- Home

- Publications and statistics

- Publications

- Interim macroeconomic projections – Marc...

In order to contribute to the national and European economic debate, each quarter, the Banque de France publishes macroeconomic forecasts for France, prepared within the scope of the Eurosystem projection exercise and covering the current year and two forthcoming years. Some of the publications also include an in-depth analysis of the results, along with focus articles on topics of interest.

As of March 2024, the March and September interim projections will be published in a shortened format, as these exercises are now updates of the previous quarter's projections for the main economic variables. The June and December projections will continue to be published in their current format.

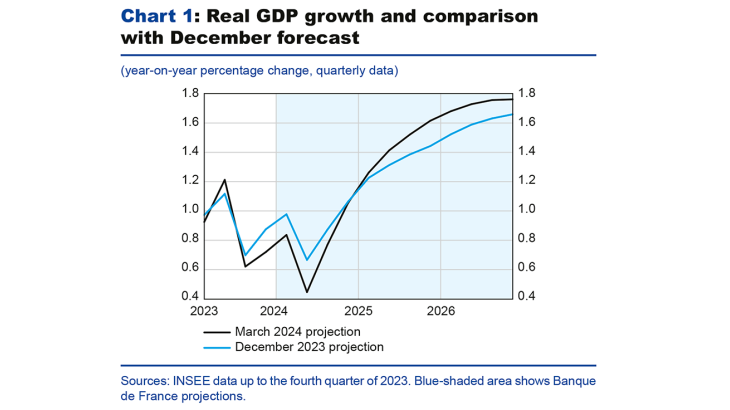

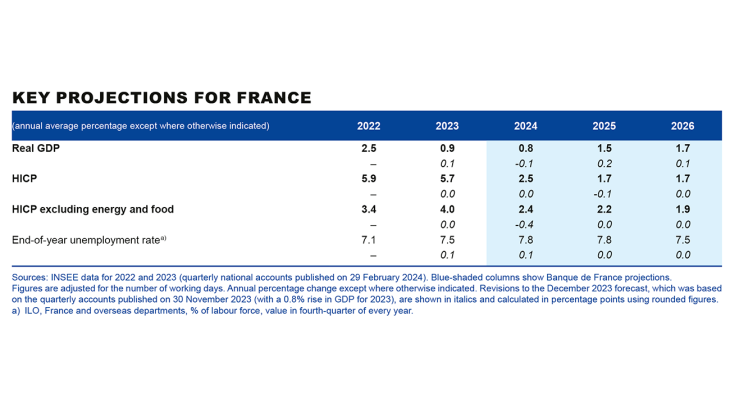

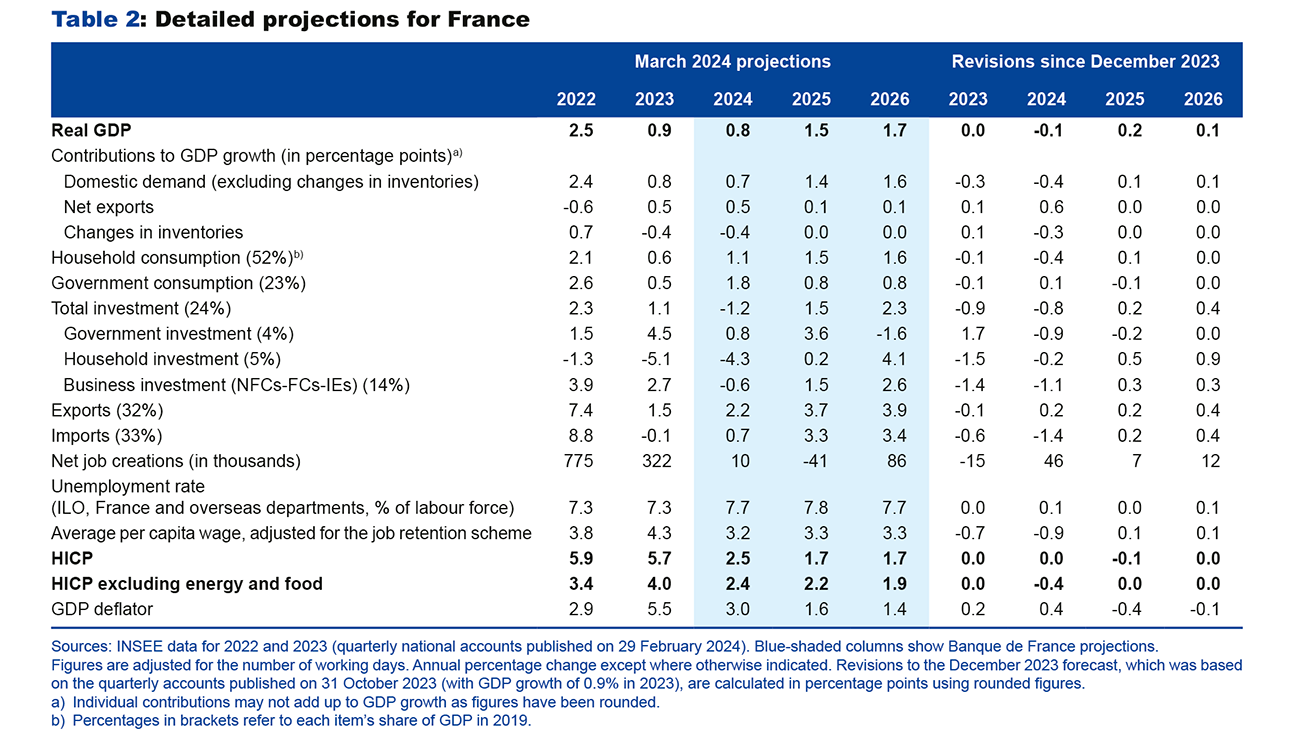

