Central banks around the world have moved away from single decision-makers toward committee-based monetary policymaking. The Federal Reserve, the Bank of England, and the European Central Bank all make policy decisions through committee deliberations. This shift reflects the belief that collective produces better outcomes than individual judgment, especially given the complexity and uncertainty inherent in economic policy design. However, when committee members disagree - as they inevitably do given different economic perspectives, regional interests, or policy preferences - should this disagreement be made public? Different central banks have taken varying approaches: the Fed and Bank of England publish detailed voting records, while the ECB keeps deliberations private, only revealing dissent during press conferences in response to journalists’ questions.

The transparency debate has intensified over the recent years as central banks have taken on expanded roles. Proponents argue that revealing disagreement enhances democratic accountability, helps markets understand the range of policy views, and can signal future policy directions. Critics worry that publicizing internal divisions might undermine central bank credibility, confuse markets, or create unnecessary volatility. Despite the importance of this debate, empirical evidence on how financial markets respond to revealed disagreement is limited. Previous research focused mainly on the U.S., where policy decisions and voting records are released simultaneously, making it difficult to separate market reactions to the policy itself from reactions to dissent votes. The ECB’s unique communication structure - where policy decisions are announced first and potential dissent is revealed later during press conferences - provides an ideal natural experiment to study this question.

In this paper, we build a novel database tracking instances of dissent within the ECB’s Governing Council from 1999 to 2023. From the 258 ECB press conferences over this period, we identify 60 episodes where the ECB President revealed that some members disagreed with the policy decision. Using high-frequency financial data, we assess how stock prices, interest rates, and market volatility respond in the immediate aftermath of dissent revelation. For meetings since 2012, we identify the exact time when dissent was revealed using press conference recordings, allowing us to isolate market reactions to that news even more precisely.

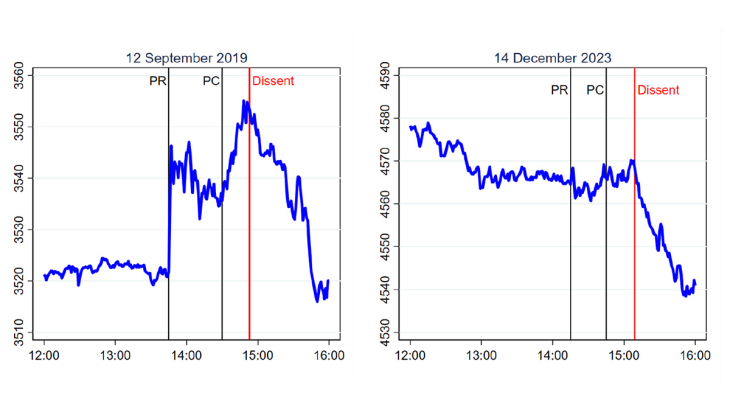

As suggested in Figure A, we provide robust evidence that stock prices react negatively to dissent. When the ECB President reveals that some committee members disagreed with a policy decision, European stock prices typically fall by about 0.2%. This effect is economically meaningful. An important finding is that this negative effect only occurs during “status quo” meetings - when the ECB decides not to change interest rates or other policies. When dissent occurs during meetings where policy actually changes, there is no effect on stock markets. This suggests investors are not concerned about disagreement when action is taken, but become disappointed when disagreement prevents desired policy changes. We also show that dissent is a major driver of stock prices on these days. During status quo meetings with dissent, disagreement among policymakers explains about one-third of daily stock price movements and three-quarters of movements during press conferences. This makes dissent one of the most important factors affecting markets on those days.

The study reveals three key insights. First, transparency may have costs - revealing disagreement can harm market sentiment, even when the disagreement does not change the actual policy decision. Second, markets care about the policy process, not just outcomes - investors react negatively to signs that policymakers cannot reach a consensus. Third, dissent affects how monetary policy works - the impact of policy changes on asset prices is altered when there is disagreement among policymakers.

These findings suggest central banks face a trade-off between transparency and market stability. While revealing internal debates can enhance democratic accountability and provide insights into future policy direction, it may also create unnecessary market volatility and disappointment, especially when disagreement prevents action.

Keywords: Asset Prices, Disagreement, Monetary Policy Committee, Bad News, European Central Bank

Codes JEL : G14, E43, E52, D70