private market funds”, The Supervision Blog, 3 June. It should be noted that these estimates are based on market data due to a lack of official data sources on this market.

ix Digital Asset Service Provider, a status created under Law No. 2019-486 of May 2019, known as the PACTE Law (Plan d’action pour la croissance et la transformation des entreprises – Business Growth and Transformation Law).

xMarkets in Crypto-Assets (MiCA), Regulation EU 2023/1114 of 31 May 2023.

xiVilleroy de Galhau (F.) (2025), Letter to the President of the Republic: From stupefaction to a general mobilisation. How to respond to America’s policy shift, 9 April.

xiiFuest (C.), Gros (D.), Mengel (P.-L.), Presidente (G.) and Tirole (J.) (2024), EU Innovation Policy – How to Escape the Middle Technology Trap, European Policy Analysis Group, April.

xiiiVilleroy de Galhau (F.) (2025), “Venturing into open waters to unlock Europe’s innovative potential”, speech at Euronext Paris, 18 March.

xivVilleroy de Galhau (F.) (2025), “A European approach to simplification: avoiding three misconceptions and suggesting concrete milestones”, Eurofi Warsaw, 11 April.

xvVilleroy de Galhau (F.) (2025), Presentation of the ACPR annual report, speech, 27 May.

xviVilleroy de Galhau (F.) (2025), “A mobilising deadline for seizing ‘Europe’s moment’”, speech before the National Assemble Foreign Affairs Committee, 14 May.

xviiBanque de France (2025), Household savings – Q4 2024, 22 May.xviiiEY (2025), Annual barometer 2024, May.

xix Dealroom (2025), Global Tech Index 2025, 21 May.

xx Law No. 2024-537 of 13 June 2024 aimed at increasing corporate financing and the attractiveness of French firms.

xxiValéry (P.) (1931), Glimpses of the Modern World

Download the full publication

Updated on the 16th of June 2025