What is a hyperinflation and why do we care?

In his seminal work, Phillip Cagan (1956) defined an episode of hyperinflation as one in which the rate of inflation exceeds 50% on a monthly basis. This is an extremely high rate, as it implies that the general price level doubles in around 50 days or less.

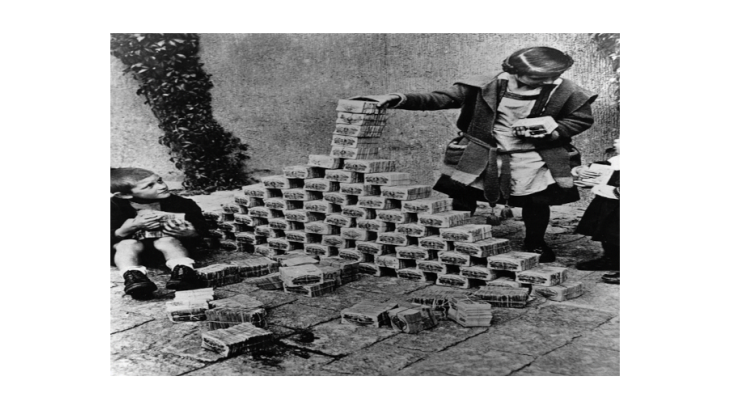

Given these magnitudes, episodes of hyperinflation cause massive disturbances in countries’ financial and economic systems and disrupt social and political stability. In particular, as the value of the currency tumbles, households’ wages and savings - sometimes accumulated over decades - lose their purchasing power in a matter of weeks. For example, during the German hyperinflation of 1922-23, the mark devalued so quickly that it was used as a toy rather than as a means of payment or a store of value, as shown in Chart 1.

Higher inflation rates also tend to be more volatile. A more uncertain economic environment makes it more difficult for households and companies to decide on current and future consumption, investment, and hiring plans. Thus, past episodes of hyperinflation have usually implied high levels of unemployment. Unchecked, the financial and economic hardship eventually caused political instability. The most prominent example for this type of issue is again the German hyperinflation of 1922-23, which is thought to have contributed to the rise of the Nazi party.

Mechanisms and causes of hyperinflation?

The intersection between demand and supply of money determines its value or purchasing power. When household wealth and/or income increases they want to hold more money, because it facilitates their purchases of more goods and services. The demand for money declines when people expect money to devalue in the future and prices to rise. In such situations, people are better off exchanging their money for goods and services as long as someone else will accept it.

Monetary authorities or central banks usually supply the economy with money. In the past, doing so sometimes became a convenient source of revenue for the state. In particular, during the time period we consider here, the money supply consisted primarily of coins and banknotes. A banknote commanded a nominal value of say 100 pounds but was a lot cheaper to produce. The difference between the banknote’s production costs and its nominal value, known by economists as “seigniorage”, constituted a financial gain for the state. Thus, countries at times relied on seigniorage to finance expenditures, since printing money was usually easier and faster than raising taxes or cutting spending. However, when people anticipated that the state would try to make money by increasing its supply above the level that people demanded, they exchanged currency for goods and services. These countervailing actions aggravated the mismatch between the money supply and its demand and sometimes generated a vicious cycle that resulted in further declines in the purchasing power of money.

