Firms' price setting is a classic but elusive object of economic investigation. In Ben Bernanke's words, a better understanding of the factors that determine pricing behaviour of “price setters themselves, namely businesses, is one of the major unresolved issues for monetary policymakers”. In the recent context of soaring prices and firms having financial difficulties, the relation between firms' financial situation and how they decide to adjust their prices is again attracting attention.

While these rises had several determinants, among which in particular the sharp rises in the cost of raw materials, this paper focuses on the consistent role played by firms’ financial constraints in their price setting. In particular, we investigate the relationship between the financial situation of French manufacturing firms and their price adjustments at the extensive margin (i.e., the frequency of price increases and decreases) over a long and recent period of time, including the post pandemic years of rising prices. Our analysis is mainly based, on the one hand, on Banque de France monthly business survey data to assess price increases and decreases decided by firms and, on the other, on their balance sheets to approximate their financial constraints, for the period 2010-2022.

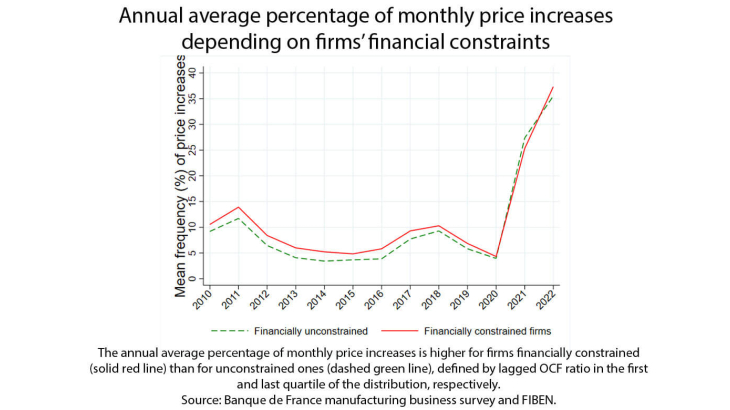

We find systematic differences in the frequencies of price increases and decreases between financially constrained and unconstrained firms. When firms are financially struggling, they are more likely to increase their prices. Moreover, there is evidence that financial constraints affect price adjustments in an asymmetric way: when firms have financing difficulties, they exhibit greater upward flexibility, but at the same time, their price setting is more rigid downward. This price setting behaviour is robust to a wide range of alternative proxies for financial constraints and different time periods.

The quantitative impact of financial constraints on the frequency of price increases and decreases is significant. In terms of interquartile shift, a firm with a lagged operating cash flow ratio (our preferred proxy for financial constraints) in the lower half of the distribution of operating cash flow ratio would decide each month 0.6 percentage point (p.p.) more price increases and 0.4 p.p. less price decreases than the same one in the upper half of the distribution. Put in other words, when facing a negative shock of two standard deviations of its operating cash flow, a firm chooses on average 1.4 p.p. more price increases and 0.9 p.p. less price decreases, which correspond to 13 and -24% of the average monthly frequencies of price increases and decreases, respectively.

Beyond proving the asymmetric impact of a firm's financial constraints on its price setting robust to many alternative ways of approximating financial difficulties, we test robustness of our findings to concerns about the potential endogeneity between price adjustment and financial constraints with an instrumental variable approach, as well as a difference in differences one. We also test their robustness to an alternative definition of the dependent variable and to the estimation of alternatives econometric models. Finally, we explore the role played by several dimensions of firm heterogeneity in the impact of financial constraints on price adjustment decisions, such as investment shocks, market power, age, and sector of activity.

While our analysis includes the pandemic and post pandemic years and shows that firms’ behaviour in terms of price dynamics when facing financial constraint holds even then, further research is left to investigate more specifically this exceptional period, ideally based on higher frequency data. Indeed, Ge (2022) suggests that financial constraints may affect price setting through multiple mechanisms possibly with different time horizons (e.g., short run fire sale of inventories).

Keywords: Producer Price Setting, Firm Financial Constraints, Customer Market

JEL: E31, G30