Some explanations may be put forward to try to understand this trend in the French position.

A steady rise in the compensation of cross-border commuters in correlation to their number

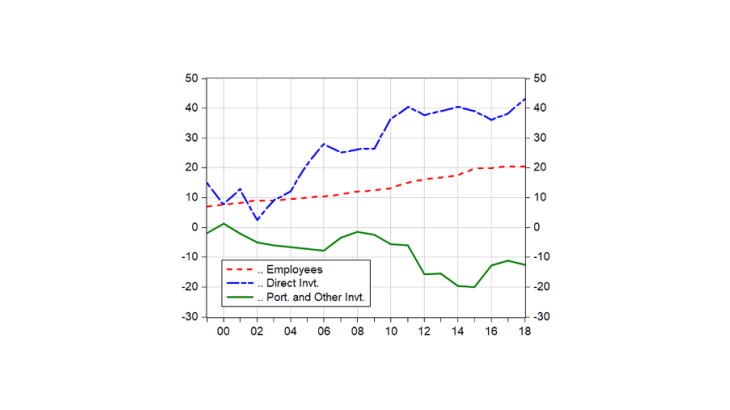

Within the primary income balance, net employee compensation has been steadily increasing. The latter mainly reflects the compensation of cross-order commuters (French residents working abroad) as that of foreign workers in France is relatively marginal. The number of cross-border commuters has risen by 12% in five years, increasing from 324,700 in 2010 to 363,700 in 2015 (Insee Première 1755, “Strong growth in the number of cross-border workers commuting to Switzerland and Luxembourg”. The average annual compensation of these employees, obtained by dividing the income of these employees by their number, rose from EUR 45,100 to EUR 58,300, displaying a very significant increase of almost 30% between 2010 and 2015. This “average” calculation could be improved by taking into account certain characteristics or specific features of this population.

France is a specific case in the euro area

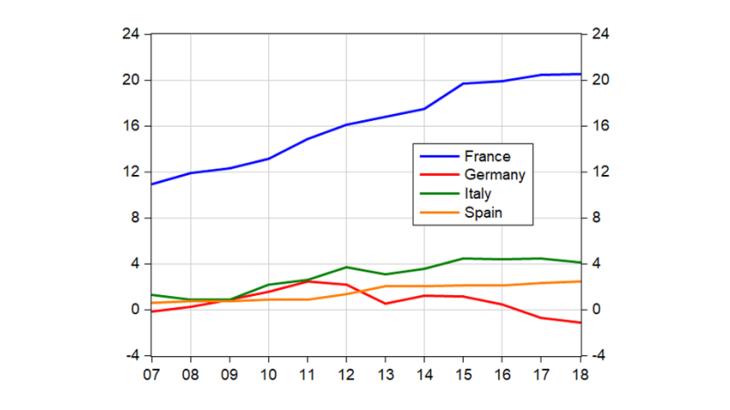

As a comparison, the net surplus of cross-border commuter compensation for France is far higher than that of other European countries for which an upward trend is not observed (see Chart 3). For example, contrary to popular belief, the balance of cross-border commuter compensation is close to zero for Germany: the "receipts", i.e. the compensation of German employees working abroad, offset the "payments" corresponding to the compensation of foreign residents working in Germany.