According to our March interim projections, GDP growth is expected to remain sluggish in 2024, to stand at 0.8% (after 0.9% in 2023), before accelerating to 1.5% and 1.7% in 2025 and 2026, respectively.

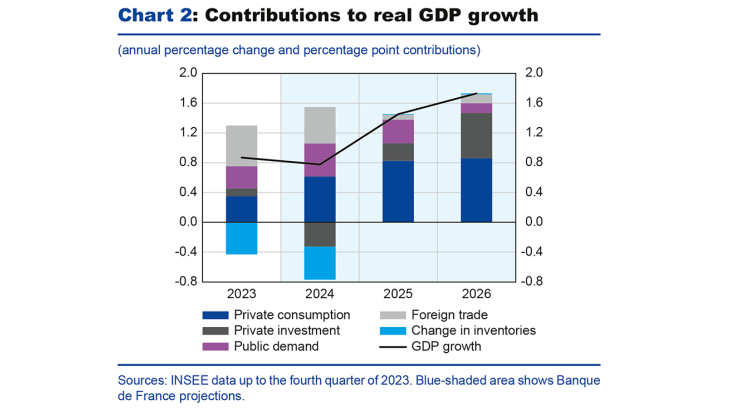

▪ In 2024, growth is expected to be driven more by household consumption than in 2023, due to the fall in inflation.

In 2025, growth should also benefit from a recovery in private investment, as monetary and financial conditions improve. In 2026, these trends should strengthen to generate robust activity.

▪ Compared with our December 2023 projections, growth for 2024 has been revised very slightly downwards, due to a smaller carry-over effect at the end of the fourth quarter of 2023. However, we expect a more marked rebound in 2025 and 2026, thanks to more favourable assumptions concerning energy prices and financial conditions.

