To curb the effect of the Covid-19 pandemic on public health, many countries around the world introduced lockdown policies in 2020. These restrictions distorted economic activity on the supply side by disorganizing work, on the demand side by limiting people's ability to consume, or through additional frictions in the functioning of transportation and distribution networks. Adjustments of supply and demand to the new conditions likely impacted bilateral trade in goods between countries, either directly or indirectly through the network of buyers and suppliers in Global Value Chains.

We estimate the effect of these lockdowns on international trade flows, using a rich dataset of monthly bilateral product-level trade flows, provided by Trade Data Monitor, that covers roughly three quarters of world trade. This very detailed information is combined with data about the intensity of lockdowns implemented in 170 countries in the world. The data cover the entire year 2020 and therefore allow to track the impact of lockdowns on trade during the first wave, and part of the second wave.

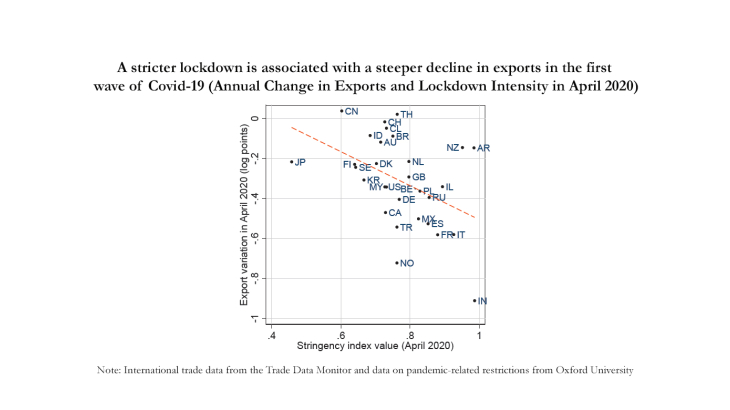

We first document that both importer and exporter lockdowns reduced bilateral trade in a sizeable way. We estimate that, on average, bilateral trade in each sector falls by about 10% when an exporter goes into full lockdown, and by about 21% for an importer (full) lockdown. This suggests that restrictions weighed more strongly on demand (by both firms and households) than on the capacity of firms to produce and export, over the entire year of 2020. These estimated effects do not change when we control for other concurrent policies (in particular trade restrictions and fiscal support) or for the evolution of the pandemic itself.

We then show that the effect of lockdowns on trade flows has changed over time. While the lockdowns strongly impacted bilateral trade during the first wave of the pandemic in spring 2020, the magnitude of this effect weakened during the second half of 2020. A likely explanation for this is that both firms and households adapted to the new business environment and expanded possibilities such as work from home or shopping online. By the end of 2020, the effect of lockdowns in the importing country on trade flows had fallen by about two thirds compared to the spring of 2020. We fail to find any significant effects of lockdowns in the exporting country on trade flows by the end of 2020.

Finally, trade between two countries may depend on lockdowns in third countries through global value chains. We measure this indirect dependence from a theoretical GVC accounting framework combined with data from a global input-output table. We find a decline in trade due to forward linkage effects, i.e. a decline in intermediate goods exports that depend on final demand in a third country entering a lockdown. Likewise, we find some support for a decline in trade due to supply disruptions of imported inputs that are used for the production of exported goods (backward linkages).