Raising rates with large excess liquidity: a new challenge for the Eurosystem

The increases in policy rates since July occurred in a context radically different from previous rate hike cycles in the euro area. They occurred in a context of large liquidity (currently around €4500 billion) while it stood at just around €30 bn in 2011. This excess liquidity is related to the Eurosystem asset purchases -- that contributed to reduce the quantity of safe assets in the hands of the public -- and long-term refinancing operations (TLTROs).

In such a situation, the transmission of central bank interest rate hikes might not be passed one-for-one to money market rates, i.e. the rates at which banks and other financial intermediaries borrow and lend cash for very short periods of time, typically 1-day, and no more than 1-year.

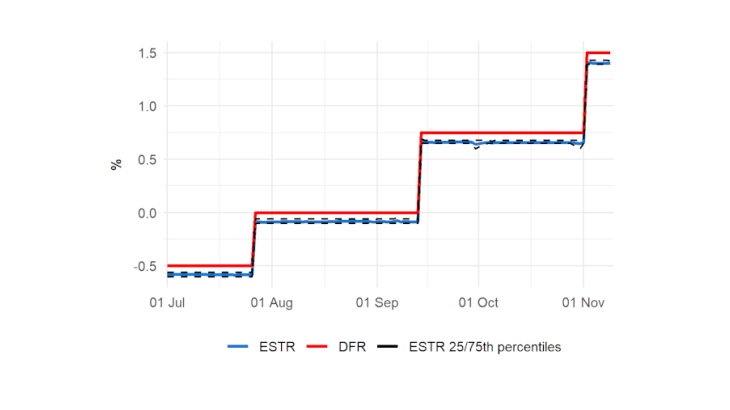

At this level of excess of liquidity, money market rates fall close to the deposit facility rate, the rate of remuneration of banks reserves at their central bank. Indeed, most short-term interest rates have traded even slightly below the deposit facility rate for years: the €STR rate (the benchmark rate for uncollateralized loans of 1-day maturity) traded consistently 8 to 10 basis points below the deposit facility rate. This kind of situation also occurred in the US, and raised doubts on the ability of the Federal Reserve to raise market rates (Bech and Klee (2011)). In the same vein, Duffie and Krishnamurthy (2016) document an imperfect pass-through to money market rates of the 2015 US tightening cycle.

The lower pass-through of secured rates compared to unsecured rates

We do not see evidence of weaker pass-through on the unsecured market: the €STR rate rose almost perfectly in line with policy rates, in July, September and November. Looking at the 5-business day-average before and after the rate hike reveals that uncollateralized or “unsecured’’ interest rates in the euro area rose by 49.5 basis points in July (compared to the 50 basis points rate hike), and by 74.3 and 74.6 basis points in September and November (compared to 75 basis points hikes). In all three cases, the pass-through was 99%.

The distribution of transactions around the €STR rate remained remarkably unchanged, as seen in Graph 1, as well as its 8-10 bps spread below the deposit facility.

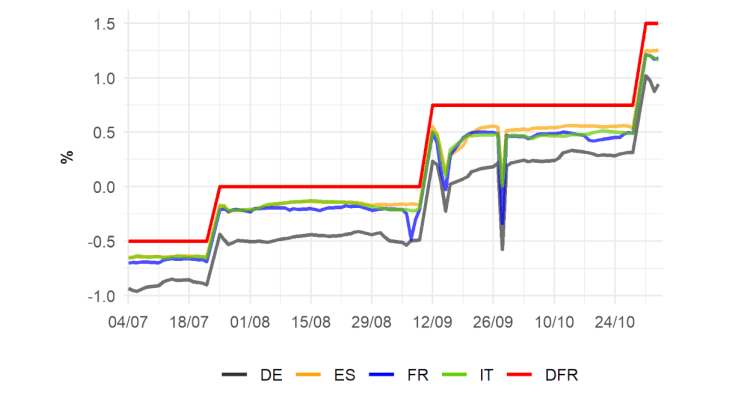

However, the large majority of transactions in the money market actually do not occur in the unsecured market, but rather in the secured market, where transactions are backed by collateral, i.e. the borrower of cash pledges securities to its lender, for instance a government bond, in guarantee.

Transactions data show that transmission in this market has been subdued in July in particular for German collateral and even more so in September and November (Graph 2). In July, comparing the average rate of German repos rate over the 5 days preceding and succeeding the rate hike shows an increase of only 38.7 basis points (– 87.9 to – 49.2 bps) in July, a pass-through of 77%. Repos against French, Italian and Spanish collateral responded with a stronger pass-through between 87% and 91%.

In September, the pass-through has been higher and cross-country heterogeneity much lower, at least initially, but the volatility of repo rates increased in the following days. On the first day of trading after the 75 basis point hike, repos of the most standard maturity (1-day, “Spot-Next”) increase by 72 basis points in Germany, 70.4 in France, 71.9 in Spain and 70.1 in Italy. These are pass-through comprised between 94-96%. However, 4 days after the hike, repo rates subsequently declined by as much as 51.8 basis points in the case of France. After this through, repo rates progressively recovered, close but below their post 0.75%-hike-levels., Repo rate dropped again on September 30th, before recovering immediately, a phenomenon observed regularly in recent years on the last day of each quarter. This pattern is related to the willingness of banks to shrink their balance sheet (thus avoiding borrowing) on the last day of the quarter, due to reporting constraints.

Based on the latest data at our disposal (using a symmetric window of 4-days), the November hike (announced on October 27th) saw a rise of repo rates of 64 (Germany) to 71 (France) basis points, a pass-through of 86 to 95%.