The market for digital financial players is booming (Chart 1). Who are their customers? How have their business models evolved and become profitable?

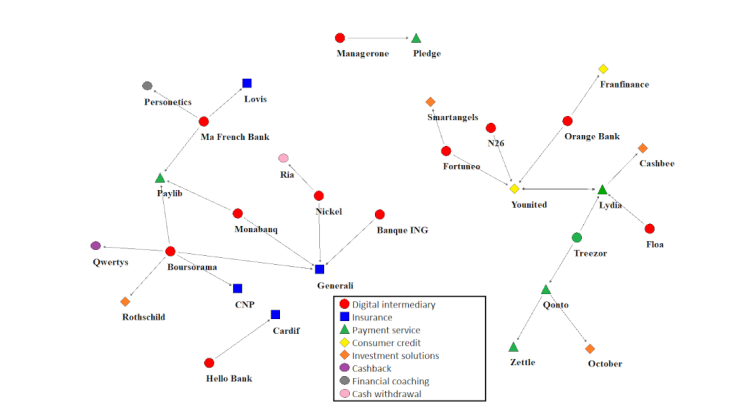

In a recent study, Clerc et al. 2022 analyse the development of the market for digital players in the French financial sector. This study is based on a survey conducted by the Autorité de Contrôle Prudentiel et de Résolution (ACPR) in 2021 among a sample of 15 financial players and intermediaries providing services that are 100% online or accessible via mobile applications.

The sample covers the main digital players engaged in credit intermediation (deposit taking and lending), both established entities and companies that have recently commenced operations in France. Thus, digital players that perform only one of these roles (e.g. FinTechs specialising in consumer credit, which do not take deposits) or whose core business does not involve these activities (e.g. AssurTechs) are not included in the sample.

This rapidly-growing market (see below) is still in its maturation phase. Some players have ceased activities because they have not achieved their customer base or profitability targets. For the remaining players, a distinction can be made between:

i) Generalist players, who offer a wide range of financial products to a diversified customer base;

ii) Specialised players, which focus on a limited number of products and services aimed at a narrower customer base, but which operate in market segments that are considered more profitable.

Digital players in finance: a rapidly growing market share

The digital financial sector players included in the study saw a significant increase in their market share in 2020 compared to previous years.

At the start of 2018, around eight million customers (exclusively individuals and SMEs) had an account with one of the institutions in our sample. This figure rose to 11.5 million at the beginning of 2019 and reached about 16 million in early 2020, i.e. an increase of 100% in two years. In comparison, the total number of retail accounts of the six major "traditional" French banking groups amounted to 74 million in early 2020, a figure that is stable compared to previous years.

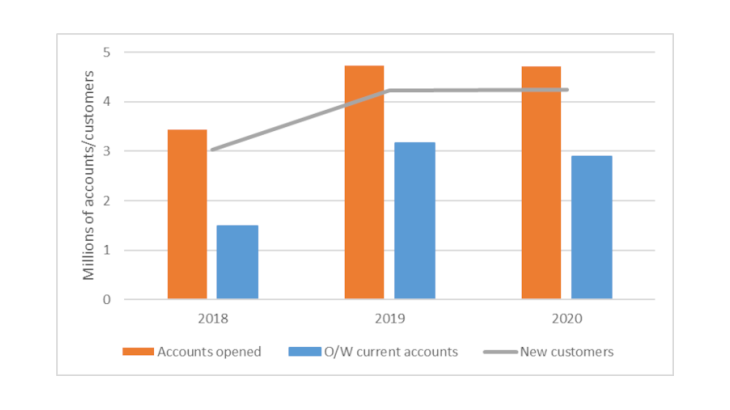

Digital finance players have succeeded in increasing their market share thanks to increasingly comprehensive product offerings that encourage customer autonomy in the areas of everyday banking and savings products. As regards the opening of new accounts in the institutions included in the sample studied, 4.7 million accounts were opened in 2020, of which 2.9 million were current accounts (Chart 1). If we add this figure to the 5.5 million new current accounts opened by retail customers in the six major French banking groups in the same year, we find that in total, around 35% of new current accounts opened in 2020 were with one of the digital players included in our sample.

The elusive search for profitability

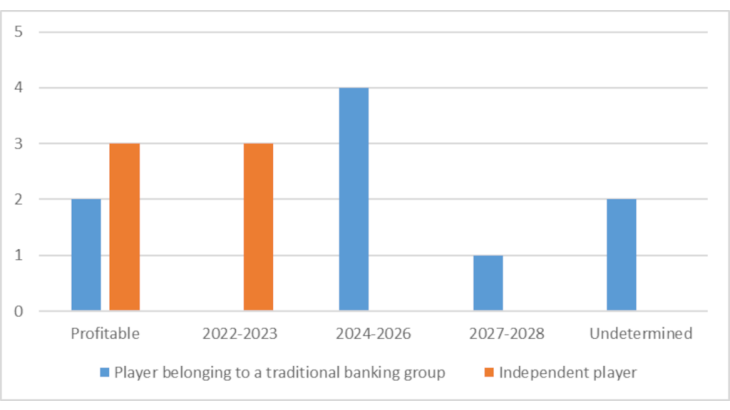

There are significant differences between digital players when it comes to breaking even. Without exception, the players in the study sample that do not belong to a traditional banking group claim that they are already profitable or will be profitable by the end of 2023 (Chart 2, orange bars). In particular, 100% online mobile players are the most profitable due to their low operating costs and specialisation in specific market segments.