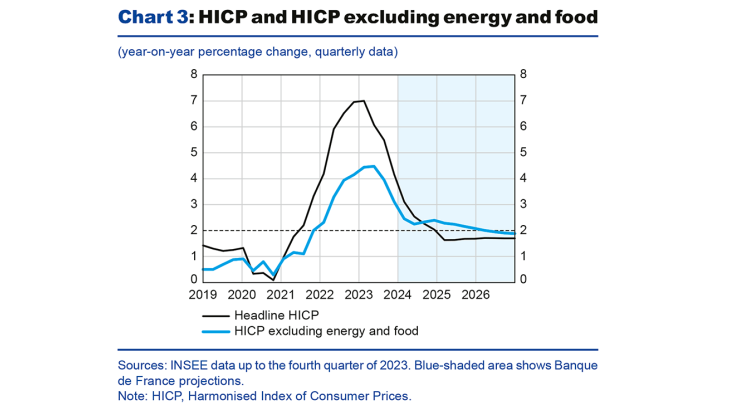

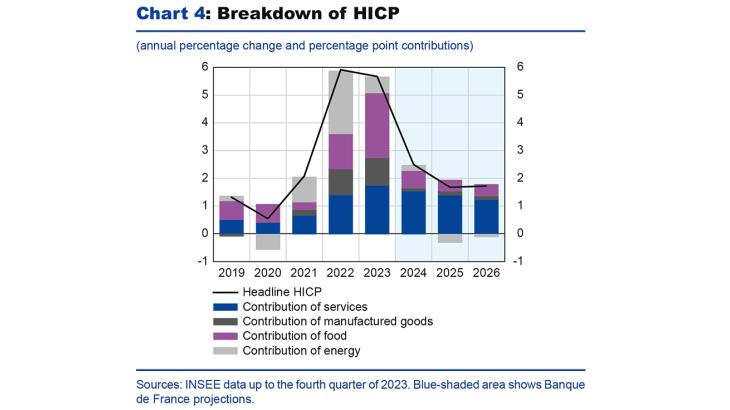

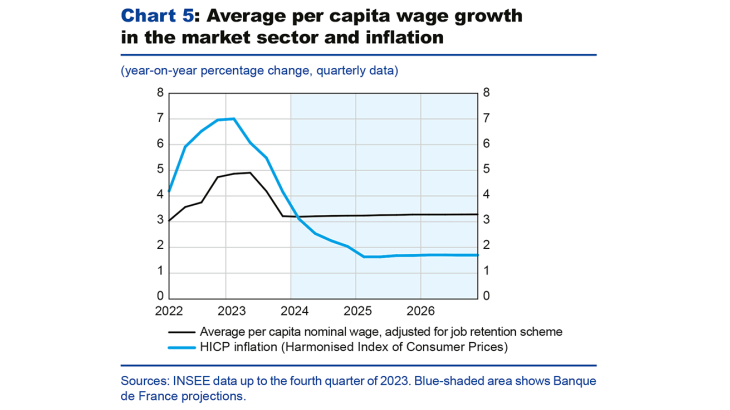

▪ These new projections confirm the decline in inflation that we forecast in our previous projections. After reaching 5.7% in 2023, HICP inflation is expected to drop significantly to an average of 2.5% in 2024, then 1.7% in 2025, where it should remain in 2026. Year-on-year, it is expected to be close to 2% by the end of 2024. The normalisation of food and energy commodity prices is expected to continue, with food and manufactured consumer goods experiencing only moderate price increases in 2025 and 2026, while final energy prices are expected to fall over these two years. Services prices should slow at a later stage, with inflation returning to a rate close to its 2002-2009 average (2.6%) by 2026. Overall, core inflation (HICP excluding energy and food) should decrease sharply to 2.4% in 2024, before settling at 2.2% and 1.9% in 2025 and 2026, respectively.

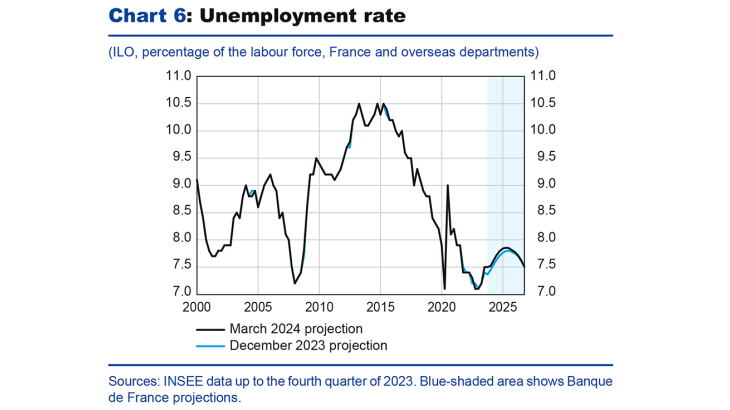

▪ Based on the latest economic data, we expect wages to increase less markedly in the short term. However, nominal wages should slow at a weaker pace than prices, thus bolstering the purchasing power of labour income. As a result of the temporary drop in employment expected in 2024 and 2025, the unemployment rate is expected to rise slightly to close to 7.8% between the end of 2024 and the end of 2025, before resuming its decline in 2026 towards the level that we forecast in our December projections (7.5%).

