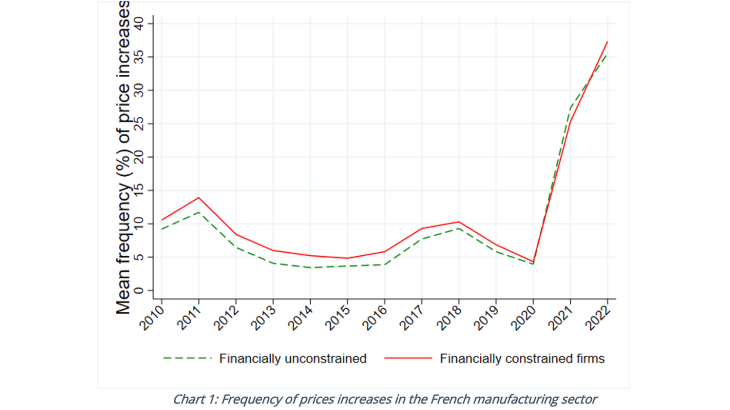

During the inflation surge of 2021-22, the percentage of French firms that decided to increase their prices was exceptionally high. Chart 1 shows the annual average monthly frequency of price increases (% of companies that increased their prices each month in a given year) in the French manufacturing sector. Firms are defined as financially constrained (respectively, unconstrained) in a given year when, the previous year, their operating cash flow (OCF) was in the bottom (respectively, top) quartile of the distribution. When firms are more financially constrained, they seem to increase their prices more often overall.

Multiple factors may trigger price increases, including financial constraints

The evolution of producer prices results at the aggregate level from individual firms’ price setting behaviour. Some firms decide to change their prices, while others do not. When changing a price, the price setter can increase or lower it, and choose the magnitude of this change. The aggregate evolution of prices in fine depends on the proportion of firms modifying their prices (extensive margin) and on the average size of price changes (intensive margin). The frequency of price increases is the single most important component in periods of high inflation. Disregarding price changes resulting from sales and promotions, the extensive margin is the main driver of aggregate price variations in France, even in periods of low inflation.

Firms may have many reasons to increase their prices. Several relate to the macroeconomic situation or to sectoral factors. Beyond those common to all firms operating in a given sector and year, a firm may decide to increases its prices for a number of reasons that are idiosyncratic to the firm itself. More specifically, price increases are likely to be triggered by rises in the costs of a firm’s inputs, such as raw materials, as was the case in recent years due to supply bottlenecks following the Covid crisis and the invasion of Ukraine. Moreover, a firm is likely to raise its prices when demand for its products grows. Another less obvious but significant determinant of price increases are a firm’s financial constraints.

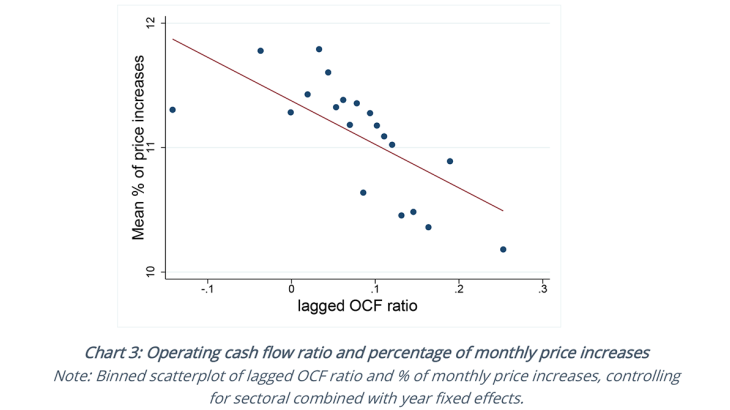

Intuitively, for a firm facing costly external financing and mark-ups in customer markets, there exists a trade-off between its current profit and its longer-run market share. When financially constrained, a firm may then raise its prices to boost liquidity, despite the loss of future market shares. Verifying this intuition empirically is, however, not straightforward. Indeed, the extent to which firms are financially constrained is not observable and elusive to quantify. Several characteristics at the firm level may potentially proxy its financial constraints.

There are several potential ways to proxy the financial constraints faced by firms

A comprehensive measure of firms' financial health is the Banque de France credit rating, which is based on firms’ financial statements and supplemented by private information held by analysts. However, because this is a qualitative measure and available for firms with turnover at least equal to EUR 750,000, it is useful to proxy financial constraints with alternative quantitative measures. Several of these measures appear monotonically related to categories of credit rating whereby, in line with the original rating scale, firms’ financial health is grouped into ‘good’, ‘intermediate’, and ‘compromised’, plus a residual category for firms without a credit rating.

Chart 2 shows the normalised mean of several proxies of financial constraints, notably the exiguity of the operating cash flow (OFC) ratio, current ratio (i.e. current assets over current liabilities) and the gross profit margin, as well as trade bill payment default, the leverage ratio and Whited-Wu index (i.e. external financing constraints), broken down into the above credit rating categories The OCF ratio ranges from negative (-5%) for firms whose capacity to reimburse loans is compromised, to 3% and 10%, respectively, for firms characterised by an intermediate and good credit rating. Likewise, the current ratio and the gross profit margin also monotonically increase with firms' credit rating categories (upper panel of Chart 2). Other measures, like the incidence of trade bill payment defaults, the leverage ratio, and the Whited-Wu index of external financing constraints, monotonically decrease (lower panel of Chart 2), as in their case lower levels correspond to better financial health.