- Home

- Publications et statistiques

- Publications

- Measuring the climate risk of corporate ...

This post is part, with the post 379 “Green premium: can firms fund their green projects at a lower cost?” and post 380 “Do green sovereign bonds benefit from a green premium” of the series dedicated to “Green Premiums”.

A quantitative analysis of corporate bond yields as a function of a company's greenhouse gas emissions shows that investors are by no means indifferent to climate risk when valuing these securities, especially for those bonds with the best ratings. Nevertheless, we need to take account of the interaction between credit risk and transition risk.

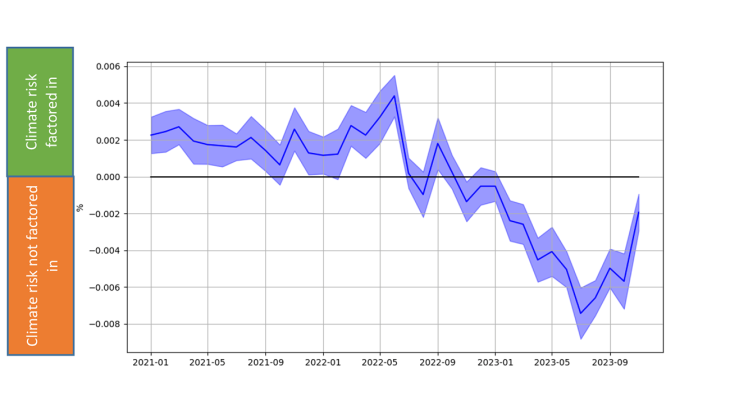

Chart 1: Change in the contribution of a company's carbon intensity to its bond yields

Interpretation: In May 2021, after controlling for country, sector, credit rating, etc., carbon intensity accounts for an increase of 0.2 basis points per tCO2/€m in the z-spread (defined as the difference between bond yields and the €STR interbank reference rate) (within a 95% confidence interval (blue area) calculated from the standard errors of a regression).

Climate change exposes businesses to a number of risks, particularly a “transition” risk associated with aligning their processes with any potentially restrictive low-carbon regulations. In principle, companies generating the highest greenhouse gas (GHG) emissions in their production activities are those most exposed to this risk. Conversely, companies with low GHG emissions (“green” companies), which are already largely compliant with regulations, should be in a more advantageous situation and in a stronger competitive position. We can therefore expect investors to factor in these differences in transition risk exposure when valuing securities (equities or bonds), and for this to be reflected in a positive risk premium on the most exposed corporate bonds, observable on the financial markets. Conversely, demand for green investments is surging, resulting in a negative premium on green bonds (“green premium” or ”greenium”, see Chouard and Jourde, 2024). This demand for green investments should have the same effect on the bonds of virtuous companies (including conventional bonds). Several studies demonstrate that this premium may be observed both on equity markets (Bolton and Kacpercyk 2021, Alessi et al 2021) and on bond markets (Seltzer et al 2022, Capasso et al 2020, Barth et al 2022).

This blog post measures the effect of transition risk on the valuation of euro area corporate bonds that are eligible as collateral in Eurosystem monetary policy operations. The study covers 15,465 bonds issued by 774 companies rated A or better by rating agencies. Because the Banque de France, in collaboration with the Bundesbank, is tasked with valuing eligible listed securities for the Eurosystem, we have access to financial and climate data for these bonds.

For the purposes of this study, transition risk exposure will be measured as the ratio of GHG emissions intensity, or “carbon intensity” (i.e. gross GHG emissions divided by turnover, provided by ISS and Carbon4FInance) to the valuation of the bonds issued by the companies in question on the conventional bond market. This work accompanies the publication of two other blog posts analysing the corporate green bond market (see Chouard and Jourde, 2024) and the sovereign green bond market (see Descombes and Szczerbowicz, 2024).

If investors associate GHG emission-intensive companies with a higher risk, we would expect to observe significantly higher yields to maturity for these companies than for those with lower levels of GHG emissions. For the purposes of the study, we used the Scope 1+2 carbon intensity (i.e. direct and indirect energy-related GHG emissions divided by turnover) of the 774 companies analysed. Scope 3 GHG emissions (GHG emissions associated with the upstream and downstream parts of the value chain) are not included in this study because ISS and C4F data on Scope 3 emissions are not yet sufficiently reliable.

The overall risk premium for polluting companies disappeared in 2023

To estimate the impact of this measure of a company's carbon intensity on its bond yields, we analysed the spread between bond yields and the €STR interbank reference rate (or z-spread) as a function, not only of the carbon intensity of the bond issuing company, but also of the residual maturity and other parameters that have a significant impact on this spread, such as the company’s country and sector or its bond credit rating.

To observe changes in the influence of each parameter over time, this analysis was performed each month over the 2021-23 period. Chart 1 (above) shows the change in the impact of carbon intensity on bond yield spreads.

We observe that this impact was positive and significant from 2021 to mid-2022 (the confidence interval is always strictly positive). This means that the more GHGs a company emitted, the riskier its bonds were perceived to be. However, this effect remained measured. It gradually decreased between June 2022 and the end of 2023 and has become significantly negative since then. Not only does the risk premium on GHG-emitting companies seem to have disappeared, but it has actually reversed. Chouard and Jourde (2024) also note the disappearance of the spread between green and conventional bonds, reflecting an adjustment of supply and demand on the green bond market. However, the inversion observed in our case can be accounted for in another way, which is detailed below.

