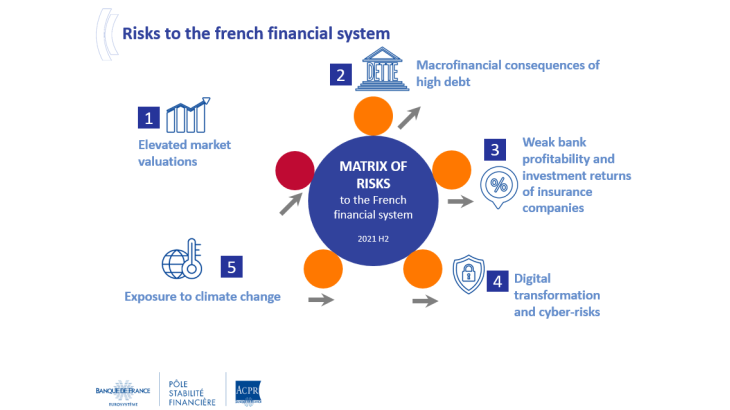

The ongoing economic recovery has mitigated short-term risks to the financial sector, notably as corporate positions have stabilised. But medium-term vulnerabilities are becoming more acute with the upswing in the financial cycle, against a backdrop of persistent uncertainty.

The global economy is continuing a sustained recovery, especially in Europe and France, on the back of stimulus plans and successful vaccination campaigns. Brisk economic growth is paving the way for fiscal and monetary support measures to be rolled back gradually, although uncertainty persists as to the future path of the pandemic and its economic fallout.

In connection with the sharp rebound in demand and amid supply constraints, energy prices and supply challenges have fuelled stronger-than-expected inflationary pressures, which are not expected at this stage to last in the euro area. While inflation expectations currently remain well anchored to the medium-term target of 2%, if they were to become unanchored to the upside, market interest rates would be pushed upwards, causing financial conditions to worsen. At present, however, financial conditions are still extremely supportive in both volume and price terms: bank credit continues to grow at a sustained pace at low lending rates, while bond spreads versus the safest issuers are holding at record low levels. Coupled with rising values for financial and property assets, these credit trends are helping to fuel the continued upswing in the French financial cycle.

Credit and asset price dynamics are displaying similar trends across Europe. In particular, the price of credit risk for European companies has fallen back below the level recorded before the March 2020 crisis. Some stockmarket indicators, meanwhile, are signalling persistent exuberance, exposing risk-asset markets to a sudden correction that could potentially destabilize non-bank financial intermediaries that use leverage and spread to other market segments.

Uncertainties about the financial position of non-financial corporations (NFCs) eased in the second half of 2021, even if they could resurface with the ongoing uncertainty about the health situation. NFC aggregate net debt has held steady in recent months. Compared with pre-crisis levels, the sharp increase in corporate cash over 2020, which has been preserved in 2021, was paralleled by a similarly-sized increase in NFCs’ gross debt over the same period. As a result, uncertainties about banks’ credit quality exposures have also eased, enabling credit institutions to write back provisions. Yet vigilance is still needed, owing to macroeconomic uncertainties, high levels of debt, and the wide diversity in financial positions across different sectors and even between companies in the same sector.

As activity picks up and unemployment comes down, the overall financial position of households looks to be heading in the right direction, as reflected in the reduced number of households in financial difficulty. Stronger credit standards for home loans, in terms of the debt-service-to-income ratio and the credit period, based on recommendations issued by the Haut Conseil de Stabilité Financière (HCSF – High Council for Financial Stability) in December 2019, have also helped to improve the sustainability of household debt, which is mainly tied up in housing loans. That being said, high household debt levels continue to be a macrofinancial vulnerability, because it curtails the ability of households to maintain their consumption and investment levels in the event of a new macroeconomic shock to their income.

A thematic chapter of this report considers post-Covid trends in the residential property sector. While strong growth in house prices might raise fears of a self-sustaining loop, fuelling increased home lending and hence a rise in household debt levels, the evidence indicates that: (i) price trends are not uniform nationwide, with prices outside urban areas experiencing a catch-up effect and (ii) households are not heavily exposed to property risk, i.e. a decline in the price of financed assets, because of the French home financing model, whereby loans are granted as a function of household income, rather than based on the value of the asset. Accordingly, debt sustainability is ensured not by the value of the asset, but by an assessment of the borrower's income at the moment when the loan is granted. Moreover, since virtually all loans are at fixed rates, borrowers are additionally insulated against higher interest rates. While credit quality associated with residential property financing represents a small risk for credit institutions, the low interest rate environment, coupled with stiff competition on this segment, benefits households while squeezing bank margins.

