A decision based on the progress of inflation and widely anticipated by the markets

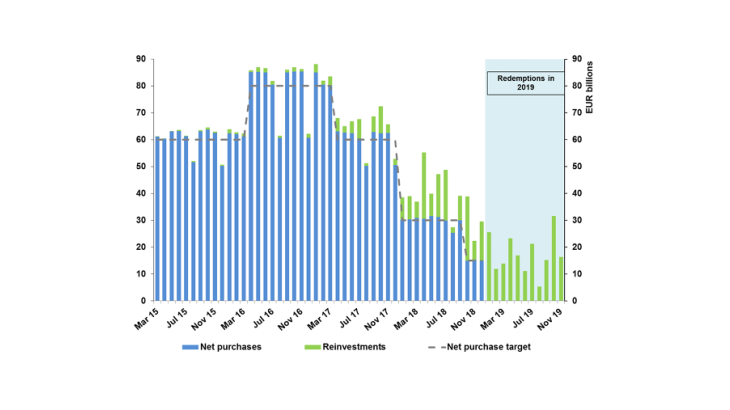

The Eurosystem’s asset purchase programme (APP) consists of three programmes for the purchase of private sector securities (covered bonds, asset-backed securities and corporate bonds) which were launched from October 2014 onwards, and a programme for the purchase of public sector securities (the Public Sector Purchase Programme or PSPP). The public sector purchases, which are the largest component of the APP in terms of volume, began in March 2015 when the euro area was facing the threat of deflation. Monthly net purchases were initially set at EUR 60 billion in March 2015, but the figure was subsequently raised to EUR 80 billion as of April 2016. It was then lowered again to EUR 60 billion, then to EUR 30 billion and finally to EUR 15 billion (Chart 1). The decision to halt the purchases at the end of 2018 is the first step towards the normalisation of Eurosystem monetary policy.

The move is justified by the progress made towards the euro area’s inflation target – which is for inflation rates below, but close to, 2% over the medium term. According to the December 2018 Eurosystem staff macroeconomic projection exercise, annual inflation in the euro area is forecast to reach 1.6% in 2019, 1.7% in 2020 and 1.8% in 2021. The degree of confidence in the path of inflation has also increased in recent quarters, as demonstrated by the reanchoring and reduced dispersion of professional forecasters’ long-term inflation expectations (ECB, 2018).

In light of this, the end of the net asset purchases was largely anticipated by market participants, especially since the Governing Council had already signalled its intention six months earlier at its meeting in June 2018. As a result, the confirmation of the decision did not trigger a significant market reaction after the 13 December Council meeting.

The flow of reinvestments should keep the Eurosystem’s asset holdings at a constant level

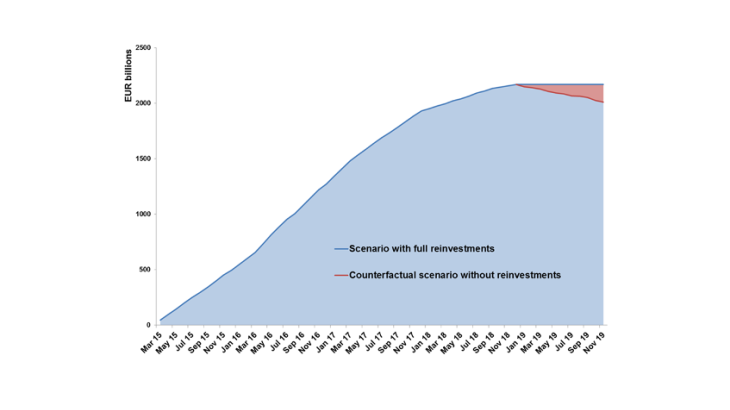

January 2019 will see the start of a new phase of the APP consisting in the continued reinvestment of all principal redemptions from maturing securities. This will keep the size of the APP portfolio stable at just over EUR 2,500 billion. The reinvestment phase applies to all APP programmes, and will continue “for an extended period of time past the date when [the Governing Council] starts raising the key ECB interest rates, and in any case for as long as necessary to maintain favourable liquidity conditions and an ample degree of monetary accommodation”.

Each month and for each programme, the Eurosystem publishes the amount of principal redemptions to be reinvested over the subsequent 12-month period. According to the latest available data, a total of over EUR 158 billion will be reinvested in 2019 under the PSPP (between January and November).

Chart 2 compares the projected trajectory of the PSPP portfolio over a 2019 horizon with a “counterfactual” scenario involving no reinvestment. Under this latter hypothesis, the size of the PSPP portfolio would start to fall from as early as January. The Eurosystem’s asset holdings would only decline gradually, however, as the average residual maturity of the PSPP portfolio is currently around 7.4 years. Under the reinvestment policy adopted by the Eurosystem, the asset holdings remain stable for as long as the reinvestments continue. The majority of market participants expect the period of full reinvestment to continue for 2 to 3 years.