Post No. 386. The Fed's monetary policy has impacted financial conditions in the euro area during the recent monetary cycle. However, those effects were primarily the indirect result of the markets' perception of a common inflation outlook for the two economic zones rath er than a direct impact. Therefore, for the markets, the ECB's credibility in fighting inflation independently of the Fed has not been called into question.

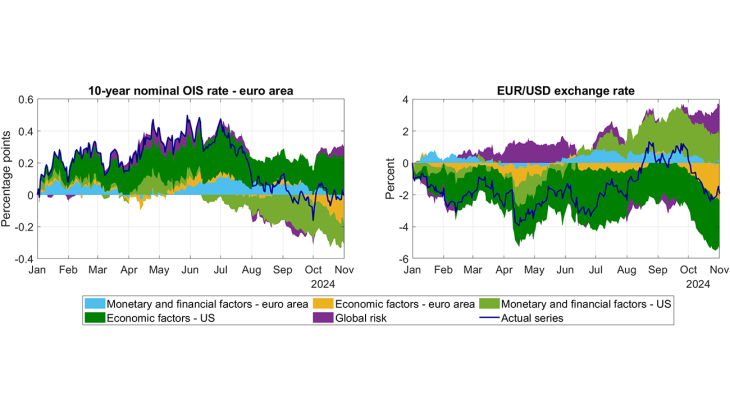

Charts 1a and 1b: Breakdown of the euro area 10 year interest rate and EUR/USD exchange rate (cumu lative changes)

Notes: The breakdown is generated by a Bayesian vector autoregression (VAR) model estimated since

2005 and based on Brandt et al. ( 2021). Normalized at zero at the beginning of the period. Fall in

exchange rate = depreciat ion of the euro.

As an open economy and trading partner of the United States, the euro area is exposed to spillovers from US Federal Reserve (Fed) monetary policy. The recent monetary cycle of rising – and then falling – key interest rates is no exception. Charts 1a and 1b show the considerable impacts of US economic and monetary factors on the financial conditions of the euro area since early 2024. Positive macroeconomic news in the US largely accounts for the rise in euro area long-term rates and the euro's depreciation against the dollar between January and June 2024 (dark green). Conversely, the Fed's more accommodative stance after June contributed to the fall in euro area long-term rates and the euro's appreciation against the dollar (light green).

However, it remains to be seen whether these side-effects emanating from the US lead the markets to revise their expectations of ECB monetary policy. On the one hand, if markets anticipated a significant impact on inflation in the euro area, they could revise their expectations of ECB monetary policy accordingly. On the other hand, if they expected the ECB to follow the Fed's stance because of its “intellectual” leadership, this could result in monetary policy expectations diverging from the inflation outlook in the euro area and becoming a destabilising factor.

How can we identify possible spillovers from Fed monetary policy to that of the ECB?

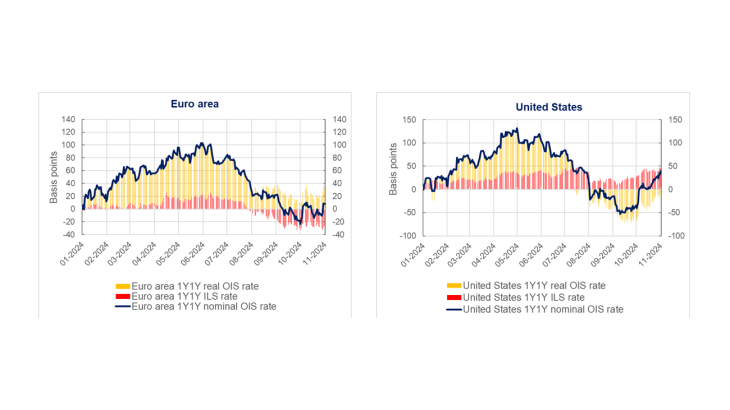

Charts 2a and 2b: Breakdown of expected short-term rates in the euro area and in the United States (cumulative change since the start of the period)

Notes: Between January and June 2024, the euro area one-year nominal interest rate increased by 100 basis points (bps), due to an 80 bps increase in the real rate and a 20 bps increase in inflation expectations.

We propose a new approach to assessing US monetary policy spillovers to monetary policy expectations in the euro area, measured by the 1-year in 1-year forward rate, i.e. the expected rate today for a one-year loan in one year's time. Chart 2 shows its evolution since the beginning of 2024 and highlights two phases: from January to June, a sharp rise in nominal forward rates in both economic zones (+100 bp, dark blue line), followed by a marked fall after June due to real and inflationary components (yellow and red bars, respectively). Faced with more persistent inflation, from December 2023, the Fed's communication strategy led the markets to defer their expectations of a rate cut, putting upward pressure on the US forward rate. This trend reversed after the summer, thanks to reassuring signals that disinflation was underway. For the euro area however, these broad fluctuations in expected rates were difficult to square with a stable inflation outlook over the period, which could indicate a strong American influence. This is all the more plausible insofar as many observers at the time doubted the possibility of a lasting divergence between the ECB and the Fed’s monetary policies.

Our estimate breaks out the two main underlying forces driving the joint movement in forward rates in the euro area and the United States:

- “news” on inflation, which first affects inflation expectations and leads to an adjustment in real interest rates in line with the central bank's reaction function;

- “news” on real interest rates, which affects real interest rates beyond the central bank's expected response to inflation. They capture the direct influence of Fed policy on the ECB.