Sovereign debt also hit record levels during the pandemic owing to the massive fiscal support provided to the economy. In France, sovereign debt has increased steadily for over 40 years, curtailing room for manoeuvre in the public finances and making the sovereign issuer more vulnerable to a deterioration in financial conditions. However, French government debt is held by a diverse group of resident and non-resident investors. Furthermore, the current financing terms applicable to this debt are extremely favourable and are considerably lower than both the growth rate of the economy and the cost of servicing maturing debt. However, reducing France's public debt ratio over time, in particular through better control of expenditures, is necessary for maintaining medium-term financial stability.

Banks and insurers remain robust and their profitability is improving, although business models still represent a medium-term challenge.

French banks consolidated their solvency and liquidity positions at high levels in the second half of 2021. The economic recovery made it possible to bring down the cost of risk, and provisions were reversed, boosting banks’ profits and sending their share prices higher. Despite the increase, credit institutions’ market valuations remain well below book values, pointing to the structural profitability challenges connected with the low interest rate environment and the digital transition.

At more than twice the minimum requirement, solvency levels also remain high among insurers. However, the low interest rate environment could affect insurers’ coverage of capital requirements by exerting downward pressure on their financial income. With the equivalent of three full years’ worth of revaluation in reserves, however, insurers are in a position to cope with a gradual increase in market interest rates and the emergence of new participants.

Elsewhere, concerns persist about the over-reliance of European Union (EU) financial firms on United Kingdom (UK) central counterparties (CCPs), with the systemic importance of these CCPs for certain euro market segments creating a risk to financial stability. To avoid a short term cliff-edge effect, the European Commission said that in early 2022 it will extend its equivalence decision, thus maintaining access to UK CCPs in the short term, but it considered inadequate a status quo in the medium term. Keeping in mind the aim to reduce the European Union's dependence on clearing services offered from British CCPs, the Commission stresses the need to continue working on the mechanisms that will pave the way to scale back exposure to UK CCPs and grow attractive clearing services in the EU.

The financial system must continue adapting to cope with increasing digitalisation, and to cyber-risk.

Digital innovation is developing quickly and taking various shapes in the financial services sector. Beyond the challenge for established intermediaries of adapting their IT systems and business models, this trend could potentially increase the exposure of all participants to cyber-attacks. These attacks already represent a significant economic cost as well as a potential threat to financial stability. Awareness about this is growing. More than ever, swift action is needed to set up arrangements that will support a coordinated response by all stakeholders. On the

prevention side, financial supervisors are working on cyber-security with the authorities responsible for the supervision and security of information, at domestic and European levels, including through crisis management test exercises.

The development of decentralised finance and growth in crypto-assets and stablecoins markets are also driving the gradual digitalisation of the financial system. The multiple risks associated with these developments, which range from money laundering and terrorist financing to major volatility and exposure to cyber-risk, call for regulatory action to be taken. Europe’s draft Markets in Crypto-Assets (MiCA) Regulation represents a first attempt to provide a framework for these transactions and must be pursued. Central banks are also looking into an operational response to it, by developing central bank digital currencies (CBDCs), which could play a part in safeguarding monetary sovereignty in this new environment. With this in mind, in July 2021 the European Central Bank (ECB) launched the investigation phase of a digital euro project. A specific thematic chapter examines these new trends in depth.

Climate change and the carbon transition represent risks to financial stability

It is vital to make the transition to carbon neutrality, a point highlighted by the most recent report by the Intergovernmental Panel on Climate Change (IPCC) in August. This transition could, however, be a source of potential financial risk, depending on how it is approached. The unprecedented nature of the transition and uncertainty surrounding the process continue to make it difficult to accurately assess the scale of these risks. As the critical threshold of 1.5°C warming draws nearer and with commitments proliferating, notably in the private sector, all the evidence suggests that the transition and/or the perception of climate change impacts are set to accelerate sharply in the coming years. Participants’ decisions are still fairly uncoordinated and could exacerbate macro shocks. Efforts are needed to harmonise and standardise approaches to monitoring financial risks. This will help to clarify expectations and improve the credibility and circulation of information.

Download the PDF version of this document

Updated on the 25th of July 2024