- Home

- Publications et statistiques

- Publications

- The war in Ukraine is strengthening mark...

Billet n°270. L’invasion russe en Ukraine a conduit à une modification de la structure des interconnexions entre les marchés financiers. Si les effets de contagion sont restés globalement limités, la guerre a fait émerger de nouvelles corrélations négatives entre, d’une part, certains indices de matières premières (aluminium, pétrole, or, argent, blé) et, d’autre part, les marchés actions, en particulier européens.

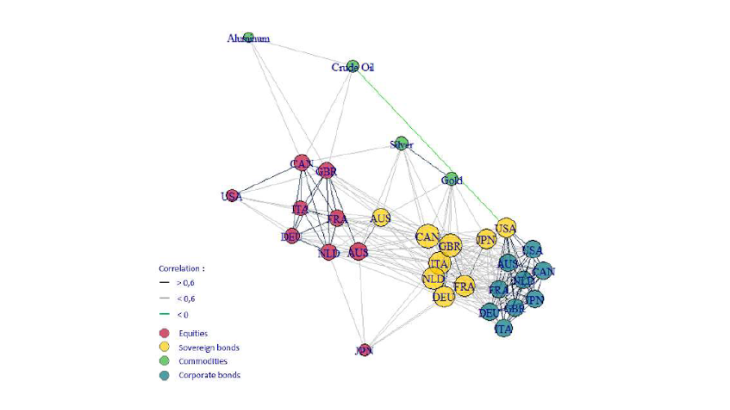

Notes: The proximity between nodes and their size depends on the number of bilateral links. The links shown are significant at the 0.1% threshold. Period: 1 January 2021 - 23 February 2022.

Interconnections and contagion effects

Interconnections refer to the economic and financial links between economic players and to their exposure to common risk factors (economic, health, climate, geopolitical, etc.). These interconnections can be measured in terms of co-movements between the returns of different financial assets. Contagion effects are reflected in the increase in these market interconnections in response to extreme negative events (Forbes, 2012).

Contagion phenomena may arise from changes in investor preferences and behavioural phenomena, such as increased risk aversion, financial panics and herd behaviour, sometimes triggered by "wake-up calls" (Goldstein, 1998). This behaviour may be individually rational, when associated, among other things, with risk and liquidity constraints that lead certain investors to sell healthy assets to offset their losses in times of crisis (Dornbusch et al., 2000). This channel may be exacerbated by excessive risk-taking by some financial participants.

The study of market interconnections and contagion effects is of great importance for financial stability. The more interconnected a market is, the more exposed it is to external shocks passed on by other markets. The sudden nature of contagion is an additional risk factor, as investors may be forced to abruptly adjust their portfolios to new market conditions. The rise in interconnections therefore tends to signal an increased risk of financial market correction (Berger and Pukthuanthong, 2012, 2015).

The impact of the war in Ukraine on market interconnections

Has the Russian-Ukrainian war led to contagion effects between financial markets? To answer this question, this post compares the interconnections between financial markets (i) before the invasion of Ukraine (1 January 2021 - 23 February 2022) and (ii) during the war (24 February - 15 April 2022). The measure of interconnectedness used is based on the adjusted correlation coefficient of Forbes and Rigobon (2002), calculated following the approach put forward by Dungey et al. (2005). Unlike the standard correlation coefficient, this measure is robust to changes in volatility regimes in financial markets. For each asset class, the study covers a sample of nine advanced markets. As regards commodities, the selection aims to represent the diversity of this asset class (foodstuffs, precious metals, industrial metals, energy, textile fibres).

Before the start of the war, asset classes were relatively uncorrelated, which facilitated diversification. This observation highlights the existence of risk factors specific to each asset class evidenced by clusters (with the exception of commodities: see Chart 1 in green) and the relative absence of risk factors common to all asset classes. Two groups stand out: bonds (sovereign and corporate, in yellow and blue) and equities (in red).