▪ The risks to economic activity in this projection are slightly on the downside for 2024: aside from geopolitical risks, households could maintain a very high savings rate, thereby delaying the expected acceleration in consumption.

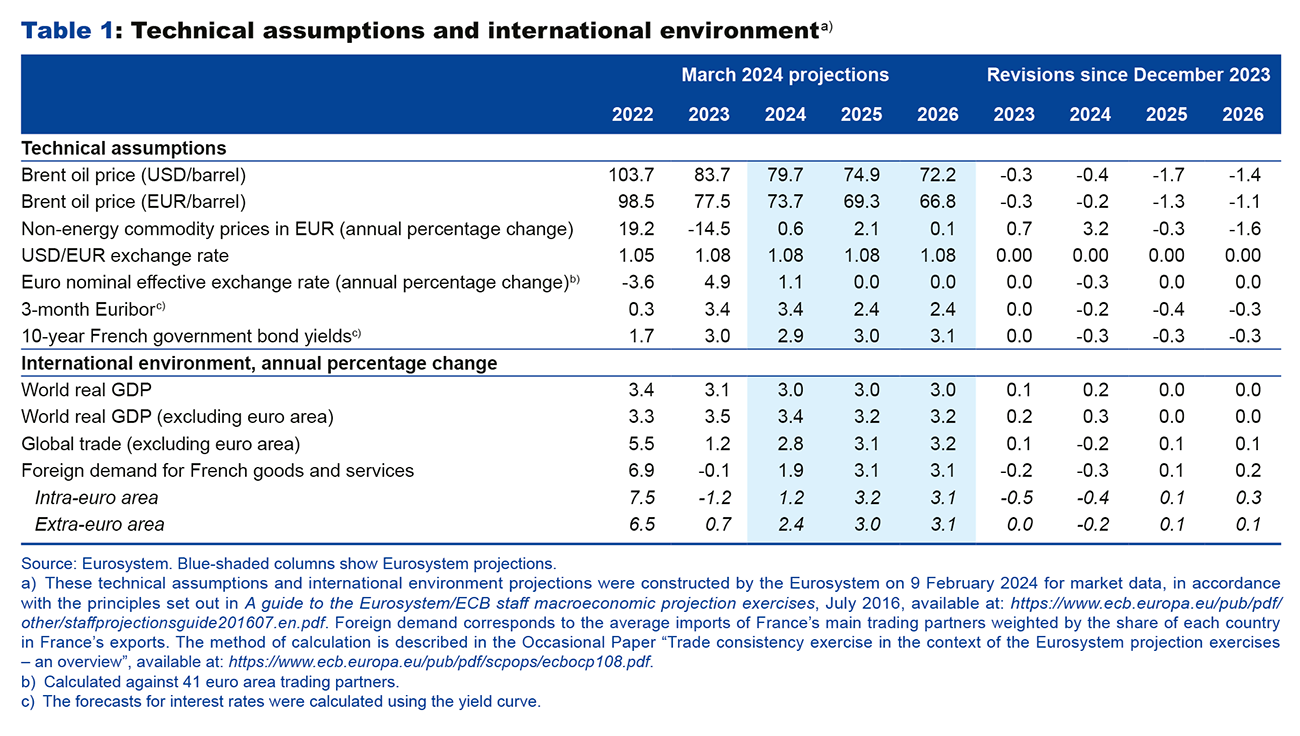

These projections are based on Eurosystem technical assumptions, for which the cut-off date is 9 February 2024. They incorporate final HICP (Harmonised Index of Consumer Prices) inflation figures for January, published on 16 February 2024, as well as the detailed figures for the fourth quarter 2023 national accounts published on 29 February 2024, and the data from the Banque de France's monthly business survey for the beginning of March.