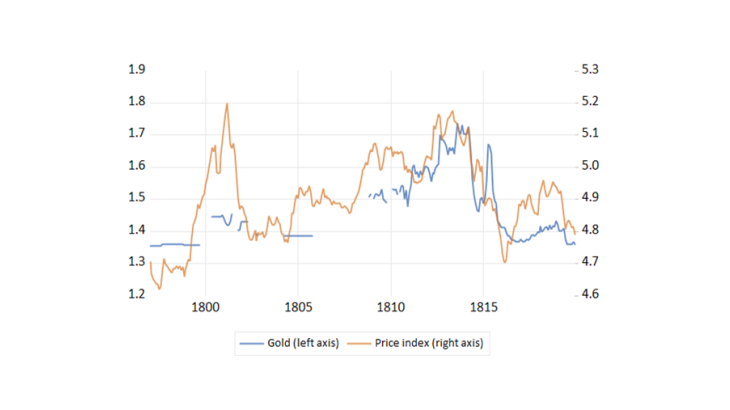

The idea that fiscal objectives, such as financing a war, become more important than monetary targets, such as price stability, is known as fiscal dominance. In these situations, combatting inflation is precluded or becomes very difficult. Thus, while most people think of inflation as a monetary phenomenon, the actions of the fiscal authority, i.e. a significant and persistent imbalance between the state’s revenues and its expenditures, have usually been the trigger for episodes of hyperinflation. Conversely, monetary dominance implies that the fiscal authority adjusts taxes and expenditures to make sure that its overall budget is sustainable in the long run. In such situations, central banks can effectively concentrate on accomplishing price stability (Villeroy de Gallhau, 2022). Moreover, a country that has credibly committed to a balanced budget over the long run can temporarily increase its money supply to a large extent without risking hyperinflation (Bordo and White, 1991). The historical record confirms this.

The historical perspective: France versus England

During much of their history prior to the 20th century, France and England were at war. This perpetual clash culminated in the French Wars (1793-1815). At the beginning of these wars, the odds were in France’s favour, as the country was bigger, richer, and equipped with a large and efficient army. However, the United Kingdom not only won the war, it also won the peace. Contrary to France, it financed this massively expensive conflict without wreaking havoc on its financial system, establishing itself as the military and economic hegemon for the century to come (see also Historical lessons from large increases in government debt).

In order to finance these wars, both countries experimented with a monetary innovation, i.e. paper currencies not convertible into a certain amount of precious metals at the central bank. However, only France experienced the first hyperinflation in modern times.

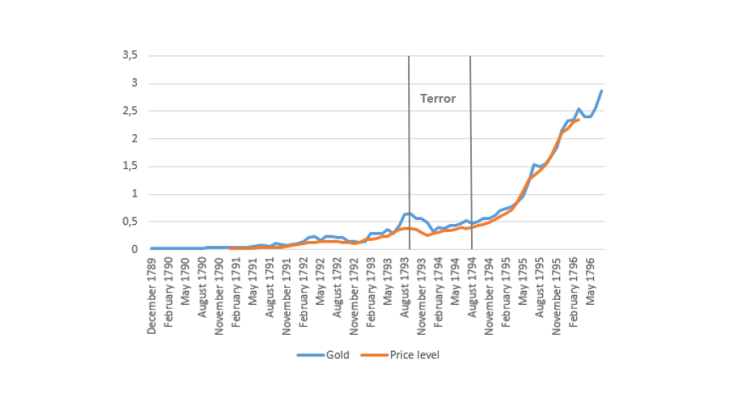

Chart 2 shows changes in the exchange-value of France’s infamous paper money the assignats into gold and a broader price index. During the assignats’ first phase (delineated by the left-hand vertical line) from 1790 to the late summer of 1793, inflation remained subdued. In order to reimburse the debt overhang inherited from the Ancien Régime, public revenues were raised by auctioning the church’s confiscated assets. Thus, during this first phase, the new paper money issued was backed by sales of Iand by the government, which constituted a new income stream. With the declaration of war on the German Empire and Austria in April 1792, debt payments were suspended indefinitely and inflation picked up. To counter this, the Reign of Terror enforced the assignat’s parity with precious metals and controlled grain prices, wages, and consumer and producer prices with the so-called General Maximum Law. The Jacobin party was overthrown in the summer of 1794. As the apparatus of legal restrictions disappeared, the assignat became a fully-fledged fiat currency, severed from any backing into specie or public revenue streams. With the government unable to raise alternative revenues, inflation soared in 1795-96 (Sargent and Velde, 1995). The episode of hyperinflation ended following a default on two-thirds of public debt in 1797 and tax revenues increased progressively under Napoleon.