- Home

- Publications and statistics

- Publications

- How do foreign banks react to French pru...

Post n°129. Overall, French prudential policies entail a reduction in foreign banks’ lending to French residents. Yet some measures may lead to undesired leakages that potentially undermine authorities’ goals: foreign bank affiliates’ exposure to France rose by 1.1% (up EUR 1.5 billion) on average over 2011-17 owing to the implementation of Basel capital requirements.

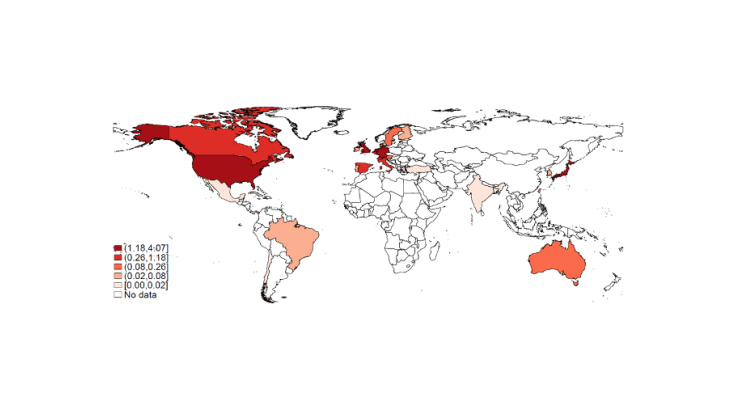

Note: Only countries reporting to CBS IB appear in colour, split into quintiles: the higher the share of French liabilities held by banks headquartered in that country, the darker the colour; data as of Q4 2017.

Foreign banks can hinder the effectiveness of prudential policies

Authorities in charge of financial stability face a challenge. Prudential regulations target the financial system, particularly banks. However, most of them apply to national institutions while, in practice, banks operate at the global level, generating international banking flows which are not comprehensively captured by policies with a domestic remit. This may give rise to spillovers, i.e. effects not intentionally considered in the objectives and/or constraints of authorities in charge of prudential policy, the effectiveness of which may be undermined.

- Inward spillovers arise when there are unintended effects on domestic authorities’ goals in the country (A) activating a measure, e.g. through bank inflows to A.

- Outward spillovers arise when a domestic measure has unintended effects on foreign authorities’ goals, e.g. through bank outflows from A.

We focus here on inward spillovers potentially faced by French authorities (existing work on outward spillovers from French banks is available here). Some of them arise from regulatory leakages: a typical example could be a situation where the growth of French residents’ debt is considered excessive and French authorities implement a prudential policy (PP) to curb this development. Foreign banks may take advantage of an unleveled playing field and increase their share in the French credit market if foreign branches operating in France and cross-border inflows from banks headquartered abroad remain out of the scope of the French PP.

In order to mitigate both inward and outward spillovers and enhance the effectiveness of macroprudential policies (MPPs) within the EU, reciprocation of an MPP is either automatic or recommended by the European Systemic Risk Board (ESRB). Reciprocation of an MPP set by a member country A implies setting an equivalent measure in other member countries on the international exposures of their national banks to the country A.

French exposures may give rise to prudential leakages in practice

According to BIS international consolidated banking statistics, total outstanding French residents’ liabilities vis-à-vis banks (both debt and equity issued by the financial and non-financial sector) amount to more than USD 5,500 billion (EUR 4,600 billion) as of Q4 2017, which is about twice France’s GDP. Roughly 20% are funded by institutions headquartered abroad, either via cross-border claims (16%) or local affiliates such as branches and subsidiaries (4%). UK banks hold more than 4% of the outstanding liabilities of French residents, while German, Japanese, and US banks each hold around 3% (Chart 1). Similarly, French banks hold a sizeable share of the liabilities of other countries’ residents.

While these exposures appear limited they are not marginal and their magnitude gives an idea of the potential spillovers arising from international bank flows as a response to prudential policies.

Overall, French prudential policies reduce foreign banks’ lending

In Dees and Ramos-Tallada (2019) we carry out an empirical analysis using BIS international banking statistics on 22 countries that gave rise to bank fund flows to France between Q4 1999 and Q4 2017. During this period, French authorities implemented several PPs, especially from the outbreak of the global financial crisis onwards. They particularly tightened two categories: bank capital requirements (in accordance with Basel Committee recommendations) and concentration limits (targeting banks' exposures to specific French borrower sectors, similar to the recent macroprudential measure capping bank exposure to highly indebted firms).

