Banks’ profitability relies prominently on their ability to collect more interests on their assets than they pay on their liabilities. The resulting net interest income (NII) is a key factor of financial stability, since it drives the capacity of banks to absorb losses and to accumulate capital through retained earnings. In this paper, we present an ALM-like model designed to project the banking sector’s aggregate NII under different financial and monetary policy scenarios, using the available information on the structure of assets and liabilities (interest rate regime, maturities etc.).

The distinctiveness of MAP (Modèle Actif-Passif) lies in its “mechanistic” nature and its flexibility in terms of admissible scenarios. The model applies simple accounting principles to project the aggregate banks’ balance sheet, leveraging the near-closed-system nature of the banking sector as a whole. It explicitly projects the expiration of existing assets and liabilities and their replacement with new ones, as well as the financial commitments between credit institutions and central banks. Scenarios are set externally and can be used to investigate the extent to which an extensive variety of circumstances may affect banks’ NII: changes in interest rates, in the volume of loans, in monetary policy decisions or in the cost structure of banks’ deposits.

The paper includes an application of the model to the aggregated euro area banking sector, whose total balance sheet amounts to more than 25 trillion euros at end-2022 and generates around 300 billion euros in annual net interest income. The scope covers the largest banking institutions (Significant institutions as determined by the EU supervisors), which together account for approximately 85% of the euro area’s total banking assets. The results provide a view on the trends in euro area banking sector quarterly profits over a 5-year horizon.

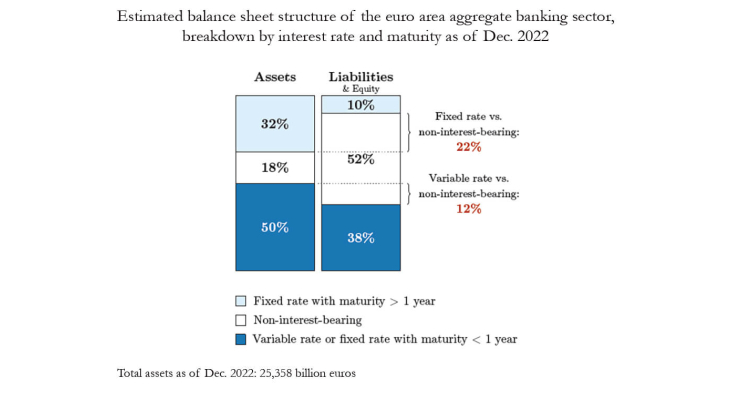

The balance sheet analysis performed to apply the model provides an analytical decomposition of the balance sheet by type of interest rate and maturity, taking into account the partial sensitivity of customer deposits to interest rates. At the euro area aggregate level, this structural decomposition indicates a positive net holding of interest-paying products as of end-2022: the surplus of long fixed-rate assets (22%) and the surplus of short and variable-rate assets (12%) are both effectively funded by non-interest-bearing liabilities. This configuration creates a positive sensitivity to higher interest rates for euro area.

Indeed, in an example scenario of rising interest rates, the model projects a rising net interest income for the euro area banking sector over the next five years, in line with the balance sheet structure. Furthermore, the MAP’s analytical approach provides a detailed composition of the projected net interest income, allowing a decomposition of the projected interest fluctuations in four categories of operations, i.e. central banks, other banks, clients and securities.

The reliability of the MAP projections can be assessed by a back-testing method using past starting points with observed data, both on overall NII and balance sheet, and on each component. The back-testing exercise realised on the euro area banking sector model for the period 2016–23 gives robust results. While the model is adapted to the present situation of eurozone banks, its modular nature makes it easy to modify, either to fit a different banking sector, or to accommodate potential future changes in the financial system (e.g. issuance of central bank digital currencies).