We identify these factors using a vector autoregression (VAR) model that includes expected inflation and the real interest rate. The model is first estimated separately for the US and the euro area to identify the news on inflation and the news on real rates in each economic zone. If inflation-linked swaps, the market indicator of inflation expectations, and the real rate both react positively, the movement is attributable to inflation news; if they both react negatively, it is attributable to real rate news. Euro area news is then regressed on US news to isolate US spillovers from domestic factors. Chart 3 presents this breakdown.

Contagion to the euro area is caused by inflation news, not the Fed's direct influence

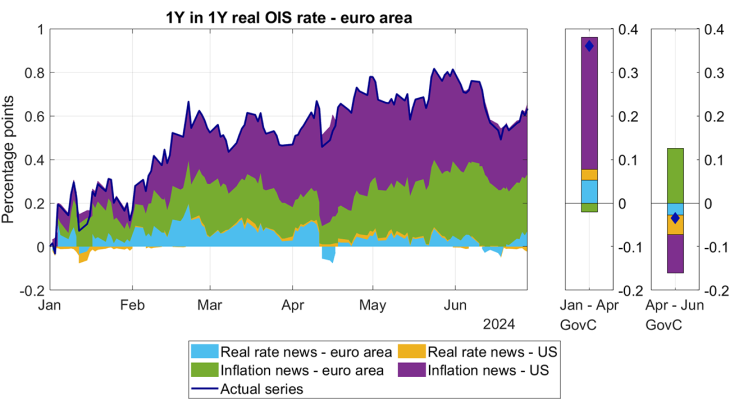

Chart 3: Breakdown of euro area expected real short-term interest rates between January and June 2024

Notes: The breakdown is generated by a daily Bayesian vector autoregression (VAR) model estimated as described in section 1. Normalized at zero at the beginning of the period.

According to Chart 3, between January and April 2024, the movement in euro area real rates was mainly determined by news concerning inflation in the United States, which contributed around three-quarters of the total increase between the Governing Council meetings of January and April (in purple in the first chart on the right, i.e. 0.3 percentage points). This suggests that the markets were especially sensitive to the sequence of news indicating more persistent inflation in the United States, which they may have considered as a harbinger of inflation in the euro area, leading them to revise their interest rate expectations upwards for the euro area. By way of contrast, American news unrelated to the inflation outlook had little effect on real interest rates in the euro area (yellow), indicating that the Fed's direct influence on euro area monetary policy remained limited.

Subsequently, between the April and June 2024 Governing Council meetings, news about inflation in the euro area was the main cause of adjustments to euro area real rates (green in the second chart on the right), whereas inflation news in the US contributed negatively. These observations are in line with the data published during this period, revealing negative surprises concerning inflation in the US and, conversely, stable or positive inflation news in the euro area through to June.

A clear understanding of ECB monetary strategy during the tightening cycle

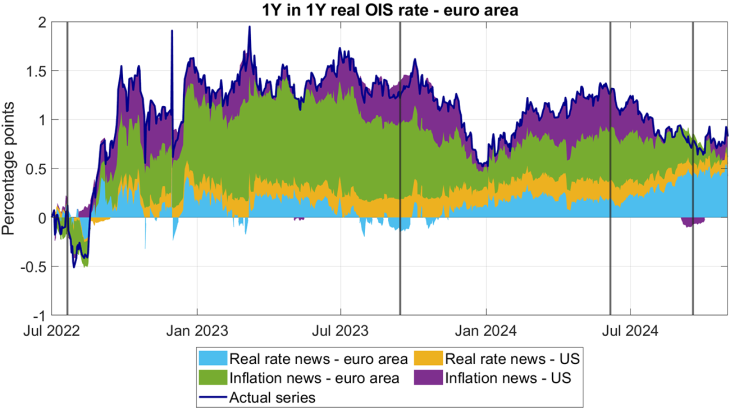

Chart 4: Breakdown of euro area expected real short-term interest rates since July 2022

Notes: The vertical lines represent – in that order – the first and final rate hikes in the euro area, followed by the first rate cuts in the euro area and the US.

Chart 4 extends the analysis in Chart 3 to the entire period of the ECB's rate tightening cycle. From July 2022 (date of the ECB's first interest rate hike) to September 2023 (date of the ECB's last interest rate hike), the increase in real rates in the euro area resulted almost entirely from news about inflation in the euro area, demonstrating that market rate expectations were well in line with the ECB's reaction function, anchored in the euro area inflation outlook. More recently, the convergence of Fed and ECB monetary policies following the ECB rate cut in June and the Fed rate cut in September, led to a parallel fall in real forward rates in both economic zones. This fall is attributable to the gradual disappearance of upward inflationary surprises, in line with the continuation of the disinflationary trajectory observed.

Our results therefore show that, according to market expectations, the ECB only reacts to US news when this influences the outlook for inflation in the euro area. Conversely, there is no direct influence from US monetary policy in such a way that markets would expect the ECB to align its decisions with those of the Fed regardless of the domestic inflation outlook. These results illustrate the ECB's perceived credibility in fulfilling its mandate independently.

It should be noted that this analysis assumes a stable relationship between inflation expectations and interest rates. Factoring in the possibility of increased market sensitivity to news about inflation during periods of high inflation would require further investigation.

Download the full publication

Updated on the 4th of February 2025