- Home

- Publications et statistiques

- Publications

- The drivers of growth in trade in financ...

Post n°337. The Paris financial centre is strengthening its position: trade in financial services by financial intermediaries (FIs) reported in the balance of payments has increased significantly between 2019 and 2023 compared with the other main financial centres. This is partly due to Brexit. The financial services surplus exceeded EUR 5 billion in 2022, and seems to have stabilised around this level in 2023.

Trade in financial services has gathered pace over the last three years

Financial services cover explicitly charged commissions, such as fees on security transactions, foreign exchange transactions and off-balance sheet transactions. These transactions are mainly purchases or sales carried out by financial intermediaries (FIs) – credit institutions, investment firms and asset management companies.

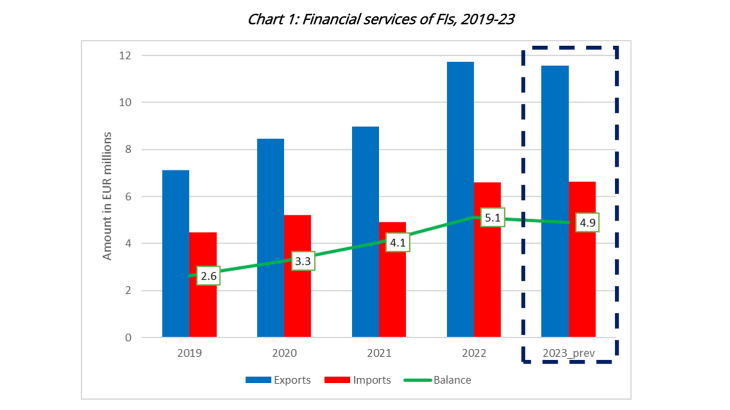

France’s trade in financial services – both in terms of exports and imports – has grown very rapidly since 2020, with growth in exports exceeding growth in imports from 2019 to 2022. In 2022, FIs accounted for the vast majority of France’s total net financial services trade surplus of EUR 5.8 billion with a contribution of EUR 5.1 billion, having already generated EUR 4.1 billion in 2021, EUR 3.2 billion in 2020 and EUR 2.6 billion in 2019 (see Chart 1). This net export position is also significant relative to the total services surplus in the balance of payments, as it accounts for 10% of the net balance for 2022 (EUR 52 billion).

According to Banque de France estimates based on data for the first nine months of the year, this balance should remain stable in 2023, unchanged scope, at around EUR 4.9 billion.

France’s resident financial intermediaries are scaling up in the major foreign financial centres

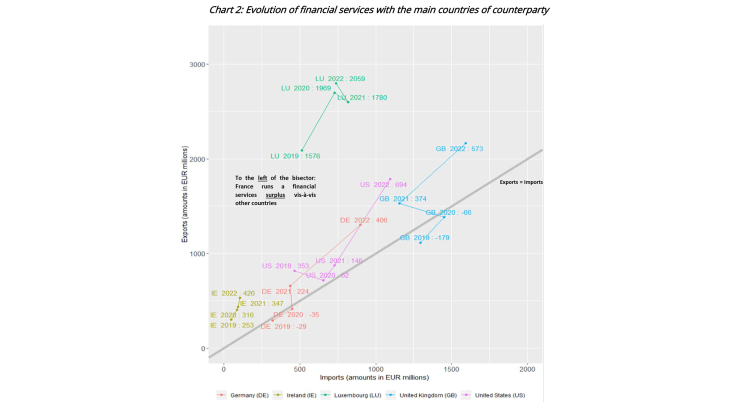

Two categories of flow stand out from the financial services traded by FIs (see Chart 2):

- Significant but relatively stable trade surpluses from 2020 to 2022 with regard to countries such as Luxembourg (LU) and Ireland (IE).

- Exports outpacing imports relative to a number of countries, with France becoming a net exporter of financial services to the United Kingdom (GB) and Germany (DE) in 2021. Moreover, its position as a net exporter to the United States (US) improved considerably in 2022.

Key: French FIs are net exporters in terms of financial services with Luxembourg (LU) – net positions of EUR 2.0 billion in 2020, EUR 1.8 billion in 2021 and EUR 2.1 billion in 2022.

