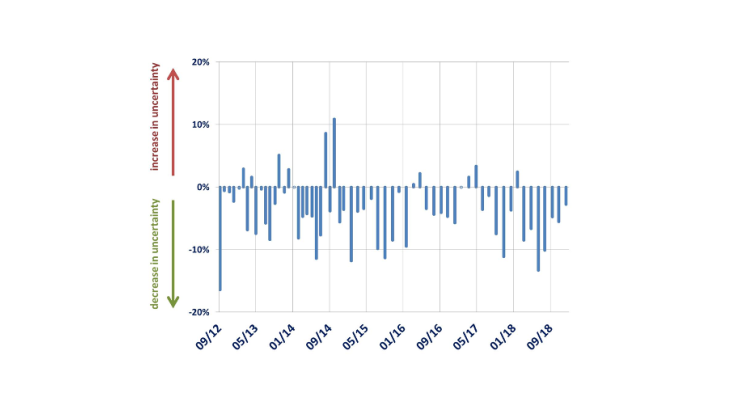

Note: Changes in market uncertainty as measured by daily growth rates in the VSTOXX (V2X) index - the most popular index for market uncertainty in the euro area - on days of the ECB’s Governing Council Monetary Policy meetings since September 2012.

ECB’s Governing Council communication effectively reduces market uncertainty

Since central banks started to introduce unprecedented unconventional policies, they have increased their communication efforts. Nevertheless, the effects of such enhanced communication are far from evident. On the one hand, more information helps markets to better evaluate the impact of the new policies. On the other hand, the complexity of the policies themselves or the emphasis on the poor state of the economy justifying their introduction may have left the market more, rather than less, uncertain.

In this blog post, we provide a first assessment of the effects of ECB institutional communication on market uncertainty as measured by the VSTOXX index. The VSTOXX is the most widely used index of market uncertainty for the euro area. It is designed to reflect the market expectations of volatility over a 30-days horizon. We consider changes in this index at Governing Council Monetary Policy Meetings dates. On these days, the ECB President publicly announces the new policy decisions and answers questions during a press conference that is typically the most important financial event of the day. Thus, by looking at the daily growth rate of VSTOXX occurring at a particular Governing Council date we obtain a proxy for the change in market uncertainty associated with ECB institutional communication. In Figure 1, each bar corresponds to the growth rate of VSTOXX at a Governing Council Monetary Policy meeting day starting from September 2012, just after the peak of the European sovereign debt crisis.

The first finding is that on average the ECB’s Governing Council official communication decreases market uncertainty. Specifically, 49 over 60 observations (i.e. 81.6%) correspond to a decrease in market uncertainty. Moreover, the average decrease in the sample amounts to -3.78%, which is significantly lower than the average increase of 0.2% computed on the whole daily series of growth rates over the same time span. This result contrasts with the view recently put forward by Leombroni, Vedolin, Venter and Whelan (2018) that recent ECB Governing Council communication could have contributed to increasing, rather than decreasing, market uncertainty.

Market uncertainty is particularly sensitive to announcements about asset purchases

Another insightful lesson from Figure 1 is that market uncertainty is particularly sensitive to announcements about asset purchases. In fact, the three largest drops in uncertainty correspond to: 6 September 6 2012, day of the introduction of Outright Monetary Transactions (‑16.4%); 14 June 2018, day of the announcement of the likely end of net asset purchases (‑13.3%); and 22 January 2015, day of an important extension of the Asset Purchase Programme (‑11.8%).

However, the sensitivity to asset purchase announcements also led to the largest spike in market uncertainty. This was the case on 2 October 2014 (10.8%). On this occasion, the ECB’s Governing Council announced the beginning of the covered bonds and asset-backed securities purchases with only a vague reference to the impact of the programme on the ECB balance sheet.

One possible interpretation, supported by media coverage that day, could be that the absence of a definite figure for the intervention increased uncertainty on its actual impact. This would suggest that communication about asset purchases can be powerful at reducing market uncertainty when the announcements are perceived as accurate, whereas they can even have opposite effects otherwise.

The ECB’s Governing Council communication has recently been associated with lower market uncertainty

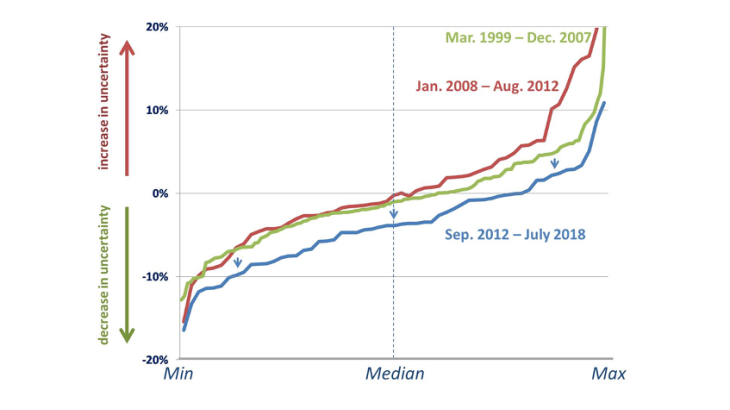

Comparing the impact of ECB Governing Council communication over time shows that it has recently been more effective at reducing market uncertainty than it was before and during the crisis. Indeed, the comparison between the distributions of daily changes in market uncertainty obtained over different time spans reflects this trend.

In particular, the blue curve in Figure 2 shows the distribution of the daily changes plotted in Figure 1 ordered from the smallest to the largest. We report the analogous distributions for the “crisis sample” from January 2008 to August 2012 in green, and the “pre-crisis sample” from March 1999 to December 2007 in red.

We make two main observations. First, the “crisis sample” and the “pre-crisis sample” have identical shapes for negative values. This suggests that ability of the ECB’s communication to lower market uncertainty did not deteriorate during the crisis even if positive spikes in market uncertainty were more frequent (i.e. the red line is higher that the green for the positive variation in market uncertainty).

Second, by contrasting the three curves, we note that the most recent period lies substantially below the other two. This indicates that the ECB’s Governing Council communication since 2012 has been more effective overall in reducing market uncertainty than it has ever been. This denotes a remarkable improvement in the ECB’s communication especially given the increasing complexity of unconventional policies.