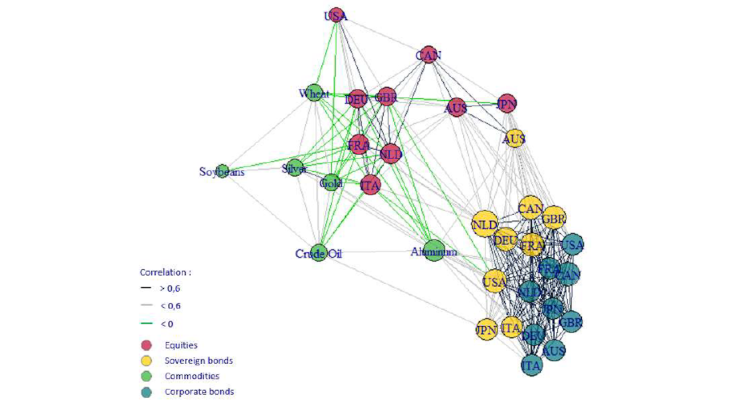

Notes: The proximity between nodes and their size depends on the number of bilateral links. The links shown are significant at the 0.1% threshold. Period: 24 February – 15 April 2022.

During the war in Ukraine, commodities became much more interconnected (see Chart 2 in green). Indeed, the war generated negative correlations between some commodities (aluminium, oil, gold, silver, wheat, soybeans) and equity markets, especially in Europe (Germany, France, Italy, the Netherlands, England). These new links stem from concerns about the economic impact of rising commodity prices or even supply difficulties (aluminium, oil, wheat, soybeans). Precious metals (gold, silver) seem to have acted as safe havens in this period of risk aversion.

Given these new negative links, the average level of (intra and inter-asset class) correlation between financial markets decreased from 46% before the war to 41% during the war. However, the level of intra-asset class correlation increased, notably within (i) European equity markets (from 81% to 91%), (ii) the corporate bond market (from 85% to 92%) and (iii) the commodities market (from 29% to 38%). The same holds true for correlations between sovereign bonds and corporate bonds, which rose from 50 to 70%.

Overall, the density of the interconnection network, defined as the ratio of the number of significant links to the number of possible links, rose slightly from 36% to 43% (with the average number of links per index or financial asset increasing from 12 to 15), which points to a stronger propagation of shocks during the Ukrainian crisis.

Financial market contagion in a historical perspective

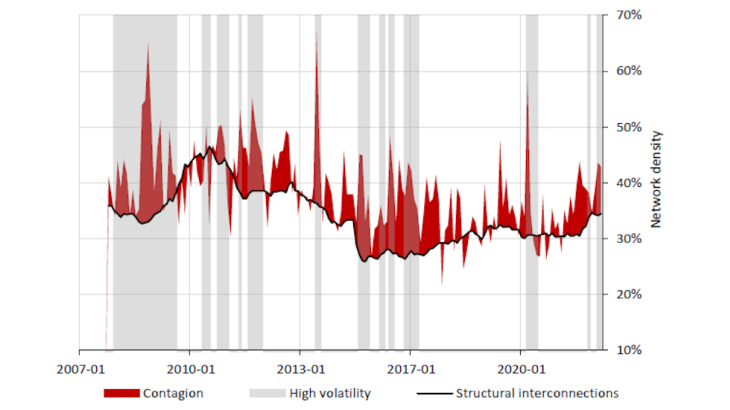

Are the contagion effects of the Russian-Ukrainian war historically high? In a historical perspective (between 2007 and 2022), it is possible to construct an indicator that estimates the level of contagion between the different asset classes each month (see Chart 3, red area) compared to a so-called "structural" level of interconnection (black curve), which prevailed over the previous three years (excluding episodes of high volatility on financial markets). This measure is based on the density of the interconnection network (see definition above).

The contagion phenomena measured generally appear to be associated with periods of high financial market volatility (see Chart 3, shaded area). Three episodes of contagion stand out in terms of their intensity: (i) the 2008 financial crisis, (ii) the taper tantrum in 2013, which refers to the sharp rise in market rates on US Treasury securities following the Federal Reserve's announcements regarding the exit from its quantitative easing programme, and (iii) the health crisis in early 2020 (see ERS, December 2021, Chart 1.13, p. 17).

Compared to these episodes, the contagion effects between financial markets caused by the war in Ukraine appear limited at this stage. The current phenomenon is comparable in scale to the contagion that followed the annexation of Crimea in 2014. This preliminary conclusion can be explained by the resilience of the global financial system, the relatively weak financial integration between Russia and the rest of the world and the fact that the economic impact of the war has so far been relatively localised, affecting mainly Europe and the Middle East (GFSR, April 2022).

Updated on the 25th of July 2024