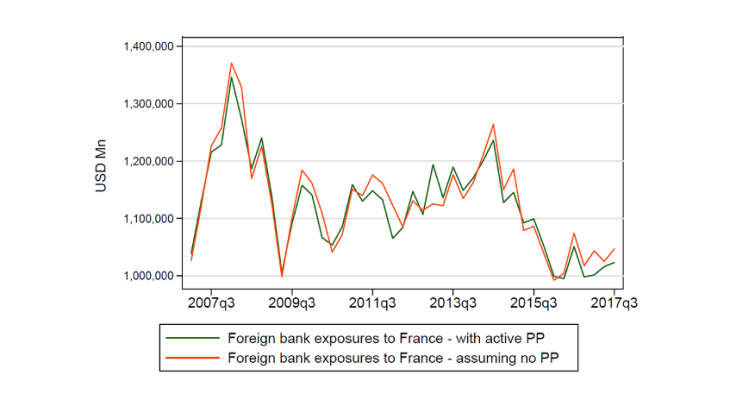

To estimate foreign banks’ response to French PPs all else being equal, we take into account the different macroeconomic and structural contexts between France and its counterparties, such as prudential and monetary policy stances, expected exchange rates, and the degree of capital flow mobility. To get an idea of the magnitude of international spillover effects, we compute the linear prediction from the estimated model assuming both active PPs and no PPs in France (i.e. a counterfactual exercise).

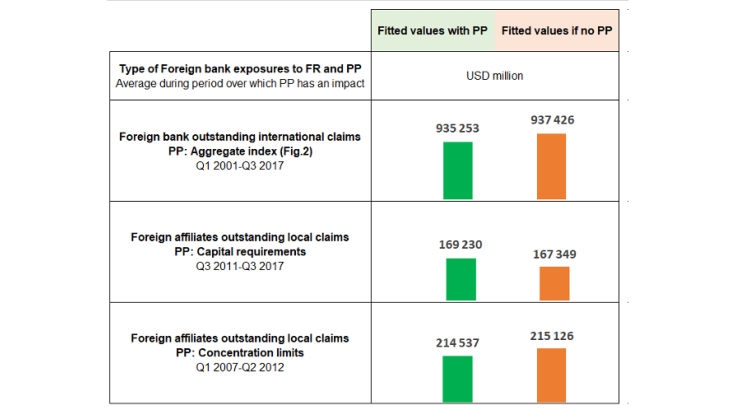

When considering aggregate foreign bank inflows and an overall measure of PPs, we find that foreign banks reduce inflows to France on average by about 1% in the year during which a tightening of the French prudential stance occurs. Our counterfactual exercise shows that the outstanding amount of foreign bank claims on French residents would have been larger by USD 2.1 billion (EUR 1.8 billion), i.e. 0.08% of French GDP, on average over 2001-17 in the absence of PPs (Charts 2 and 3).

Yet French capital requirements raise foreign bank affiliates’ exposure to France

The effect found above for the overall French prudential stance may be driven by some categories of PPs and bank flows: when reacting to a tightening of concentration limits, our estimates show that foreign bank affiliates “follow” French banks, reducing their local claims on France by 2% during the first year. In terms of average exposure over the whole implementation period, the stock of these claims was USD 590 million (EUR 430 million), or 0.02 % of French GDP, lower, owing to these PPs (Chart 3). As long as their regulatory scope is limited to systemic French banks, this behaviour suggests that concentration limits act as a signal of higher risks from domestic borrowers, encouraging foreign banks to reduce their exposure.

However, the results are the opposite if we consider another type of PP: a tightening of French capital requirements entails a 1% rise in foreign bank affiliates’ flows to France during the first year. On average, their stock of local claims over the implementation period was USD 1.9 billion (EUR 1.5 billion) higher than in the measure’s absence, i.e. 0.07% of French GDP. This provides some evidence of a risk of regulatory leakage through foreign banks’ branches, which could have taken advantage of slower Basel II, II.5 and III phase-in schedules in some home countries compared with France. In so far as this inward spillover may potentially undermine French prudential authorities’ objectives, this calls for a reciprocity framework for capital-related PPs, and provides an empirical foundation for the compulsory recognition by other EU member countries currently in force for the recent counter-cyclical buffer set by France.

Updated on the 25th of July 2024