Each year, trade unions and employer federations negotiate industry-level wage floor scales below which employees cannot be paid. These negotiations generally take place once a year, at the beginning of each year. In 2022, the high level of inflation (5.9% in December 2022) led many industries to revise their usual wage bargaining timetable and the negotiated increases for 2022 (Gautier 2022).

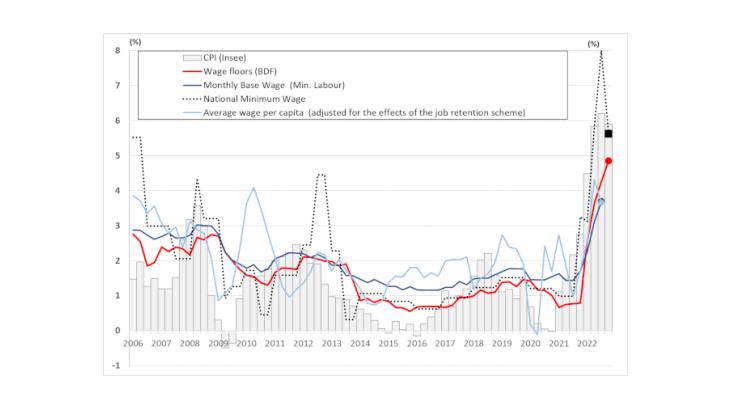

Drawing on data on wage agreements from over 300 industries in France, this post takes stock of the changes in negotiated wages during 2022. Almost half of the industries revised their agreements for 2022 in the course of the year. In the last quarter of 2022, the average increase in industry-level wage floors negotiated in industry-level collective agreements amounted to 5% year-on-year (Chart 1). Increases in industry-level wage floors helped support annual wage growth. At the end of 2022, both the monthly base wage (i.e. the wage actually paid, excluding bonuses and overtime) and the average wage per capita (which also takes into account bonuses, overtime, and labour composition effects) rose by 3.7% year-on-year, compared to 1.7% in the last quarter of 2021.

Inflation and increases in the national minimum wage have affected the wage bargaining timetable

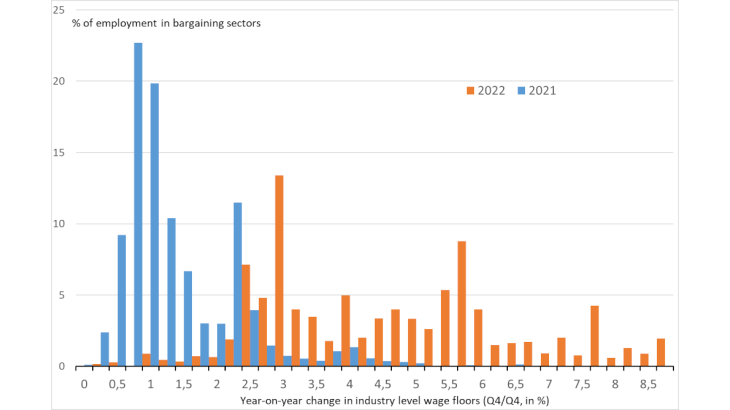

Wage bargaining discussions are usually clustered over a few months, between the end of the year and the beginning of the following year. The acceleration in inflation since the end of 2021 and the upward revision of the national minimum wage (NMW) in October 2021 (+2.2%) and January 2022 (+0.9%) led a large majority of industries to sign an agreement at the beginning of 2022: 60% of industry-level wage floors were thus raised in the first quarter of 2022 (compared with only 33% in the first quarter of 2021).

More unusually, in the course of 2022, almost 150 industries revised their wage floor increases for 2022 at least once. Twenty-five industries revised their original agreement for 2022 twice or more. In total, 44% and 26% of wage floors were raised in the second and third quarters of 2022 respectively (compared with 18% and 13% in 2021 for the same quarters). This increase in the frequency of in-year agreements is unprecedented in its scale. In the past, increases in the NMW during the year have tended to lead to a small rise in the number of agreements (as in July 2012, for example, Fougère et al. 2018).

