Monetary policy affects long-term interest rates not only through the direct impact of its instruments such as the short-term policy rate or asset purchases, but also by shaping market expectations about the future path of these policy instruments. While the effects of monetary policy actions on financial markets have been widely studied, much less is known about whether investors respond symmetrically to tightening versus easing monetary policy. This paper investigates this question in the context of the euro area, examining whether sovereign bond markets react asymmetrically to monetary policy surprises from the European Central Bank. These monetary surprises should be seen as shocks to the information set of investors and reflect the unanticipated component of policy decisions.

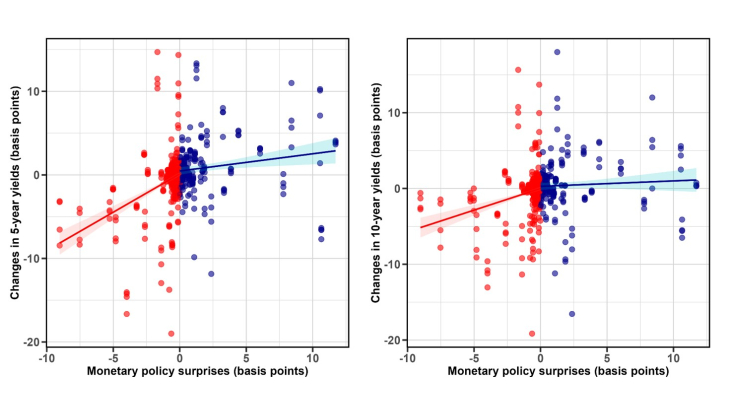

We find strong evidence of asymmetric effects: easing monetary surprises—those that suggest a more accommodative stance than financial markets expected—lead to significantly larger declines in sovereign bond yields of the four largest euro area economies than the corresponding increases observed after tightening surprises. More specifically, a 100 basis point easing surprise reduces 5-year sovereign bond yields in these countries by approximately 92 basis points, while a 100 basis point tightening surprise increases them by only 21 basis points. This asymmetric pattern, evidenced graphically in Figure A, holds across short-, medium-, and long-term maturities and is robust to alternative specifications.

We explore the potential drivers of this asymmetry. We find that the asymmetry does not stem from central bank information effects (i.e. macroeconomic information implicitly revealed by policy decisions) or from differences in prevailing economic and financial conditions. We provide evidence that the asymmetry is driven by signals about the likely future policy path. Investors appear to view an unexpected easing as a signal of a more persistent stance, while an unexpected tightening is perceived as more limited or transitory.

To understand how policy signals translate into yield changes, we decompose sovereign bond yields into a component that is common to all euro area countries, and a country-specific component, which captures notably risk and term premia. The common component reacts more strongly to easing surprises, suggesting that investors interpret these as signals of a more persistent shift in the expected policy path. In contrast, tightening surprises tend to affect the country-specific component, reflecting adjustments in risk or term premia that partially offset the positive effect of the expectations hypothesis (the common component) on yields.

Finally, we examine how central bank communication during ECB press conferences shapes investors’ reactions. By conducting textual analysis of press conference transcripts, we derive a measure of the policy stance signals conveyed in ECB communication. These signals affect how investors interpret monetary surprises. These surprises have stronger effects when combined with communication suggesting greater future policy space, and weaker effects when that space appears limited. This underscores the importance of forward-looking signals in the monetary policy transmission to long-term yields.

Overall, this paper provides novel evidence on the asymmetric effects of monetary policy on the sovereign yields of the four largest euro area countries. Easing surprises have a stronger and more persistent impact on long-term yields than tightening surprises. These findings have important implications for central bank communication, particularly in low-interest-rate environments where the signaling channel plays a central role.

Keywords: Term Structure, Asymmetric Effects, Central Bank Communication, Signaling, Long-Term Interest Rates

Codes JEL : E43, E52, E58, G12