- Home

- Publications et statistiques

- Publications

- Interest rates in decentralised finance

Post No.352. Interest rates on decentralised finance (DeFI) loan and deposit platforms are volatile and appear surprisingly disconnected from interest rates in traditional finance. This blog post explains how these rates are determined and through which channels monetary policy can influence them.

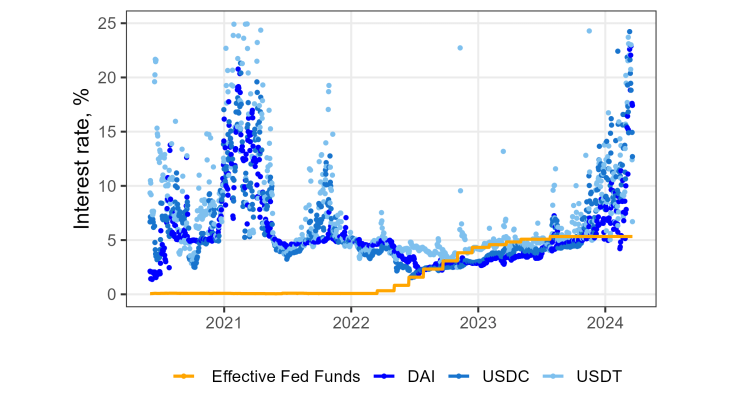

Chart 1: DeFI borrow rates for the main stablecoins

Note: The blue dots show the borrow rates on the three stablecoins DAI, USDC and USDT, issued respectively by Maker DAO, Circle and Tether. At the start of January 2022, the average intraday rate charged to borrow a stablecoin on the platforms Aave v1, v2 and v3, and Compound v2 and v3 was close to 5%, whereas the Fed funds rate was zero. Interest rates above 25% are not shown for legibility reasons. Last observation: 19 March 2024.

Smart contracts, the cornerstone of decentralised finance

Blockchain is a technology for storing and transmitting information, and is notably used to exchange digital assets. Transaction data are grouped together in blocks that are secured using cryptography, and are then recorded on a distributed, decentralised ledger which is permanent and transparent. In the case of “public” blockchains, there is no central controlling body or restriction of access: anyone can view the recorded data and submit new transactions.

Blockchain technology can be leveraged to carry out multiple transactions using computer programmes known as smart contracts. The transactions are executed according to pre-set parameters that are agreed by the contracting parties and coded into the programme.

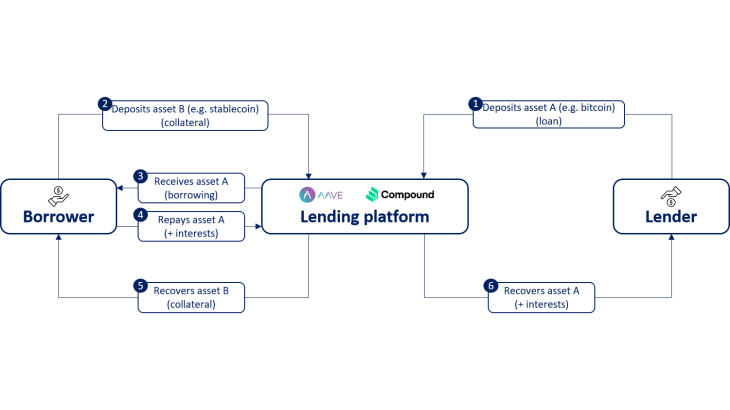

The concept of smart contracts has led to the emergence of an ecosystem of financial applications using blockchain infrastructure: this is referred to as decentralised finance, or DeFI for short. One of these applications allows users to borrow and lend crypto-assets against other crypto-assets (typically stablecoins) deposited as collateral, in a similar way to repo transactions in traditional finance. Platforms such as Aave and Compound use a smart contract that transfers ownership of the crypto-assets and sets an interest rate without the need for an intermediary, as shown in the simplified diagram below.

Chart 2: Simplified operation of DeFI collateralised lending platforms

This collateralisation system is designed to limit the credit risk for the lender, but it does not eliminate it entirely. The lender is still exposed to the risk of a sharp devaluation of the collateral (asset B in the diagram), for example in the event of a contagion between the crypto-assets used as collateral (see article by Tovanich, Kassoul, Weidenholzer and Prat, 2023), or a cyberattack on the platform. On this issue, see also the rapport by the ACPR.

Blockchain, an unrivalled source of data

This blog post studies the data directly available on the Ethereum blockchain, which accounts for 80% of DeFI activity. We analyse two DeFI platforms: Aave and Compound. By way of illustration, according to Defillama, on 1 September 2023, Aave had USD 4.5 billion locked in its smart contracts, of which 85% was on the Ethereum blockchain.

To extract the data, the Banque de France has deployed an archive node in its cloud, in other words an archive of all data generated since the blockchain was created, including historical states, which is synchronised in real time with the global Ethereum network. This node allows us to collect historical data without relying on a third-party data provider.