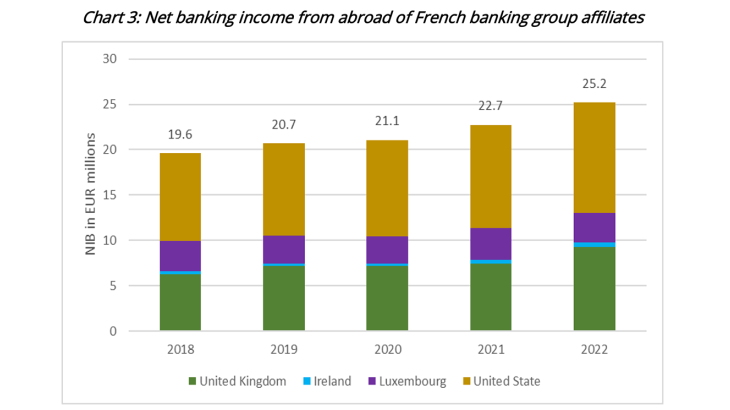

A first possible explanation for this geographical pattern of trade in financial services is an "activity volume" effect, linked to the strong momentum in bank performance in certain financial centres from 2018 to 2022 (see Chart 3). For example, French banking group affiliates located in the United States, the United Kingdom, Ireland and Luxembourg reported steady growth in net banking income (NBI) over the period. The surge in activity in these financial centres may have led to greater demand for financial services in these countries, and French-resident institutions have duly responded. However, the possibility of a substitution effect cannot be ruled out: the French banking affiliates located in these four countries may have captured part of this demand for financial services. But this is difficult to quantify. Conversely, the growth in net exports of services from the Paris financial centre and towards these destination countries is well measured and shows that this demand effect (or activity volume effect) has outweighed any potential substitution effect.

A second explanation stems from the specialisation of certain financial centres in portfolio management activities. Among FIs, portfolio management companies are responsible for significant flows relative to Luxembourg. From 2020 to 2022, exports of financial services to Luxembourg averaged EUR 1.2 billion, generating an average net surplus of EUR 0.8 billion. These services meet the needs of Luxembourg’s investment fund industry, which hosts a large number of collective investment undertakings (CIUs) managed from France (part of the operating costs is therefore excluded from cross-border trade). The business model of management companies explains their position as net exporters: income is earned by charging CIUs various fees linked to performance, management or transfers, while expenses vis-à-vis the rest of the world are minimised.

Source: Outward FATS, Banque de France

The Paris financial centre has benefited from Brexit

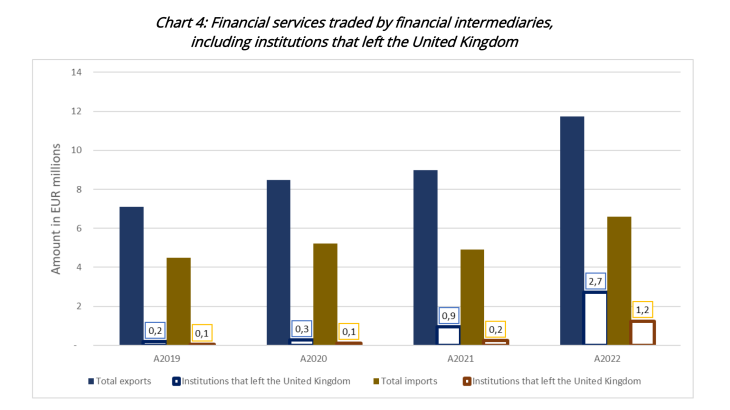

The most significant development behind the rapid growth in French FIs' trade in financial services over recent years is the United Kingdom’s exit from the European Union. Many US banking groups have set up or expanded their operations in France since 2020. “Financial institutions that left the United Kingdom” are continental European companies that, following Brexit, integrated activities and employees that were previously located in the United Kingdom. They have been identified on the basis of both quantitative indicators, such as trade in service declarations since 2019, and qualitative information sources such as interviews or press reports.

These banking groups, most often Anglo-Saxon in origin, have gravitated towards Paris, where the authorities have rolled out policies selling France’s economic attractiveness (the Choose France Summit, since 2017, for example). Financial institutions that have left the United Kingdom have also pointed to the favourable financial environment (AMF, ACPR, ESMA, and the EBA, which relocated to Paris post-Brexit) and a financial sector that boasts an impressive skilled workforce, among the Paris financial centre’s assets (see Villeroy de Galhau, 2018).

Transfers of activities have led to companies relocating to several countries, primarily Ireland, but also to Paris, from where it is possible to cover the activities of customers in France and continental Europe. Other financial centres in Europe, such as Frankfurt, Luxembourg and Amsterdam, have also benefited from Brexit, welcoming previously UK-based financial institutions. Since 2020, the gradual relocation of these institutions to France and the expansion of export activities – setting up offices and a number of trading rooms enabling the provision of remote financial services – have helped to boost financial services exports from France. The contribution of financial institutions that left the United Kingdom to France’s financial services exports thus increased from 3% in 2020 to 10% in 2021 and 23% in 2022 (see Chart 4).

In addition to financial services, Brexit has also had an impact on other categories of services traded by FIs. Computer and information service transactions and intra-group transactions are conducted between these Paris-based institutions and other European countries. These transactions partly offset the positive financial services balance, with parent companies located abroad invoicing, for example, for intra-group management fees (most often in the form of transfer pricing). Thus, unlike French banks, financial institutions that left the United Kingdom make a loss on this type of transaction, primarily to the United Kingdom (deficits of EUR 113 million in 2020, EUR 345 million in 2021, and EUR 474 million in 2022).

There is no doubt that the Paris financial centre has benefited from Brexit thanks to the relocation of financial institutions that left the United Kingdom. Data available for 2023 suggests that this new banking landscape is stabilising at a high level: financial services exports are becoming a long-term contributor to France's trade in services.

Download the PDF version of the publication

Updated on the 25th of July 2024