Why labels?

With savers becoming increasingly concerned by environmental and corporate social responsibility issues when making their investment choices, the French government sought to promote two public labels for investment funds in order to avoid greenwashing and guarantee a level playing field. Therefore, at the end of 2015 and the beginning of 2016, the Socially Responsible Investment (SRI) label and the Greenfin label, which had formerly been known as the Transition énergétique et écologique pour le climat label (TEEC – Energy and Ecological Transition for the Climate), were created with the aim of mobilising a part of savings towards financing the energy transition and sustainable development. In the management of institutional investors’ assets, this initiative thus takes into account extra-financial criteria laid down by law (Loi sur la transition énergétique pour la croissance verte (LTECV – the French Law on Energy Transition for Green Growth) of August 2015, European Regulation on sustainability-related disclosures of November 2019). The creation of a European ecolabel for green financial products is also under discussion. At the same time, the French “Pacte” law requires life insurers to include at least one SRI or Greenfin-labelled fund or fund invested in the solidarity economy in their unit-linked contracts as from 2020.

What are the SRI and Greenfin labels?

Socially responsible investment is defined as “an investment that seeks to reconcile economic performance and social and environmental impact by financing companies that contribute to sustainable development, regardless of their sector of activity” (AFG, French Social Investment Forum, 2013). Although this definition is commonly accepted, it can take on a wide range of forms or approaches that vary in terms of selectivity and constraints. The SRI label requires the systematic and measurable integration of extra-financial analysis (of Environmental, Social and Governance – ESG – criteria) into investment decisions. A set of requirements specified by government ruling covers the objectives of fund investment policies, the selection process (analysis and rating methodologies), management transparency, commitment and dialogue with portfolio companies, as well as indicators of the impact of investments on the environment and society.

The Greenfin label operates in a similar way to the SRI label and is also based on financial management transparency and environmental impact indicators. However, it is more restrictive in that the investment scope is limited: more than 75% of the fund must be allocated to green bonds (see Bui Quang et al., 2019) or to green activities that are precisely defined in a taxonomy. Moreover, certain sectors that are not particularly compatible with the energy transition or that are controversial (nuclear energy, fossil fuels) are excluded. The label accreditation process is audited by an authorised certification body.

Few funds claiming to be involved in sustainable finance take the step to obtain the label

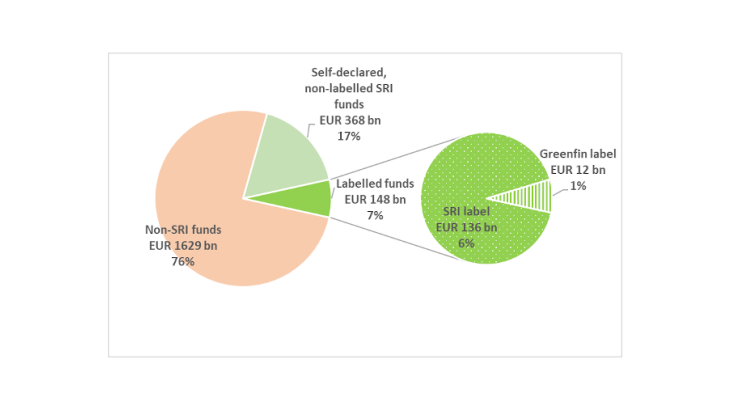

At the end of 2019, after major growth during the year that saw a three-fold increase in their outstandings, 379 labelled funds with total assets of EUR 148 billion accounted for almost 7% of the French collective investment management market (French and foreign investment funds managed in France excluding securitisation, see Chart 1).

The SRI label is the most successful, with a 6% market share (EUR 136 billion) compared with 1% (EUR 12 billion) for the Greenfin label. However, according to AFG’s annual survey, in 2018 almost EUR 516 billion of investment funds – 24% of the market –were managed in accordance with a so-called responsible investment approach. There still appears to be considerable room for improvement.

The label, a factor of attractiveness for investors...

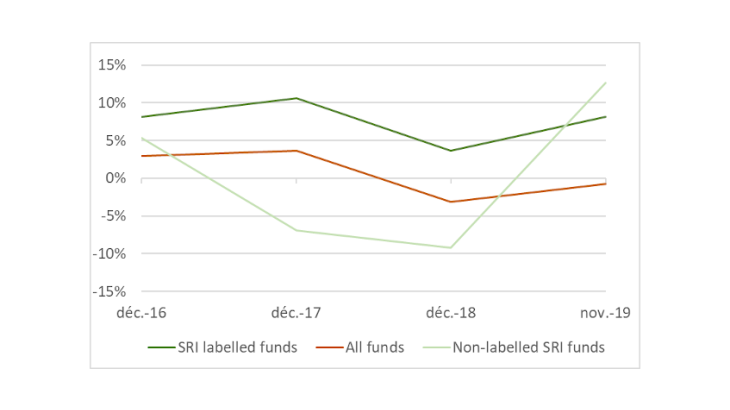

French SRI-labelled funds report high annual subscription rates of between 5% and 10%. These levels are significantly higher than the average for French funds as a whole, which have recorded net outflows for the past two years (see Chart 2). Furthermore, studies show that taking extra-financial criteria into consideration would not reduce or increase performance levels in the short to medium term (Revelli and Viviani, 2014; Friede, Bush and Bassen, 2015). It also appears that between the beginning of 2016 and the third quarter of 2019, overall, the performance of labelled funds was relatively similar to that of conventional funds in the same category (Stat info, Investment funds, Q3 2019). Between 2016 and 2018, labelled funds also received more inflows than funds that claimed to be socially responsible investors but did not have a label. However, this trend was reversed in 2019, underlining the need in an increasingly competitive market to improve the promotion of the labels and the guarantees that they offer.