We then collected more than a million lending and borrowing transactions from the Aave and Compound platforms for three stablecoins: USDC, USDT and DAI, all of which aim to keep their tokens at parity with the US dollar.

The setting of interest rates in DeFI

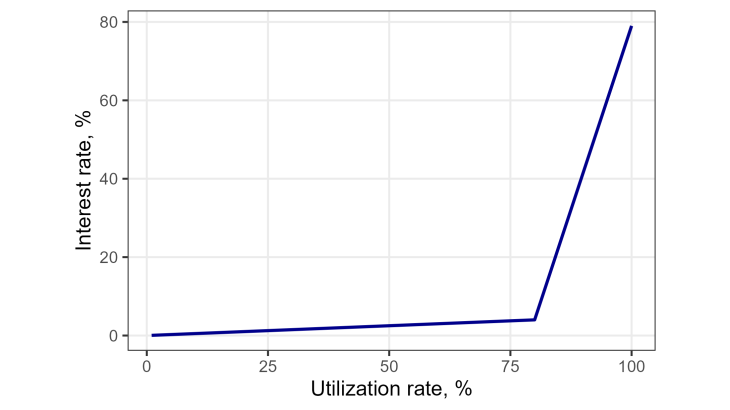

On the main DeFI platforms, interest rates are set automatically using an algorithm coded into each platform’s smart contract. These algorithms are based on the amount deposited and borrowed for each crypto-asset, and are known to all users. The formula is simple: the borrow rate is an increasing function of the utilisation rate – in other words, the ratio between the amount borrowed and the amount deposited (Chart 3 shows the function applied by Aave for the token USDC).

The interest rates cannot be negative. They can be as high as 80% if there is an imbalance between borrowers and lenders. They rise to a limited extent when utilisation rates are low and very sharply beyond an inflection point decided by the platform and programmed into its smart contract. This inflection point is intended to keep the equilibrium utilisation rate close to a “target rate” (of 80% or 90% depending on the platform), as a high rate will attract lenders to the platform (see Chart 3). The parameters differ across platforms and across tokens, and depend in particular on the risk associated with each crypto-asset. The deposit rate is generally equal to the borrow rate multiplied by the utilisation rate.

Chart 3: Interest rates in DeFI are an increasing function of the utilisation rate

Note: The utilisation rate is the ratio between the amount borrowed and the amount deposited.

Certain platforms offer users additional remuneration in the form of governance tokens. For example, Compound pays users its own tokens (COMP) depending on the amount they lend and borrow. The value of these tokens fluctuates and they can be sold on for additional profit, a practice sometimes called yield farming. In 2023, this represented a median additional interest rate of around 1.9%.

Overall, interest rates fluctuate depending on the supply and demand for tokens, i.e. on the amount of tokens deposited and borrowed. Chart 1 shows the change in interest rates stemming from supply and demand dynamics for the three main stablecoins since mid-2020. Several recent articles have examined the specific determinants of interest rates in crypto-asset markets, and have highlighted the significant role of speculation, as DeFI allows high leverage.

Does monetary policy influence DeFI rates?

In the case of stablecoins that maintain a quasi-fixed parity with the dollar, one might expect interest rates to be similar to those in conventional money markets (after accounting for risk premiums specific to crypto-asset markets, such as the risk of a platform default or of a depegging, etc.).

Yet there is generally a wide disconnect between DeFI interest rates and those in traditional financial markets (see Chart 1). The rise in Fed policy rates since March 2022 is an interesting case in point as it allows us to examine how changes in conventional rates affect rates for stablecoins, which are private, digital alternatives to the dollar.

Barbon, Barthélemy and Nguyen (2023) show that monetary tightening can lead to a rise or a fall in DeFI rates. On the one hand, higher policy rates can encourage lenders to switch away from DeFI, attracted by higher conventional interest rates, meaning that rates on stablecoins should also rise, based on the rate-setting formula used by platforms such as Aave and Compound. This arbitrage between different rates is generally how monetary policy is transmitted in conventional markets.

On the other hand, higher policy rates can also discourage borrowers from taking risky leveraged positions in Bitcoin using DeFI. This may reduce stablecoin borrowing on DeFI platforms, causing interest rates to fall and hence move in the opposite direction to central bank rates. The econometric analysis shows that the second mechanism outweighed the first in the first half of 2022 (DeFI rates fell whereas the Fed funds rate rose). The first mechanism subsequently became predominant, leading to a relative re-correlation of DeFI rates with monetary policy rates.

However, since the end of 2023, DeFI rates have significantly exceeded Fed rates again, most likely due to the popularity of Bitcoin ETFs which has generated strong demand for leveraged Bitcoin positions. Overall, DeFi rates appear to be mainly determined by demand for crypto-assets. The transmission of monetary policy to these rates is therefore very limited and is currently only a secondary factor in determining their level.

Download the PDF version of the publication

Updated on the 25th of July 2024