Economic activity is expected to remain sluggish in 2024, before strengthening in 2025 and 2026

Since our December projection, fresh data has led us to revise our growth forecast for 2024 very slightly downwards to 0.8%, compared with 0.9% in our previous projection (see Chart 1). This includes sharper downward revisions to consumption and investment, which are largely offset by an upward revision to the contribution from external trade. According to the latest quarterly accounts published on 29 February, GDP grew at a rate of 0.1% in the fourth quarter of 2023, which is slightly lower than forecast in December. According to the Banque de France's monthly business survey at the beginning of March, GDP growth in the first quarter of 2024 is expected to be 0.2%.

For 2025 and 2026, the new Eurosystem technical assumptions are more favourable for energy prices, particularly gas prices, and they also revise interest rates (as expected by the markets) downwards. As a result, the contribution of private investment to growth is expected to be greater towards the end of the forecast horizon. These factors lead to an upward revision of GDP growth for 2025 and 2026, to 1.5% and 1.7% respectively (compared with 1.3% and 1.6% in our previous projections).

Inflation continues to fall, with a return towards 2% by the end of 2024

HICP inflation has been declining sharply for several quarters, from 7.0% in the first quarter of 2023 to 4.2% in the fourth quarter of 2023 (see Chart 3). In early 2024, it continues to fall, despite a higher-than-expected rise in tobacco prices in January, and in regulated electricity prices in February. According to INSEE's provisional estimate, headline inflation stands at 3.1% in February 2024. This decrease was driven by the fall in inflation excluding energy and food, which, after peaking at 4.7% in April 2023, is expected to be 2.4% in February 2024, according to the provisional estimate. In particular, prices of manufactured goods have slowed more markedly than forecast in our December projection. The slowdown in wages at the end of 2023 was also more pronounced than expected, which should lead to more moderate price increases in services. As regards the prices of manufactured goods, our projections take into account the effect of geopolitical tensions in the Red Sea on transport costs, which could impact retail prices in the second half of 2024, albeit without affecting their slowdown.

Based on the latest available data, we have therefore revised the increase in energy prices in 2024 upwards; however, we have revised inflation excluding energy and food, downwards, with headline inflation unchanged from our previous projections. Thus, in the fourth quarter of 2024, year-on-year headline inflation should be around 2%, and year-on-year core inflation should be around 2.5%. From 2025 onwards, our inflation forecast is virtually unchanged, particularly for manufactured goods and food, under the unchanged assumption of a normalisation of the corresponding commodity prices as currently expected by markets. The forecast increases in services prices are also virtually unchanged, in line with a similar assessment for wage dynamics and the unemployment rate at this forecast horizon.

In 2024, nominal wages are expected to slow by more than previously forecast, whereas the unemployment rate is expected to rise slightly

Since our projections in December, we have fresh data concerning wages and unemployment. First, the average per capita wage slowed by more than forecast in the fourth quarter of 2023. In addition, the upward revision of the SMIC (minimum wage) in the first quarter of 2024 was lower than expected on account of the lower past inflation rate, and compulsory annual wage negotiations point to a moderation in negotiated wage increases in 2024. The rise in average per capita wages adjusted for the job retention schemes has thus been revised downwards to 3.2%

in 2024, compared with 4.1% in our December projection. However, nominal wages are expected to grow by more than consumer prices (see Chart 5), which, combined with a slight upward revision in employment in the short term, should bolster the purchasing power of wages from 2024 onwards. In the medium term, wage growth (3.3% in 2025 and 2026) is virtually unchanged, given the unchanged assessment for inflation and the unemployment rate.

The unemployment rate is revised slightly upwards in the short term following INSEE's latest publication for the fourth quarter of 2023 (see Chart 6), before declining in 2026 and returning to the path forecast in December. In the medium- and long-term, the trend in total employment is also not expected to change much, with a temporary slowdown in 2024 and 2025 as a result of a partial and gradual recovery of past productivity losses.

Appendix: Eurosystem technical assumptions and detailed projections

Download the PDF version of this document

Updated on the 25th of July 2024