The reasons for this are twofold. First, the agreements signed at the end of 2021 - beginning of 2022 often contained review clauses related to inflation or the NMW, which facilitated the reopening of wage bargaining discussions. Second, the increases in the NMW also contributed to the signing of new agreements. According to a legally established formula, the NMW automatically increases if, since the last revision, inflation (excluding tobacco) for households in the first income quintile is higher than 2%. The national minimum wage was thus raised in May (+2.65%) and again in August 2022 (+2.1%), bringing the year-on-year increase in the NMW to 8% and the number of NMW increases to 4 in less than 12 months. For many industries, this rapid rise in the NMW resulted in the lowest portion of their wage floor scale falling below the NMW, which prompted the social partners to renegotiate their agreement during the year to bring their pay scale into line. However, the proportion of industries whose lowest wage floor is below the NMW was still high at the end of 2022 (close to 60%), which could lead many industries to rapidly restart bargaining discussions for 2023.

A rise in negotiated wage increases in the course of the year

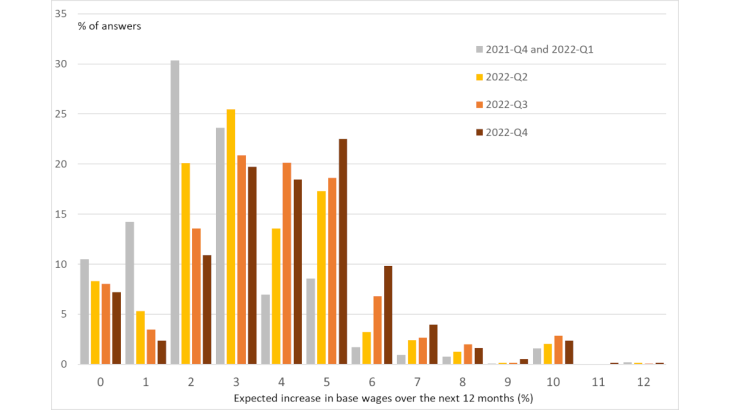

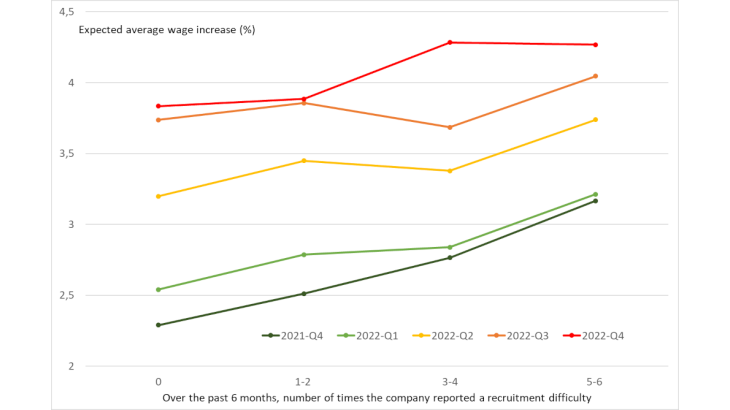

The in-year revision of agreements also contributed to raising negotiated wage increases. At the beginning of the year, these increases averaged 3%. In some industries (hotels-cafés-restaurants, hairdressing, road transport), increases of 5% or more were observed, but these were rare and essentially reflected a catch-up effect with the national minimum wage.

At the end of 2022, the average increase in industry level wage floors was close to 5%. Most of the industries that renegotiated during the year signed agreements containing wage increases of more than 5% in total over 2022, with generally an agreement at the beginning of the year of around 3% and an agreement in the course of the year providing for a further increase of between 2% and 3%. Among the industries with more than 100,000 employees, it is worth mentioning supermarkets and hypermarkets (3.2% in April 2022 and then 2.2% in mid-June), cleaning services (2.6% at the end of 2021 and then 2.9% in mid-2022), and chemicals (2.8% at the end of 2021 and 2.5% in September 2022). At the end of 2022, certain revisions were more substantial, such as in the security sector (+7.5% in September 2022), hairdressing (+5% in October 2022 after an average of 7% at the start of the year) and wholesale trade (+4.5% at the end of 2022 after +3.2% in January 2022).