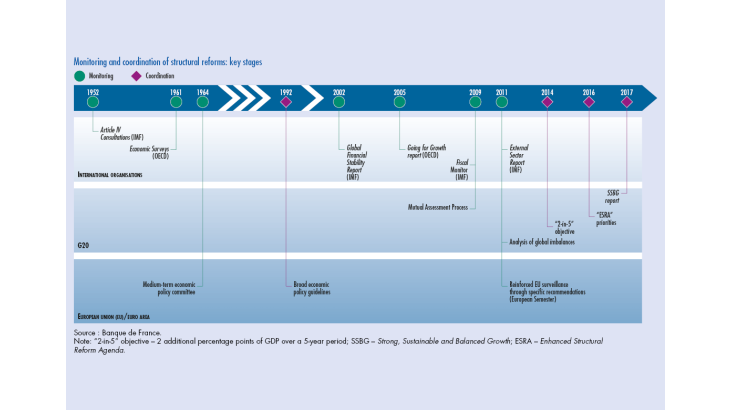

Multilateral dialogue on structural reforms initially responded to a need to share best practices aimed at promoting long-term growth and macroeconomic and financial stability. This sharing, within the framework of the bilateral surveillance of the International Monetary Fund (IMF) and the Organisation for Economic Co-operation and Development (OECD), entails recognition by the international community of “best practices”, known as the “Washington Consensus”. National government authorities have often used this surveillance to support their reform efforts. Particular pressure is exerted by the international community and peers when a country requires external financing in the event of a balance of payments crisis. In return for this financing and, beyond that, the support of the international financial community, an adjustment programme, negotiated with the IMF and more recently also involving for European countries, European organisations, is imposed. The importance of structural reforms within these programmes has significantly increased over the years.

Furthermore, globalisation has amplified interdependencies between countries through trade and financial openness and integration on the one hand and, on the other, the convergence of standards and practices that have intensified competitiveness effects and therefore the spillover effects of national economic policies and also structural reforms. Recognition of this phenomenon and of the weaknesses in multilateral coordination was hastened by the great financial crisis of 2008. After the height of the crisis – globally and then within the euro area – macroeconomic policy coordination became more difficult as economic cycles fell out of sync and fiscal policy leeway diverged, resulting in asymmetric adjustments worldwide as well as in the euro area, and persistent global imbalances. Within the Group of Twenty (G20), like in Europe, efforts to coordinate structural reforms were fuelled by both its greater relevance as a result of interdependencies and the stalled macroeconomic policy coordination as countries exited the crisis at different times, albeit slowly across the board. Although the results of this embryonic coordination were questionable, it produced two notable developments: it established the idea of mutual benefits from national structural reforms; and it strengthened consensus on the assessment of the macroeconomic effects of structural reforms and therefore on the definition of the related best practices.

[To read more, please download the article]