Carbon intensity is correlated with traditional financial indicators

In order to understand this inversion effect, we repeated the previous study, successively removing the effects of the other parameters – sector, country or credit quality – to isolate the factor or factors making the strongest contribution to inverting the climate effect.

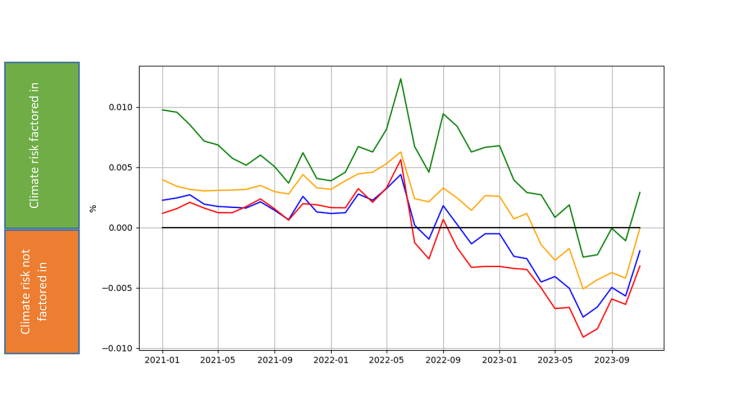

This analysis shows that factoring in the sector of activity has little effect (the blue curve in the chart below is similar to the red reference curve, which corresponds to the curve in Chart 1): carbon intensity affects yields in an identical manner regardless of whether the sector effect is factored in. Risks therefore appear to be identified specifically for each GHG emitter company, irrespective of their sector of activity. The orange curve shows that by factoring out the company’s country, the effect of carbon intensity increases slightly. Some of the risk that could be attributed to a company's GHG emissions are in fact country risks.

Chart 2: Contribution of carbon intensity to corporate bond yields, factoring in different explanatory variables

Note: The interpretation is the same as for Chart 1, but excluding one explanatory variable for each curve; sector of activity for the blue curve, country for the orange curve, and credit rating for the green curve.

Ultimately, it appears that the variable with the greatest influence on the carbon intensity effect is credit rating. The green curve shows that the measurement of the role of carbon intensity would be much higher if the credit rating effect were not factored in. A large part of the apparent risk premium is actually a credit risk, and the reduction resulting from factoring in this credit risk indicates that it is greater for GHG-emitting companies than for others.

Because the risk of not making the transition is a financial risk of having to bear the costs of bringing production processes into compliance with regulations, it constitutes an additional credit risk, which can be incorporated into the traditional financial analysis of a company by rating agencies.

The impact of carbon intensity on yields differs according to the credit rating of corporate bonds

To isolate the effect of our carbon intensity variable from the effect of credit rating on spreads, we perform a separate analysis for each credit quality category: AAA and A.

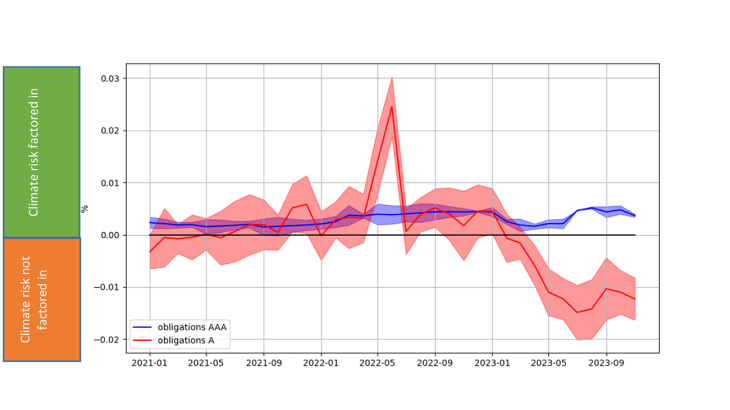

Chart 3: Contribution of carbon intensity to corporate bond yields, by credit rating

Note: The interpretation is the same as for Chart 1, but the bond universe is restricted to AAA bonds for the blue curve and to A-rated bonds for the red curve.

For AAA-rated corporate bonds, the effect of carbon intensity on yields remains significantly positive throughout the period, although it diminishes in 2023. Nevertheless, this proves that when credit risk is very low, there is a risk premium on the securities of GHG-emitting companies. For A-rated bonds, the effect is virtually nil over almost the entire period and even turns negative in 2023 (“brown penalty”), suggesting that the market considers that the rating agencies overweight climate risk.

We can therefore conclude that climate data influences bond valuation, particularly for those companies with a good credit rating; the more this rating deteriorates, the more the carbon intensity effect becomes an adjustment to the rating agencies' overweighting of climate risk, rather than a real transition risk premium.

Conclusion

Climate risk measured by the intensity of greenhouse gas emissions has an effect on investors' perception of risk, but this effect is concentrated on companies with the best ratings. At the same time, there is a negative correlation between GHG emissions and credit quality, suggesting that rating agencies factor climate risk into their ratings. These findings suggest that we should continue to measure this effect in the future to refine our valuation models.

Download the full publication

Updated on the 19th of February 2025