The primary objective of the European Central Bank (ECB) is to maintain price stability throughout the euro area. In 2021, following its strategy review, the ECB reaffirmed its commitment to an inflation target, set at a 2% annual increase in the Harmonised Index of Consumer Prices (HICP) over the medium term. Inflation is volatile in the near term, exhibiting temporary fluctuations that do not necessarily indicate where the rate will be in the future. These fluctuations are often due to prices of specific goods, and reflect changes in relative prices rather than an increase in the general price level. Consequently, in implementing monetary policy, it is essential to identify the underlying inflationary trend, after filtering out these idiosyncratic and transitory movements.

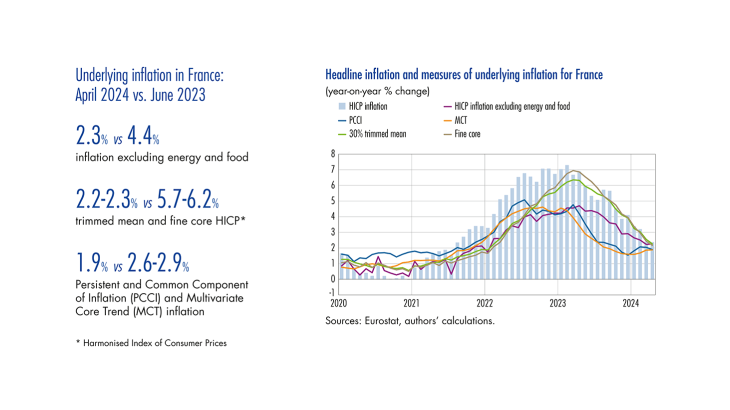

One such approach, known as “exclusion-based” and used regularly by central banks, is to strip out sectors showing the biggest temporary price changes. The most prominent of these measures is “core” inflation, which excludes food and energy prices, the two most volatile components (see Gordon, 1975; Eckstein, 1981; and Clark, 2001, for a general introduction). As discussed by Lalliard and Robert (2022), other indicators have been developed, such as trimmed mean HICP and fine core HICP. These filter out the HICP components experiencing the biggest changes each month, with the analyst setting the exclusion threshold (e.g. 30% of items) on a discretionary basis. Trimmed mean inflation strips out items that are temporarily the most volatile (i.e. month to month). In contrast, the “permanent exclusion” index strips out items that are historically most volatile (i.e. over a reference period).

However, the exclusion-based approach is partial as it only eliminates the most volatile items, and does not directly eliminate the transitory component of inflation. Yet the latter component is vital to understanding the surge in inflation between 2021 and 2023, when many economic sectors, such as furniture and motor vehicles, were hit by a series of exceptionally strong temporary shocks. For a measure to capture trend inflation, it needs to be capable of stripping out these transitory effects. To address this issue, the Banque de France has expanded its range of underlying inflation indicators to include an approach based on statistical models, aimed at filtering out temporary inflation fluctuations and retaining only the persistent component.